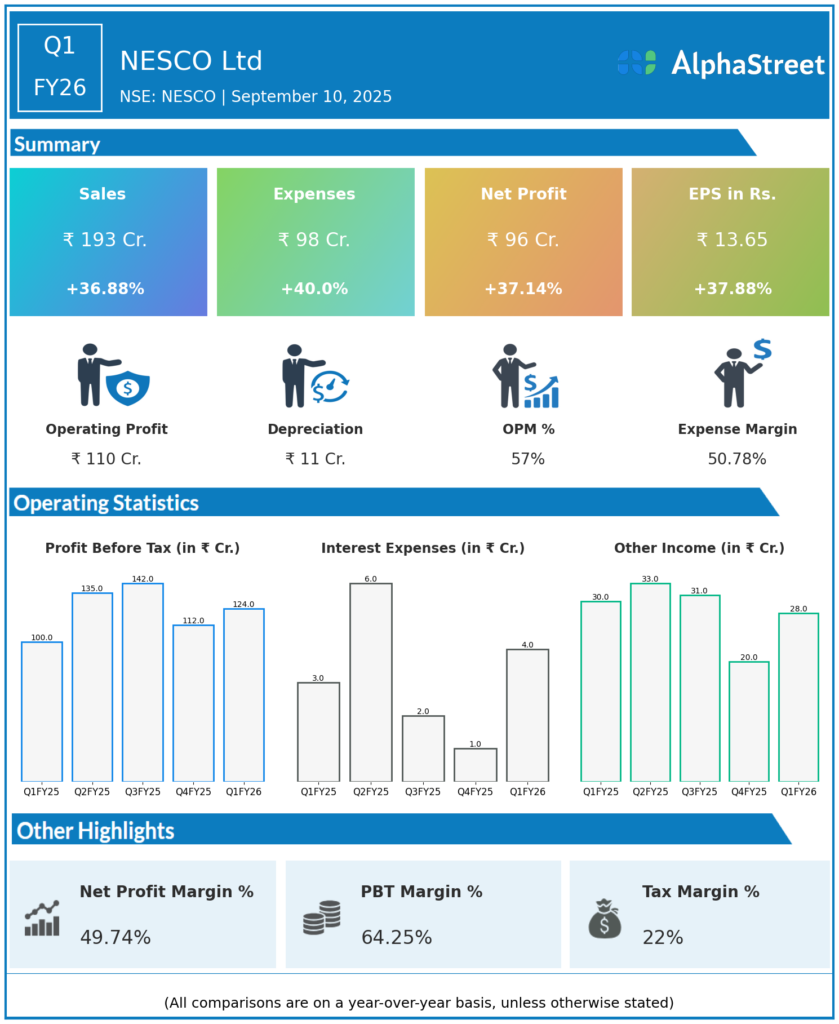

NESCO is engaged in the businesses of Licencing premises in IT park buildings and providing related services, licencing premises for exhibitions and providing services to the organisers, manufacturing of machines and capital equipment, and providing hospitality and catering services. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Income: ₹193 crores, up 0.7% QoQ and up 37% YoY (Q1 FY25: ₹161.61 crores).

-

Total Expenses: ₹97.63 crores, up 16.4% QoQ and up 40% YoY.

-

Profit Before Tax (PBT): ₹123.82 crores, down 9% QoQ (Q4 FY25: ₹136.01 crores), up 20.8% YoY.

-

Profit After Tax (PAT): ₹96.14 crores, down 8.5% QoQ (Q4 FY25: ₹105.12 crores), up 37% YoY (Q1 FY25: ₹69.8 crores).

-

Earnings Per Share (EPS): ₹13.65, down 8.7% QoQ (Q4 FY25: ₹14.90), up 38% YoY.

-

EBITDA: ₹110.5 crores, up 28% YoY; margin narrowed by 300bps YoY to 57.7% from 61%.

-

Segment Highlights:

-

Realty revenue: ₹98.5 crores, up from ₹88 crores YoY and ₹95 crores QoQ.

-

Bombay Exhibition Centre: Revenue ₹40.4 crores (up from ₹24.1 crores YoY, down from ₹46.75 crores QoQ).

-

Foods business: Revenue ₹47 crores (up from ₹19 crores YoY, ₹38 crores QoQ).

-

Key Management Commentary & Strategic Highlights

-

Management highlighted strong YoY revenue and profit growth, led by higher occupancy in IT park buildings and the continued revival of events at the Bombay Exhibition Centre.

-

The Foods business achieved remarkable growth due to robust demand for hospitality services at events and increased capacity utilization.

-

Despite sequentially lower profit, overall business momentum remains strong, with focus on margin improvement and operational efficiency.

-

No major strategic shifts announced; core emphasis remains on industrial infrastructure, hospitality, and maximizing real estate value.

Q4 FY25 Earnings Results

-

Total Income: ₹192 crores.

-

Total Expenses: ₹85 crores.

-

Profit Before Tax (PBT): ₹136.01 crores.

-

Tax Expense: ₹30.89 crores.

-

Profit After Tax (PAT): ₹89 crores.

-

EPS: ₹12.58.

-

Bombay Exhibition Centre Revenue: ₹46.75 crores.

-

Foods Business Revenue: ₹38 crores.

-

Realty Revenue: ₹95 crores.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.