Nestle India Limited is a subsidiary of Nestle which is a Swiss MNC. The company operates in the Food segment. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

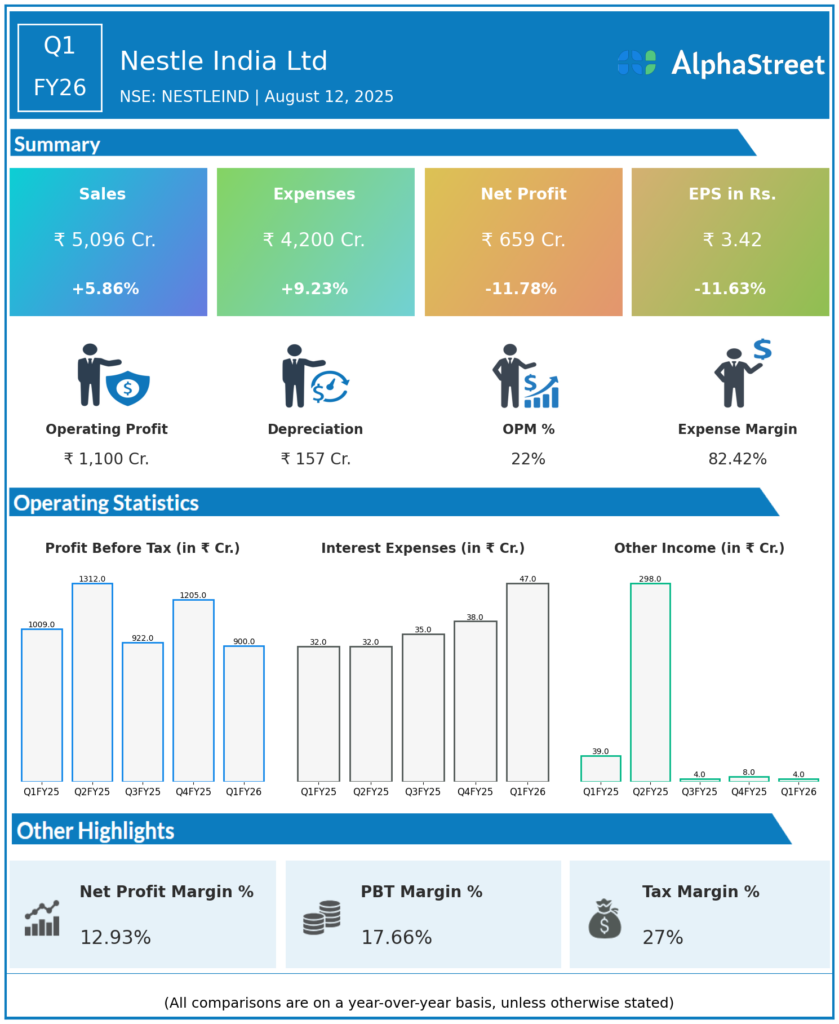

Revenue from Operations: ₹5,096 crore, up 5.9% year-over-year (YoY) from ₹4,814 crore in Q1 FY25.

-

Net Profit (PAT): ₹659 crore (consolidated), down 11.7% YoY from ₹747 crore in Q1 FY25. Standalone PAT was ₹659 crore, also down by 11.7%.

-

EBITDA: ₹1,100 crore, down 1.3% YoY; EBITDA margin contracted to 21.7% of sales, a three-year low.

-

Domestic Sales: Up 5.5% YoY to ₹4,860 crore.

-

Export Sales: Up 16% YoY to ₹214 crore.

-

EPS: ₹3.42 for the quarter, down by 11.63% on the YoY basis

-

Dividend: Final dividend of ₹10/share for FY25 declared.

-

Bonus Issue: Announced first-ever 1:1 bonus share issue (record date: August 8, 2025), doubling the number of shares.

Key Management Commentary & Strategic Highlights

-

Margin Pressure: Profit miss attributed to elevated commodity costs (especially cocoa and coffee), higher operating expenses due to expanded manufacturing footprint, and higher finance charges from temporary borrowings.

-

Operational Expansion: Significant capacity addition over the past 7–8 months resulted in increased operational costs but positions the company for future growth.

-

Category Performance:

-

Powdered and Liquid Beverages (Nescafé): Double-digit growth, further market share gains with strength in both affordable and premium products.

-

Maggi, KitKat, Milkmaid: Delivered strong, volume-led and double-digit growth.

-

Out-of-Home (OOH) business and E-commerce channels (12.5% of domestic sales) emerged as fastest-growing segments, driven by quick commerce and new launches.

-

Three out of four product categories showed volume-led growth; seven of top twelve brands posted double-digit growth.

-

-

Challenges: Milk and nutrition segments remained muted due to margin pressure and subdued volumes.

-

Cost Outlook: Cocoa and edible oil prices stabilizing. Coffee and milk prices show a declining/moderate trend, offering some relief for future quarters.

-

Leadership Transition: Manish Tiwary appointed as Chairman and Managing Director effective August 1, 2025, succeeding Suresh Narayanan.

Q4 FY25 Earnings Results

- Nestle India Ltd reported Revenues for Q4FY25 of ₹5,504.00 Crores up from ₹5,268.00 Crore year on year, a rise of 4.48%.

- Total Expenses for Q4FY25 of ₹4,308.00 Crores up from ₹4,054.00 Crores year on year, a rise of 6.27%.

- Consolidated Net Profit of ₹885.00 Crores down 5.25% from ₹934.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹9.18, down 5.26% from ₹9.69 in the same quarter of the previous year.

-

Margin: Q1 FY26’s EBITDA margin at 21.7% is a multi-year low, highlighting recent pressures.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.