Nuvoco Vista Corporation Ltd (NVCL), is one of the largest cement companies and concrete manufacturers in India with a consolidated capacity of 25 MMTPA. It offers a diversified range of products such as cement, Ready-mix Concrete (RMX), and modern building materials i.e. adhesives, wall putty, dry plaster, cover blocks, and more.

Q3 FY26 Earnings Results

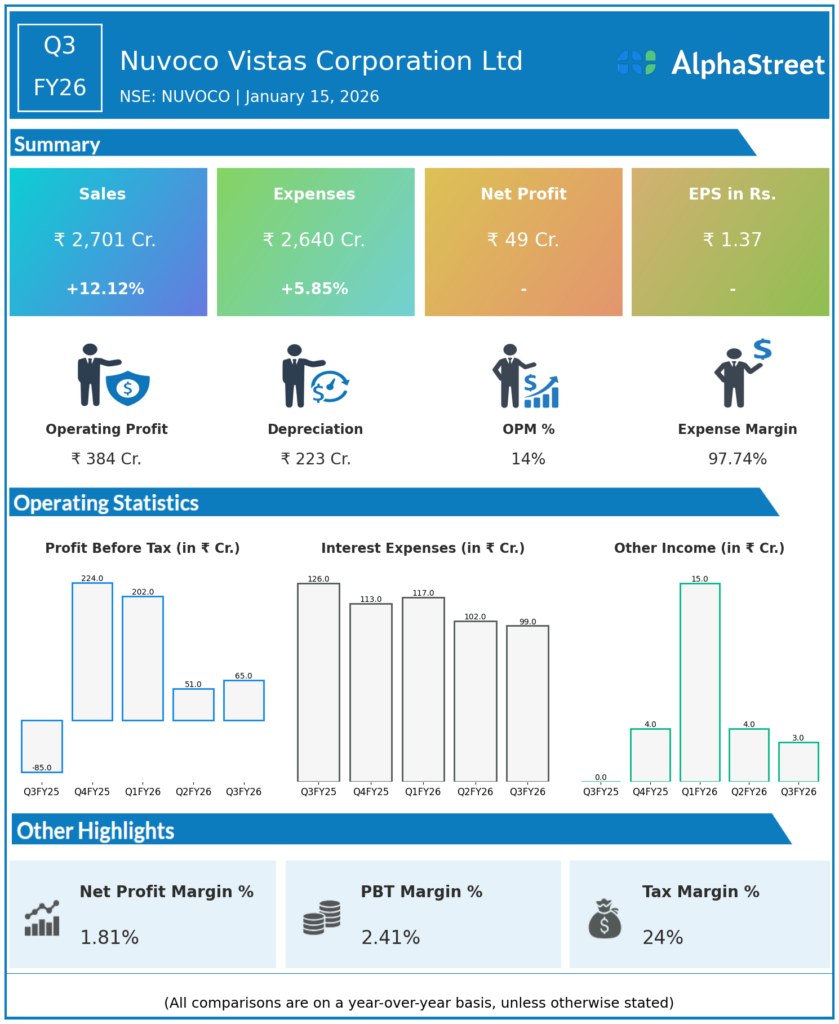

- Volume: 5.00 MMT, up 7% YoY from 4.70 MMT; up from 4.30 MMT in Q2 FY26, marking an all‑time high third‑quarter volume.

- Revenue from Operations: ₹2,701.27 crore, up 12.1–12.2% YoY from ₹2,409.36 crore in Q3 FY25; up ~10% QoQ from ₹2,457.57 crore in Q2 FY26.

- EBITDA: ₹386 crore, up 50% YoY from ₹258 crore in Q3 FY25 and up from ₹371 crore in Q2 FY26.

- EBITDA margin (implied): Around 14.3% in Q3 FY26 vs ~10.7% in Q3 FY25, reflecting sharp operating leverage and cost efficiencies.

- Profit After Tax (PAT): ₹49.37 crore, versus a net loss of ₹61.37 crore in Q3 FY25; PAT declined sequentially from ₹36.43 crore in Q2 FY26 plus ₹133.16 crore in Q1 (higher base), but marks a second straight profitable quarter.

- Total income: ₹2,704.03 crore; total expenses ₹2,639.49 crore, up only 5.8% YoY against 12.2% income growth.

- Mix metrics:

- Premiumisation: 44% of sales, up from 39% in Q3 FY25 and sustained for the second consecutive quarter at this level.

- Trade mix: 71% vs 71–74% in recent quarters, indicating continued focus on higher‑margin trade channel.

Management Commentary & Strategic Decisions – Q3 FY26

- Managing Director Jayakumar Krishnaswamy highlighted that Q3 saw “highest‑ever third‑quarter volume” and a 50% YoY rise in EBITDA, achieved despite early macro headwinds from prolonged monsoon and festive season, with demand recovering strongly in December.

- Profitability improvement was driven by premiumisation, an elevated trade share, operational excellence and cost optimisation, which together expanded margins even as fuel and logistics costs remained a watch area.

- Strategic initiatives and outlook:

- Continued emphasis on premium brands and value‑added products to sustain higher realisations and margin resilience across cycles.

- Execution of Vadraj Cement acquisition and refurbishment on track; commissioning guided for Q3 FY27–Q1 FY28, targeting total cement capacity of around 35 MMTPA and strengthening presence in the western region.

- Ongoing deleveraging and working‑capital discipline, with net‑debt reduction focus maintained after substantial like‑to‑like debt reduction in H1 FY26.

- Management remains positive on demand supported by infrastructure, housing and government spending, while maintaining focus on price discipline and mix to offset cost inflation.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹2,457.57 crore, up 8.3% YoY from ₹2,268.58 crore in Q2 FY25; down ~14% QoQ from ₹2,872.7 crore in Q1 FY26 due to seasonality and monsoon impact.

- Cement Sales Volume: 4.30 MMT vs 4.20 MMT in Q2 FY25, up ~2% YoY.

- EBITDA: ₹371 crore, up 62% YoY from about ₹229 crore in Q2 FY25; highest‑ever second‑quarter EBITDA.

- EBITDA margin (implied): Around 15.1% vs ~10% in Q2 FY25, reflecting strong operating leverage and better pricing/mix.

- Profit After Tax (PAT): ₹36.43 crore, versus a loss of ₹85.17 crore in Q2 FY25; sequentially down from ₹133.16 crore in Q1 FY26.

- H1 FY26 snapshot: Revenue ₹5,330.27 crore, up 8.7% YoY; profit ₹169.59 crore vs a loss of ₹82.33 crore in H1 FY25.

- Net debt: Reduced like‑to‑like by ₹1,009 crore YoY to ₹3,492 crore (excluding Vadraj acquisition debt), reflecting ongoing deleveraging.

- Mix metrics:

- Trade mix: 74%, an all‑time high.

- Premium products: 44% of sales, also a record, up sharply from prior year levels.

Management Commentary & Strategic Directions – Q2 FY26

- Management emphasised that record Q2 EBITDA and the turnaround from loss to profit were driven by higher premium share, stronger trade mix, cost efficiencies and stable input prices.

- The company highlighted its deleveraging progress, with significant net‑debt reduction and contained working capital, strengthening the balance sheet ahead of capacity expansion.

- Strategic focus outlined in Q2:

- Further push on premium and blended cements, leveraging brand strength in key north, east and central markets to improve realisations.

- Tight control on costs and logistics, and leveraging synergies from optimisation projects and alternative fuels to protect margins.

- Timely execution of Vadraj refurbishment and integration to enhance western region footprint and support the ~35 MMTPA capacity target.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.