NTPC (National Thermal Power Corporation) Ltd along with its subsidiaries/ associates & JVs is primarily involved in generation and sale of bulk power to State power utilities. Other business of the group includes providing consultancy, project management & supervision, energy trading, oil & gas exploration and coal mining.

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

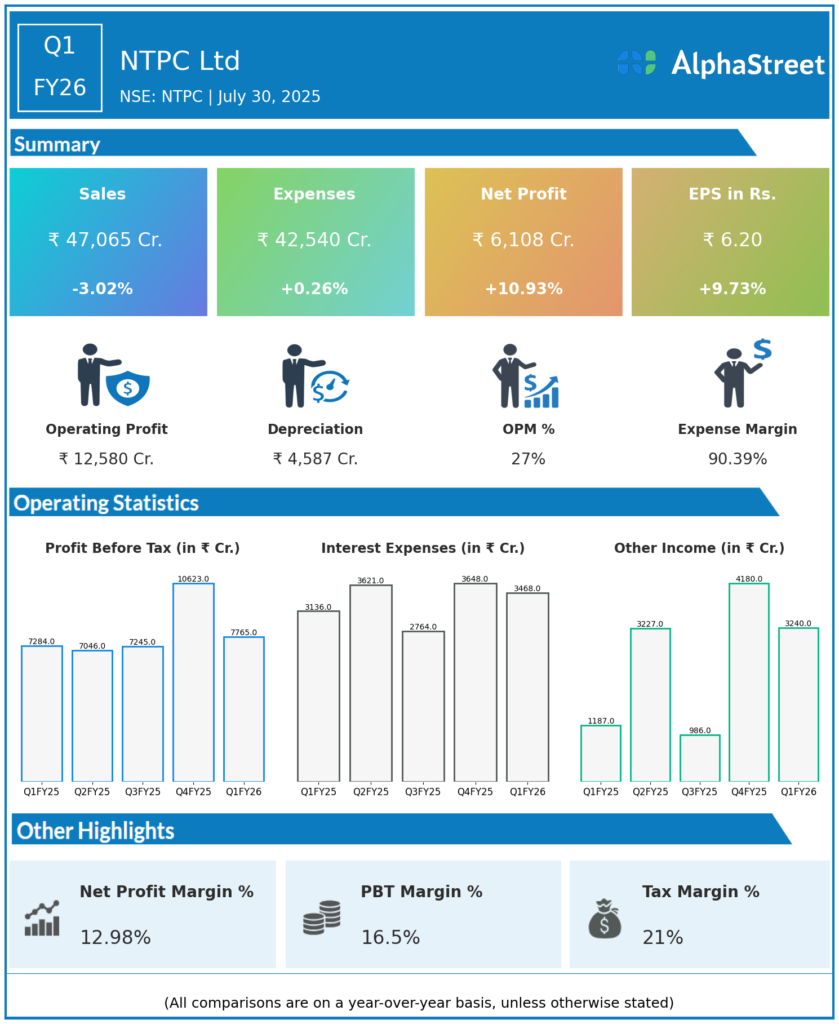

Consolidated Total Income: ₹47,065 crore, down from ₹48,982 crore YoY (-3%).

-

Standalone Income: ₹43,333 crore vs ₹45,053 crore YoY.

-

-

Consolidated Net Profit (PAT): ₹6,108 crore, up 11% YoY from ₹5,506 crore.

-

Standalone PAT: ₹4,775 crore, up 6% YoY from ₹4,511 crore.

-

-

EBITDA: Down 17% YoY to ₹10,284 crore; margin contracted to 24.2% from 28%.

-

Operational Highlights:

-

Group generated 110BUs (billion units) of power vs 114BUs YoY; standalone gross generation 91BUs vs 98BUs YoY.

-

Coal stations PLF remained high at 75.16% vs 67.67% for industry.

-

Energy trading and international exports (Nepal, Bangladesh) contributed to revenue.

-

-

Dividend: Final dividend of ₹3.35/share for FY25 confirmed, payout from Sept 2025.

-

Stock Performance: NTPC stock rose marginally YTD but declined 15% over the prior 12 months.

Key Management & Strategic Decisions

-

Capacity Expansion: NTPC plans ~21GW new commissioning by FY26-27, with a rising share in renewables (targeting 60GW RE by 2032).

-

FY25: Added 3,972MW at group level (mainly RE and some thermal).

-

FY26-28 Capex Guidance: ~₹2.65 lakh crore at group level, ₹87,661 crore standalone.

-

-

Renewable Energy Ambition: Focus on new RE projects, pipeline of ~18GW under construction with significant new allocations in solar, wind, hydro, and pump storage.

-

NTPC Green Energy subsidiary reported strong Q1 FY26 results, with PAT up 59% YoY.

-

-

International Export Push: Strengthened cross-border electricity trade to neighboring countries through trading subsidiaries.

-

Leadership Continuity: CMD Gurdeep Singh re-appointed for one-year term (Aug 2025–July 2026) to ensure continuity during an aggressive green transition.

-

Dividend Policy: Continued focus on shareholder returns with a total FY25 dividend of ₹8.35/share.

-

Operational Efficiency: Maintained sector-leading thermal PLF and enhanced cost management; fuel costs fell in Q1 FY26 despite lower revenue, helping buttress profit.

-

Sustainability & Digitalization: Increased investments in greener capacity, digital transformation, energy storage, and green hydrogen pilots.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Consolidated Total Income: ₹51,085 crore, up from ₹48,817 crore in Q4 FY24 (+4.7% YoY).

-

Revenue from Generation: ₹49,353 crore, up from ₹47,089 crore YoY.

-

Consolidated Net Profit (PAT): ₹7,897 crore, up 22% YoY from ₹6,490 crore.

-

Standalone PAT: ₹5,778 crore, up 4% YoY.

-

-

EBITDA: ₹11,942 crore; margin 26.9%.

-

Dividend: Board recommended a final dividend of ₹3.35/share for FY25, in addition to interim dividends paid earlier.

-

Operational Highlights:

-

Highest consolidated group PAT ever, driven by capacity growth, higher other income, and improved JV contributions.

-

Thermal power stations achieved a Plant Load Factor (PLF) of 77.44%, notably above the industry average.

-

Group capacity rose by 3,972MW to ~79,930MW, with significant additions in renewables alongside incremental thermal additions

-