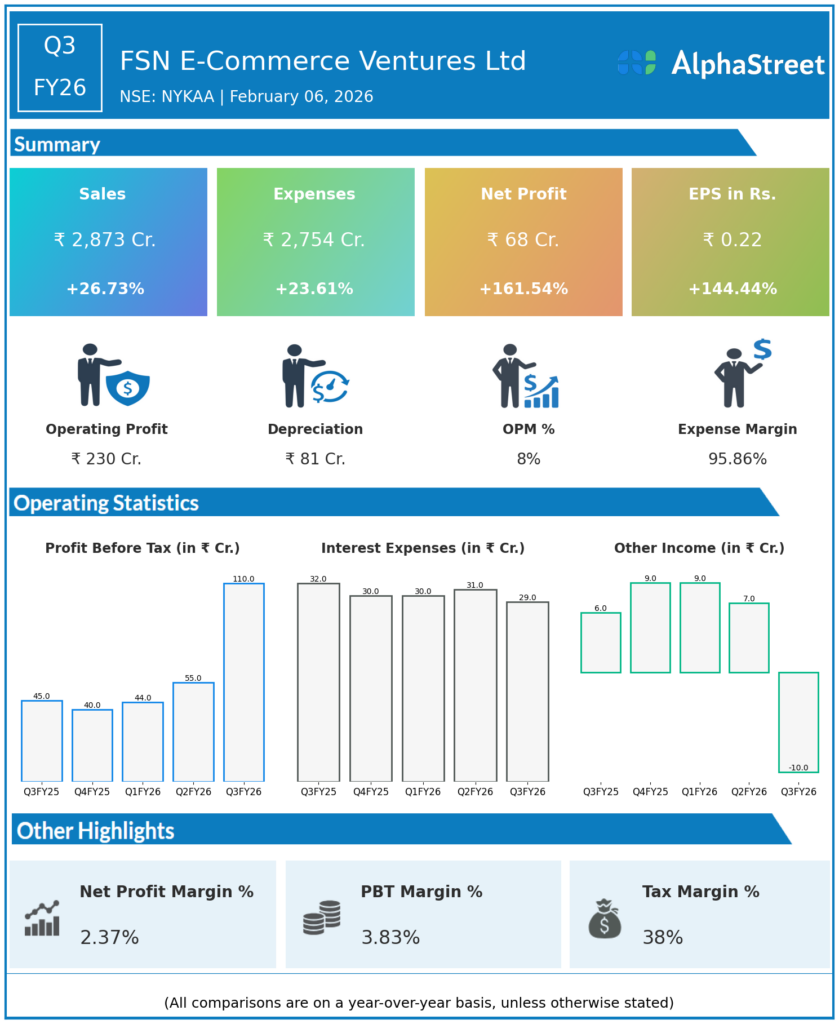

FSN E-Commerce Ventures Ltd (Nykaa) achieved remarkable Q3 FY26 profitability growth driven by strong revenue expansion in beauty and fashion e-commerce. Expense management supported substantial bottom-line gains.

Executive Summary

FSN E-Commerce Ventures Ltd reported consolidated revenues of ₹2,873 crore for Q3 FY26, up 26.73% YoY from ₹2,267 crore. Net profit surged 161.54% YoY to ₹68 crore from ₹26 crore, with EPS rising 144.44% YoY to ₹0.22 from ₹0.09. Controlled expense growth relative to sales fueled margin improvement.

Revenue & Growth

Revenues grew 26.73% YoY to ₹2,873 crore from ₹2,267 crore, reflecting higher sales across beauty, personal care, and fashion categories. Total expenses increased 23.61% YoY to ₹2,754 crore from ₹2,228 crore. QoQ data unavailable from provided figures.

Profitability & Margins

Consolidated net profit jumped 161.54% YoY to ₹68 crore. EPS advanced 144.44% YoY to ₹0.22. PAT margin expanded to 2.37% from 1.15% YoY; EBITDA and gross margin details not specified in dataset.

Balance-sheet Highlights

Balance sheet specifics including net debt, current assets, or liabilities not provided in input data. Operations leverage digitally native platform with owned brands and diverse product portfolio. Net debt/EBITDA and current ratio unavailable.

Cash Flow / Liquidity

Cash flow statement information absent from dataset. Operating cash flow, free cash flow, and liquidity metrics like current ratio not reported. Inventory management supports e-commerce scalability.