Nilkamal Ltd transformed from Plastic Furniture to Complete Furniture Solution Provider for Home Furniture, Office Furniture, etc., in various materials and upholstered products.

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

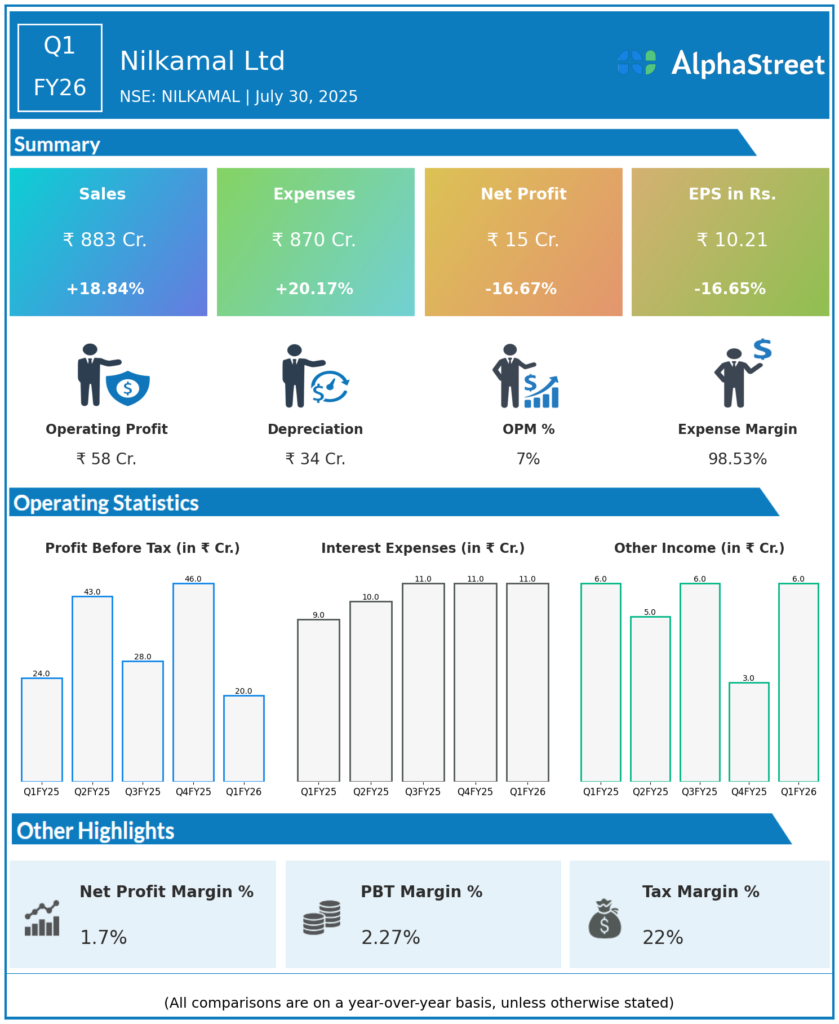

Consolidated Revenue from Operations: ₹883 crore, up 19% YoY.

-

Net Profit (PAT): ₹15 crore, a steep drop from previous periods.

-

EPS: Not explicitly reported, but reflective of significant margin pressure.

-

New Business Trends:

-

Muted B2B business (excluding racking), with postponement of institutional spending due to the election cycle.

-

B2C segment: Declined 13% YoY due to soft demand and lower footfalls in lifestyle/@home retail.

-

Racking business: Grew 44% YoY.

-

Mattress business: Up 10% YoY, supported by more channels and in-house foam manufacturing.

-

E-commerce sales: Grew 16% YoY.

-

-

Key Investments: Announced capex of ₹150 crore for FY26 to enhance manufacturing capacity and new channels.

-

Management/Board: Appointment of a new independent director to strengthen governance.

Key Management & Strategic Decisions

-

Retail Rebranding: Unification of @Home and Nilkamal Furniture Ideas under “Nilkamal Homes” to drive retail expansion and improve brand visibility.

-

Channel & Product Diversification: Strong focus on growing the mattress and Bubbleguard divisions; expanding digital and channel partner networks.

-

Cost Management: Ongoing efforts to optimize costs amid rising material expenses; renewed focus on operational efficiency in muted demand conditions.

-

Investments: Significant capex outlay (₹150 crore) for upgrade/expansion, especially in high-growth businesses.

-

E-commerce Expansion: Leveraging digital and e-commerce to broaden delivery reach and product portfolio.

-

International Operations: Subsidiaries in Sri Lanka saw improved performance; UAE subsidiary experienced muted growth.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Consolidated Revenue from Operations: ₹894.01 crore, up 7.17% YoY.

-

Net Profit (PAT): ₹34.13 crore, down 3.9% YoY from ₹35.51 crore in Q4 FY24, but up 58.8% sequentially from Q3 FY25.

-

EBITDA: ₹87.73 crore, up 4.04% YoY.

-

EBITDA Margin: Approximately 9.8%.

-

EPS: ₹23.30, compared to ₹23.83 in Q4 FY24.

-

Profit Before Tax: ₹45.57 crore, down 1.9% YoY.

-

Expenses: Total expenses rose 7.7% YoY to ₹851.16 crore, driven by an 8.45% increase in raw material costs and higher other expenditures.

-

Dividend: Board declared a final dividend of ₹20 per share.

-

Segmental Trends:

-

B2B/material handling business: Revenue grew 4.7% YoY.

-

Retail/e-commerce sales: Declined 6.3% YoY.

-

Mattress business: Grew by 38% in FY25.

-

Bubbleguard business: Up 14% in FY25.

-