Oberoi Realty Ltd is a real estate development company, headquartered in Mumbai. It is the part of Oberoi Realty Group, focused on developments in the residential, office space, retail, hospitality, and social infrastructure verticals.

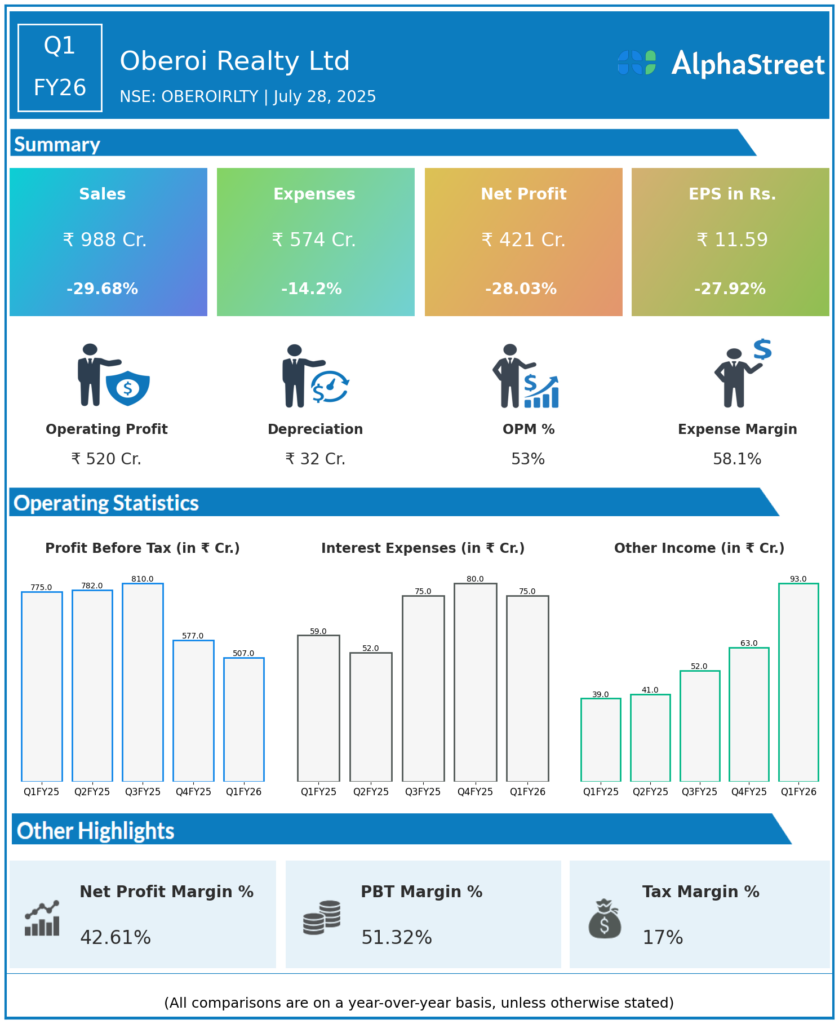

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Revenue: ₹987.6 crore, down 29.7% YoY and 14.1% QoQ.

-

Net Profit: ₹421.3 crore, down 27.9% YoY (from ₹584.5 crore in Q1 FY25) and slightly down 2.8% QoQ.

-

EBITDA: ₹520 crore, a 36.2% decline YoY.

-

EBITDA margin: Contracted to 52.7% from 58% YoY.

-

Earnings Per Share (EPS): Approximately ₹11.59 in Q1 FY26, compared to ₹16.08 in Q1 FY25.

-

Bookings: 181 units (3.53 lakh sq. ft.) booked in Q1 FY26 with gross booking value around ₹1,639 crore.

-

Key Launch: Tower D at the Oberoi Elysian project in Goregaon with ₹1,000 crore housing sold at launch.

-

Interim Dividend: ₹2 per equity share (20% of face value).

Key Management & Strategic Decisions

-

Focus remains on premium residential developments with significant new launches (Elysian in Goregaon, projects in Borivali, Worli, and Gurugram) with GDVs ranging from ₹2,400 crore to ₹9,100 crore.

-

Management continues to maintain a very low net debt-to-equity ratio (~0.01 to 0.12) highlighting strong financial discipline.

-

Interim dividend declared, reflecting shareholder confidence.

-

Strong operating cash flow and balance sheet position maintained.

-

Strategy emphasizes steady launch pipelines and pre-sales to ensure healthy cash flows.

-

Emphasis on sustainability and green building norms in construction projects.

Q4 FY25 Earnings Summary (Oct–Dec 2024)

-

The detailed Q4 FY25 earnings report for Oberoi Realty is not explicitly available, but based on Q1 FY26 sequential comparison, Q4 FY25 revenue was approximately ₹1,441.95 crore (as Q1 FY26 revenue dropped about 25.5% sequentially to around ₹987.6 crore).

-

Net profit for Q4 FY25 was approximately ₹433 crore (as Q1 FY26 profit was about 2.8% lower than Q4 FY25 profit of ~₹433 crore).

-

The company continued robust sales across key premium projects during this period.

Outlook

Despite the near 30% revenue and profit decline YoY in Q1 FY26 due to broader market challenges, Oberoi Realty retains a positive outlook supported by robust pre-sales, a premium project pipeline, disciplined costs, and strong balance sheet metrics.