Incorporated in April 2022, NTPC Green Energy is a renewable energy company that focuses on undertaking projects through organic and inorganic routes. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

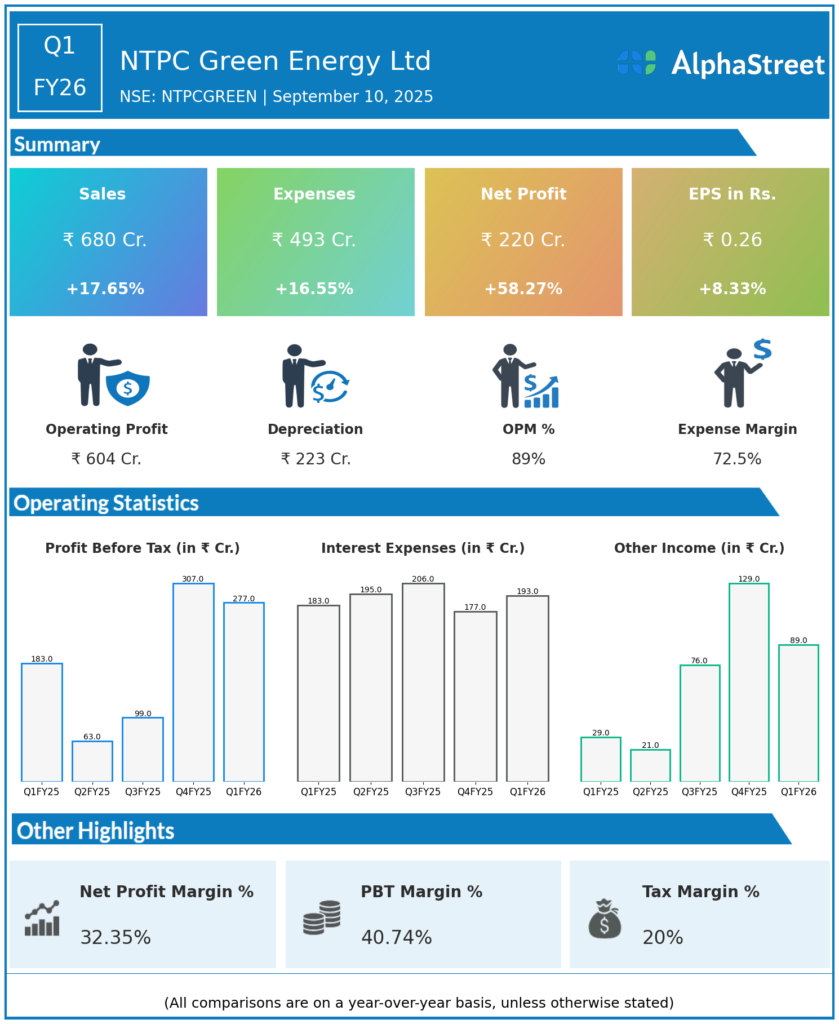

Revenue from Operations: ₹680.21 crores, up 17.6% YoY (Q1 FY25: ₹578.45 crores), up 9.3% QoQ (Q4 FY25: ₹622.27 crores).

-

Total Income: ₹751.69 crores, up 23.8% YoY (Q1 FY25: ₹607.43 crores), flat QoQ.

-

Profit Before Tax (PBT): ₹277.10 crores, up 51% YoY (Q1 FY25: ₹183.44 crores), and marginally down from ₹307.02 crores QoQ.

-

Profit After Tax (PAT): ₹220.48 crores, up 58% YoY (Q1 FY25: ₹138.61 crores), down 5.5% QoQ (Q4 FY25: ₹233.21 crores).

-

EBITDA: ₹603 crores, up 17.8% YoY (Q1 FY25: ₹512 crores); EBITDA margin steady at 88.6%.

-

Earnings Per Share (EPS): ₹0.26, up from ₹0.24 YoY.

-

Total Expenses: ₹492.55 crores, up 16.2% YoY.

-

Tax Expense: ₹56.62 crores, up 26.3% YoY.

-

Renewable Generation: 2,010 MU, up 26% YoY, led by higher solar PLF and new capacity.

-

Capacity Addition: 260 MW added in Q1; total commissioned capacity at 3.4 GW, with 7.4 GW under implementation.

-

Joint Venture Profit Share: ₹17.96 crores, swung positive YoY.

-

Operational Highlights: Over 96% of operational capacity has secured long-term PPAs.

Key Management Commentary & Strategic Highlights

-

Management highlighted robust revenue and profit growth driven by scaling renewable assets, strong solar generation, and favorable weather conditions.

-

New capacity additions and improving utilization contributed to a 26% jump in green energy generation; operational discipline preserved high EBITDA margins despite rising costs.

-

Joint ventures began contributing positively, enhancing bottom-line performance and diversification of revenue streams.

-

Management remains focused on expanding clean energy footprint with 7.4 GW under implementation, aiming for strong future capacity and operational excellence.

-

Strategic expansion and steady financial performance reinforce NTPC Green’s role as a leader in India’s renewable transition.

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹622.27 crores.

-

Total Income: ₹751.50 crores.

-

Profit Before Tax (PBT): ₹307.02 crores.

-

Profit After Tax (PAT): ₹233.21 crores.

-

Earnings Per Share (EPS): ₹0.28.

-

Capacity Addition: Notable but lower than Q1 FY26.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.