NHPC, a Navratna Ratna public sector utility, is Government of India’s flagship hydroelectric generation company. The company is primarily involved in the generation and sale of bulk power to various Power Utilities. Its other business includes providing project management / construction contracts/ consultancy assignment services and trading of power. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

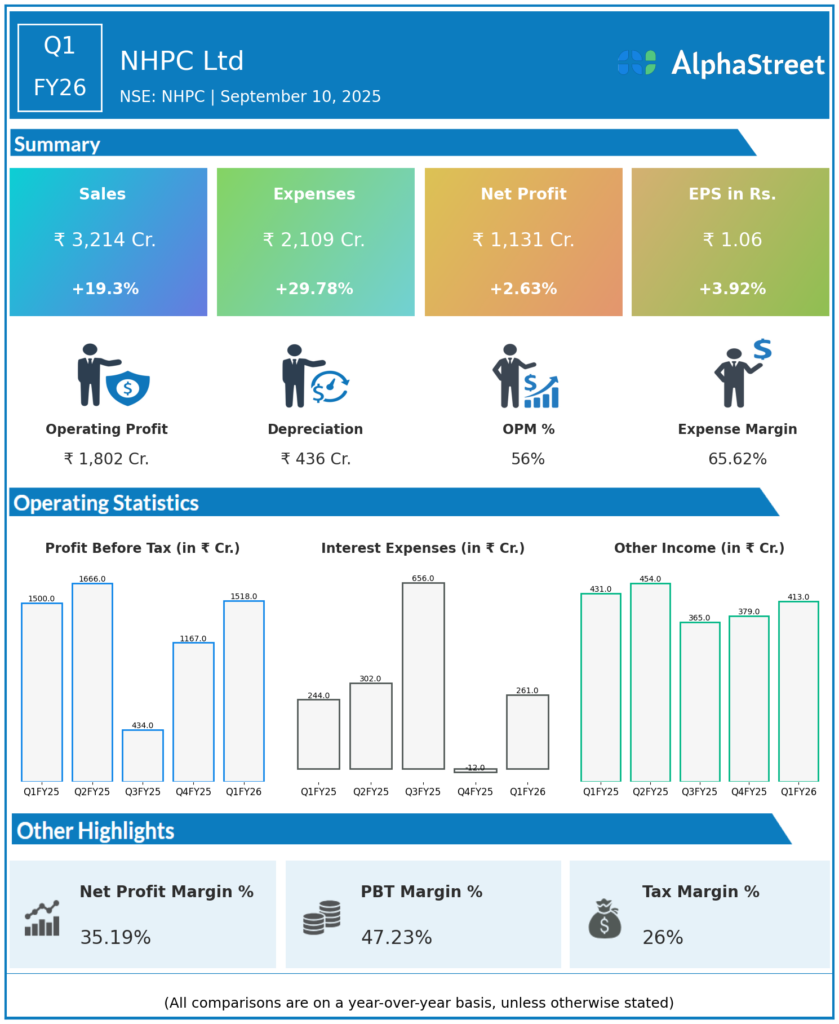

Total Income: ₹3,442.76 crores, up 13.3% YoY (Q1 FY25: ₹3,037.92 crores), up 48.4% QoQ (Q4 FY25: ₹2,320.18 crores).

-

Revenue from Operations: ₹3,213.77 crores, up 19.3% YoY (Q1 FY25: ₹2,694.20 crores).

-

Total Expenses: ₹2,108.83 crores, up 30.3% YoY.

-

Profit Before Tax (PBT): ₹1,517.69 crores, up 0.7% YoY (Q1 FY25: ₹1,506.61 crores), up 36.4% QoQ (Q4 FY25: ₹1,112.92 crores).

-

Profit After Tax (PAT): ₹1,131.16 crores, up 2% YoY (Q1 FY25: ₹1,108.46 crores), up 85.2% QoQ (Q4 FY25: ₹610.93 crores).

-

Earnings Per Share (EPS): ₹1.10, up 10% YoY (Q1 FY25: ₹1.00), up 83.3% QoQ (Q4 FY25: ₹0.60).

-

EBITDA: ₹2,032 crores; EBITDA margin 59%.

-

Power Generation: 8,813 million units in Q1 FY26, up from 7,914 units YoY, contributing 22% to India’s hydropower output for the period.

-

Major Projects: 800 MW Parbati-II and 214.28 MW commissioned at Kamisar Solar Power Project in Bikaner.

-

Balance Sheet: Shareholder funds at ₹40,726 crores; long-term borrowings increased to ₹37,978 crores reflecting ongoing capex for expansion.

-

Installed Capacity: 8,247 MW, with 9,790 MW under construction and further capacity under clearance and investigation.

Key Management Commentary & Strategic Highlights

-

Management highlighted robust operational efficiency and strong revenue growth driven by increased generation and commissioning of key projects (Parbati-II, Kamisar Solar), reinforcing NHPC’s leadership in hydropower and renewables.

-

Strategic focus remains on capacity expansion, with ambitious growth plans and disciplined capital expenditure to further bolster portfolio.

-

NHPC’s aggressive project pipeline, 9,790 MW under construction, 7,666 MW awaiting clearance, and 20,950 MW under survey—positions the company for sustained long-term growth and renewables leadership.

-

Management also stressed resilience in O&M, strong EBITDA margin, and financial discipline supporting shareholder value amidst sectoral volatility.

-

The company continues to leverage government policy, market opportunities in solar/wind, and sector consolidation for future advantage.

Q4 FY25 Earnings Results

-

Total Income: ₹2,347 crores.

-

Total Expenses: ₹1,257 crores.

-

Profit Before Tax (PBT): ₹1,112.92 crores.

-

Tax Expense: ₹505.71 crores.

-

Profit After Tax (PAT): ₹920 crores.

-

EPS: ₹0.85.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.