Nuvoco Vista Corporation Ltd (NVCL), is one of the largest cement companies and concrete manufacturers in India with a consolidated capacity of 25 MMTPA. It offers a diversified range of products such as cement, Ready-mix Concrete (RMX), and modern building materials i.e. adhesives, wall putty, dry plaster, cover blocks, and more. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

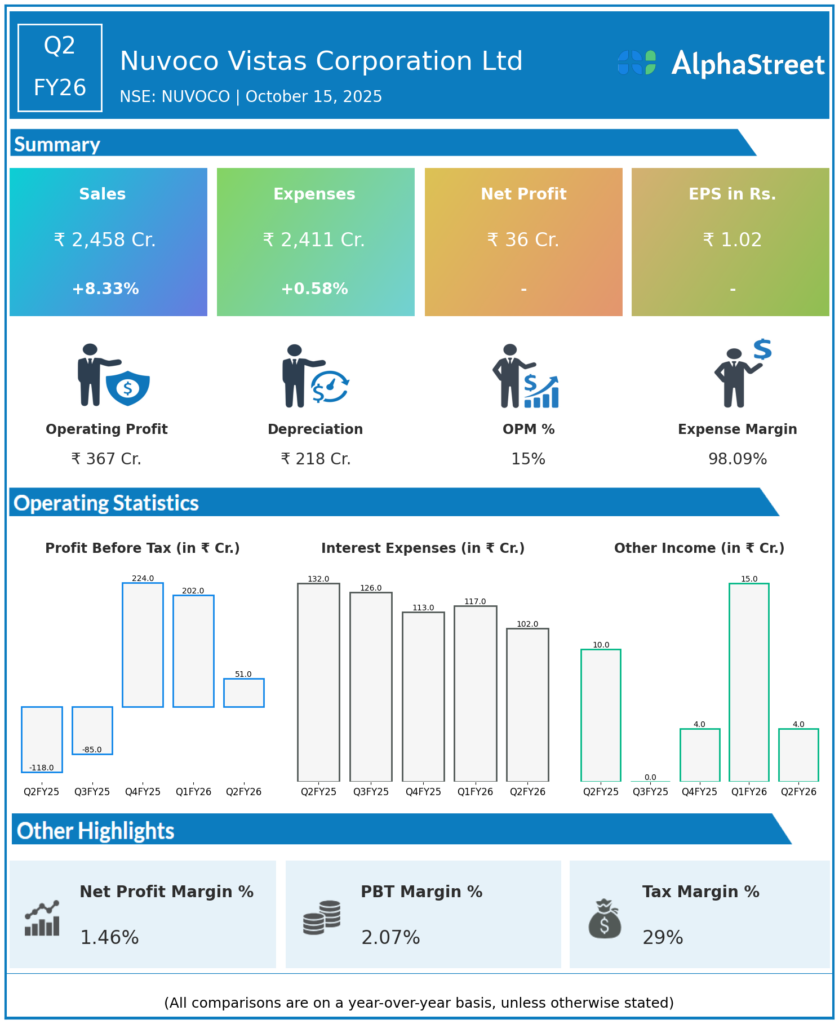

Revenue from operations: ₹2,457.57 crore, up 8.3% YoY from ₹2,268.58 crore in Q2 FY25.

-

Net profit (PAT): ₹36.43 crore, compared to a loss of ₹85.17 crore in Q2 FY25.

-

EBITDA: ₹371 crore, all-time high for Q2; EBITDA margin at 15%, driven by better trade mix and cost control.

-

Cement sales volume: 4.3 MMT, slightly up from 4.2 MMT YoY.

-

Premium product sales: Record 44% share in trade volumes, highest ever.

-

Net debt (ex. Vadraj acquisition): Reduced by ₹1,009 crore YoY to ₹3,492 crore, part of ongoing deleveraging.

-

Expenses: ₹2,410.27 crore, marginal YoY rise.

-

Ready Mix Concrete and value-added products: Up 8.9% YoY.

-

Sustainability: Industry-leading lowest carbon emissions at 453.8 kg CO2/ton cementitious material.

Management Commentary & Strategic Decisions

-

MD Jayakumar Krishnaswamy cited premiumisation, trade mix optimization, and disciplined cost controls as key drivers for the profit turnaround and record EBITDA, despite challenging monsoon and GST-related distribution issues.

-

Refurbishment of Vadraj Cement Plant is underway, with operationalisation targeted by Q3 FY27, supporting expansion to 35 MMTPA capacity by FY27.

-

The company maintains an expansion strategy in eastern India (4 MMTPA) and is focused on premium portfolio growth for sustainable higher realizations.

-

Continued deleveraging was re-emphasized, with over ₹1,009 crore in net debt reduction YoY (excluding acquisition debt).

-

Commitment to sustainability remained central, reflected in leading carbon emissions reduction among Indian cement majors.

Q1 FY26 Earnings Results

-

Revenue from operations: ₹2,872.7 crore, up 8.95–9% YoY from ₹2,635 crore in Q1 FY25.

-

Net profit (PAT): ₹133.16 crore, up sharply from ₹2.84 crore in Q1 FY25, driven by premiumisation and trade sales.

-

EBITDA: ₹533 crore, up 53% YoY; highest ever for Q1.

-

Cement sales volume: 5.1 MMT, up 6% YoY.

-

Premium products: Accounted for 41% of trade volume, highest in 13 quarters.

-

Net debt (like-for-like): Rs 3,474 crore, reduced by ₹884 crore YoY.

-

Acquisition: Vadraj Cement acquisition completed, cement capacity to expand to approx. 31 MMTPA by Q3 FY27.

-

Sustainability: Carbon emissions lowered to 453.8 kg/ton cementitious materials.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.