New India Assurance Company Ltd is India’s largest non-life insurance company. It is promoted by the Government of India (GoI) holding ~86% stake. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

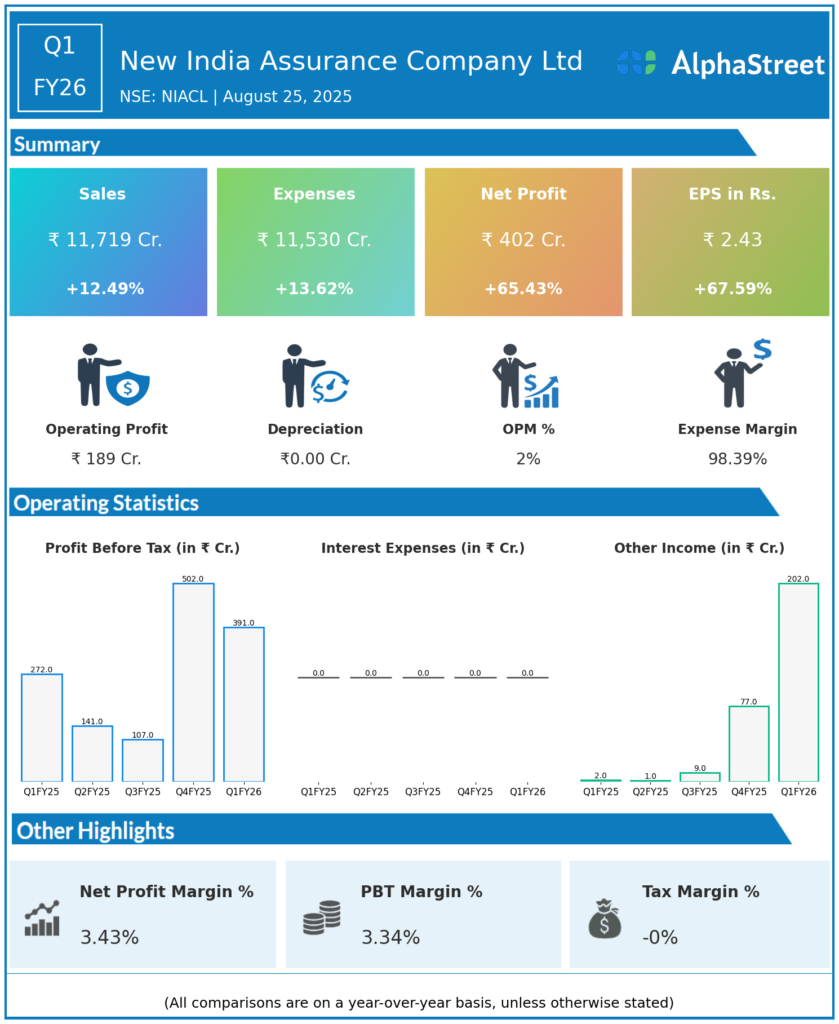

Consolidated Revenue from Operations: ₹11,719 crores, up 12.49% YoY from ₹10,418 crores in Q1 FY25.

-

Profit Before Tax (PBT): ₹391.13 crores, up 43.8% YoY from ₹272.09 crores in Q1 FY25, down 16.8% QoQ from ₹469.86 crores in Q4 FY25.

-

Profit After Tax (PAT): ₹401.67 crores, up 65.4% YoY from ₹242.88 crores in Q1 FY25, up 28.4% QoQ from ₹312.90 crores in Q4 FY25.

-

Earnings Per Share (EPS): ₹2.43, up 67.5% YoY from ₹1.40 and up 26.3% QoQ from ₹1.90.

-

Standalone Revenue: ₹9,369.42 crores, up 10.19% YoY.

-

Standalone PAT: ₹391.01 crores, up 80.21% YoY from ₹216.97 crores.

-

Gross Written Premium: ₹13,334 crores, up 13.11% YoY.

-

Domestic Gross Direct Premium Growth: 15.27% YoY, outpacing industry growth of 8.84%.

-

Market Share: Increased from 14.65% to 15.51%.

-

Investment Income: ₹2,290 crores, up 23.7% YoY.

-

Combined Ratio: 116.16%, slightly up from 116.13% YoY.

-

Incurred Claim Ratio: 99.76%, up from 95.98% YoY.

-

Losses from Air India Flight Incident: ₹1,756 crores underwriting loss, up from ₹1,588 crores YoY, impacting underwriting profits.

Management Commentary & Strategic Decisions

-

Chairman & MD Girija Subramanian highlighted strong growth in gross written premiums and market share gains despite a cautious approach in the competitive motor insurance segment.

-

Emphasis on managing underwriting losses while leveraging strong investment income to drive profits.

-

Management confident in maintaining strong financial position with assets under management at ₹1,00,802 crores and solvency ratio at 1.87x.

-

Focus continues on diversified insurance portfolio including fire, engineering, and health insurance to maintain growth momentum.

-

The company remains vigilant on risk management and claims control in the post-Air India flight incident environment influencing claims.

Q4 FY25 Earnings Results

-

Consolidated Revenue from Operations: ₹11,664 crores.

-

Profit Before Tax (PBT): ₹469.86 crores.

-

Profit After Tax (PAT): ₹356 crores, up 13.7 percent on the YoY basis

-

EPS: ₹2.18, up 15.3 percent on the YoY basis.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.