NTPC (National Thermal Power Corporation) Ltd along with its subsidiaries/ associates & JVs is primarily involved in generation and sale of bulk power to State power utilities. Other business of the group includes providing consultancy, project management & supervision, energy trading, oil & gas exploration and coal mining.

Q2 FY26 Earnings Results:

-

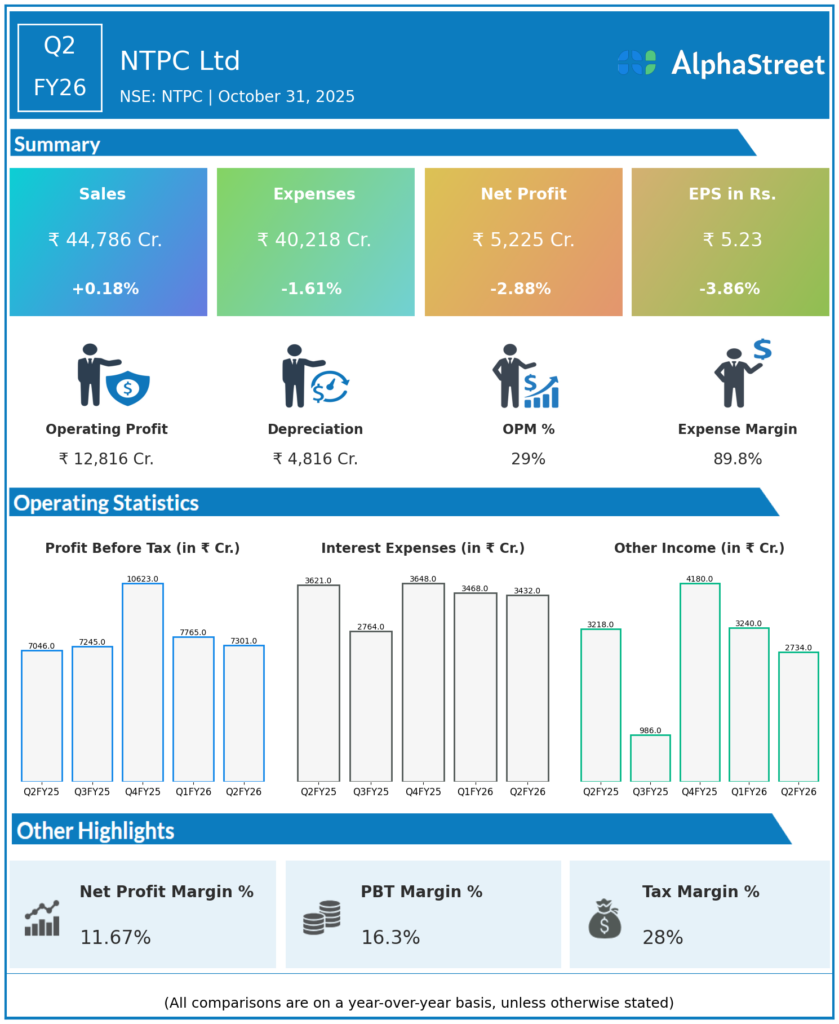

Revenue from Operations: ₹44,785.82 crore, up 0.2% YoY, down 4.8% QoQ.

-

Consolidated Net Profit (PAT): ₹5,066.78 crore, down 3.9% YoY from ₹5,275 crore; down QoQ from ₹5,274 crore.

-

EBITDA: ₹12,815.75 crore, up 10% YoY.

-

EBITDA Margin: 28.6%, improved from 26.1% in previous quarter.

-

Interim Dividend declared: ₹2.75 per equity share; record date November 7, 2025.

-

Plant Load Factor (PLF) for coal stations at 75.16%, higher than national average.

-

Operational efficiencies helped margins expand amid stable revenue.

Management Commentary & Strategic Insights:

-

NTPC focused on cost management and operational efficiency to sustain margins despite modest revenue growth.

-

Expansion in renewable energy through NTPC Green with a 135% rise in profit YoY.

-

Continued pursuit of India’s energy transition with investments in low-carbon and green energy assets.

-

Highlights include improving plant load factors, debt management, and strategic capital allocation.

-

Confident about growth prospects supported by government policies and increasing power demand post-monsoon.

Q1 FY26 Earnings Results:

-

Revenue from Operations: ₹47,821 crore.

-

Consolidated PAT: ₹6,108 crore, up 11% YoY.

-

EBITDA margin stable with focus on operational excellence.

-

PLF for coal plants at 75.16%, significantly above national average.

-

Strong first quarter performance driven by higher generation and efficient operations.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.