FSN E-commerce Ventures Ltd. (FSNEV) popularly known as “Nykaa” is a digitally native consumer technology platform, delivering a content-led, lifestyle retail experience to consumers. The company has a diverse portfolio of beauty, personal care, and fashion products, including owned brand products manufactured by it. Presenting below are its Q1 FY26 earnings results.

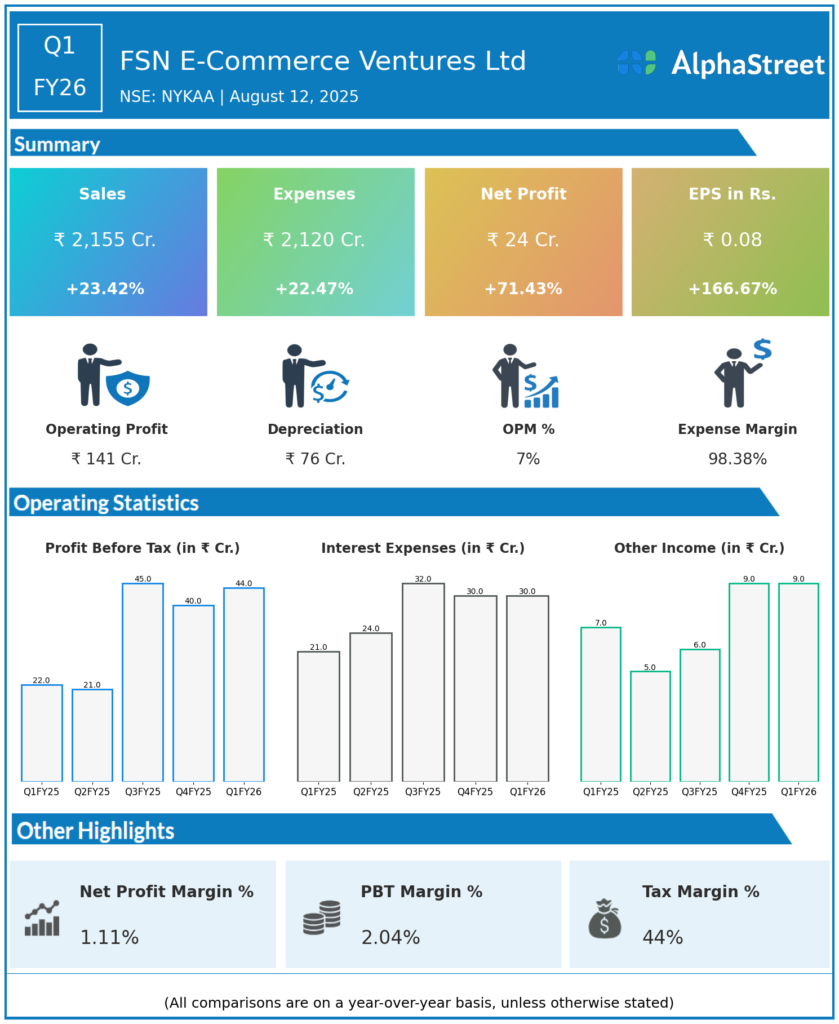

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹2,155 crore, up 23% year-over-year (YoY) from ₹1,746 crore in Q1 FY25.

-

Net Profit (PAT): ₹24.47 crore, surged 71% YoY from ₹13.64 crore in the same quarter last year.

-

EBITDA: ₹141 crore, up 46% YoY with EBITDA margin expansion to 6.5% from 5.5% in Q1 FY25.

-

Gross Merchandise Value (GMV): ₹4,182 crore, up 26% YoY, driven by premiumization and deeper market penetration.

-

Earnings Per Share (EPS): ₹0.08, up by 167% on the YoY basis.

Business Segment Highlights

-

Beauty Vertical: Key growth driver with GMV growth of 26% YoY to ₹3,208 crore. Growth was broad-based across e-commerce, retail stores, eB2B distribution, and House of Nykaa portfolio.

-

Customer Base: Expanded to 45 million cumulative customers, with the beauty customer base alone reaching nearly 37 million (a 29% increase YoY).

-

House of Nykaa: Delivered exceptional growth with an annualized GMV run rate of around ₹2,700 crore (up 57% YoY). The House of Beauty portfolio alone grew 70% YoY.

-

Offline Retail: Expanded to 250 beauty stores across 82 cities as of July 2025; total retail space grew 36% YoY to over 2.5 lakh sq. ft. Flagship stores boosted experiential retailing and premium positioning.

-

eB2B Distribution (Superstore by Nykaa): Achieved GMV growth of 40% YoY to ₹288 crore, reaching over 3 lakh retailers in 1,100 cities.

-

Fashion Vertical: GMV grew 25% YoY to ₹964 crore, with improving EBITDA margin narrowing losses (from -9.2% to -6.2%). Customer engagement rose with 165 million visits and 8.5 million customers.

Key Management Commentary & Strategic Highlights

-

Falguni Nayar, Executive Chairperson and CEO: Emphasized Nykaa’s consistent ability to balance growth and profitability across beauty and fashion businesses, driven by premiumization and deeper market penetration.

-

Focus remains on expanding offline presence, deepening brand loyalty, and accelerating new launches, especially within the House of Nykaa brands.

-

Nykaa continues to leverage omnichannel strategy, digital transformation, and customer engagement to sustain mid-20s consolidated growth.

-

The company completed approval for acquiring the remaining 40% stake in Nudge Wellness Pvt Ltd, enhancing its wellness segment presence.

Q4 FY25 Earnings Results

- FSN E-Commerce Ventures Ltd reported Revenues for Q4FY25 of ₹2,062.00 Crores up from ₹1,668.00 Crore year on year, a rise of 23.62%.

- Total Expenses for Q4FY25 of ₹2,031.00 Crores up from ₹1,656.00 Crores year on year, a rise of 22.64%.

- Consolidated Net Profit of ₹19.00 Crores up 111.11% from ₹9.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹0.07, up 250.00% from ₹0.02 in the same quarter of the previous year.

-

EBITDA margin was 5.5% in Q1 FY25 and improved to 6.5% in Q1 FY26.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.