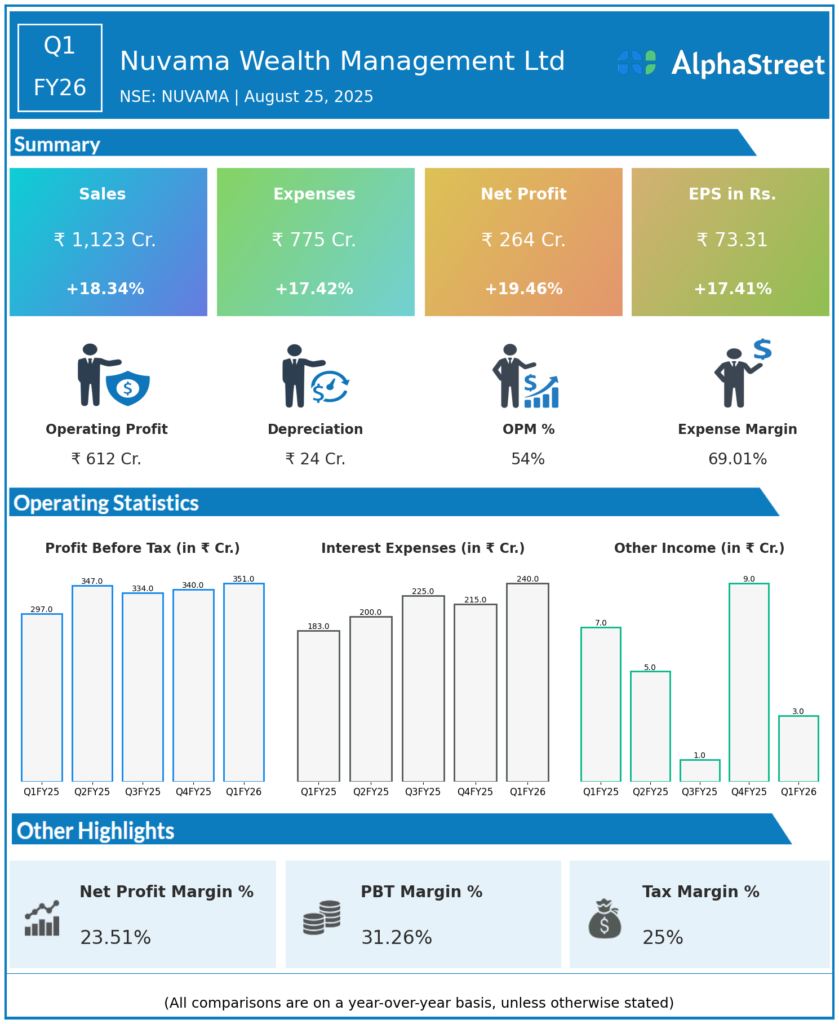

Incorporated in 1993, Nuvama Wealth Management Ltd is in the business of broking and trading in equity securities and is also registered as an Investment Adviser and Merchant Banker with SEBI. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Revenue: ₹1,124.61 crores, up 18.0% YoY and 21.1% QoQ.

-

Total Expenses: ₹775 crores, up 17.4% YoY and 15.7% QoQ.

-

Profit Before Tax (PBT): ₹349.20 crores, up 19.0% YoY and 46.7% QoQ.

-

Profit After Tax (PAT): ₹263.87 crores, up 19.5% YoY and 46.0% QoQ.

-

Earnings Per Share (EPS): ₹73.31, up 17.4% YoY and 40.8% QoQ.

-

Client Assets: ₹4.6 trillion, grew 19% YoY.

-

Wealth and Asset Management: Revenues grew 18% YoY, Asset Services revenues grew 46% YoY driven by client additions and scale-up.

-

Cost-to-Income Ratio: 55%, reflecting operational efficiency.

-

Return on Equity (ROE): Over 30% in Q1 FY26.

Management Commentary & Strategic Decisions

-

MD & CEO Ashish Kehair cited strong India economy supporting steady consumer demand and improved liquidity post-RBI rate cuts, enabling healthy fund flows.

-

Despite global trade tensions and market volatility, company’s diversified business model drove broad-based growth across segments.

-

Focus on scaling multi-product platform, investments in talent and technology to enhance client engagement and accelerate growth.

-

Continued expansion in Commercial Real Estate via PRIME fund with ongoing pipeline for investment deployment.

-

Capital Markets businesses showed steady gains aided by improving market sentiment and deep client relationships.

-

Management confident in differentiated value proposition, well placed for sustainable, long-term growth.

Q4 FY25 Earnings Results

-

Total Revenue: ₹1,120 crores.

-

Total Expenses: ₹545 crores.

-

Profit Before Tax (PBT): ₹238.11 crores.

-

Profit After Tax (PAT): ₹255 crores.

-

EPS: ₹71

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.