Neogen Chemicals Ltd, incorporated in 1991, manufactures bromine and lithium-based organic and organo-metallic compounds, used in the pharmaceutical, agricultural chemicals, and engineering industries.

Q2 FY26 Earnings Results

-

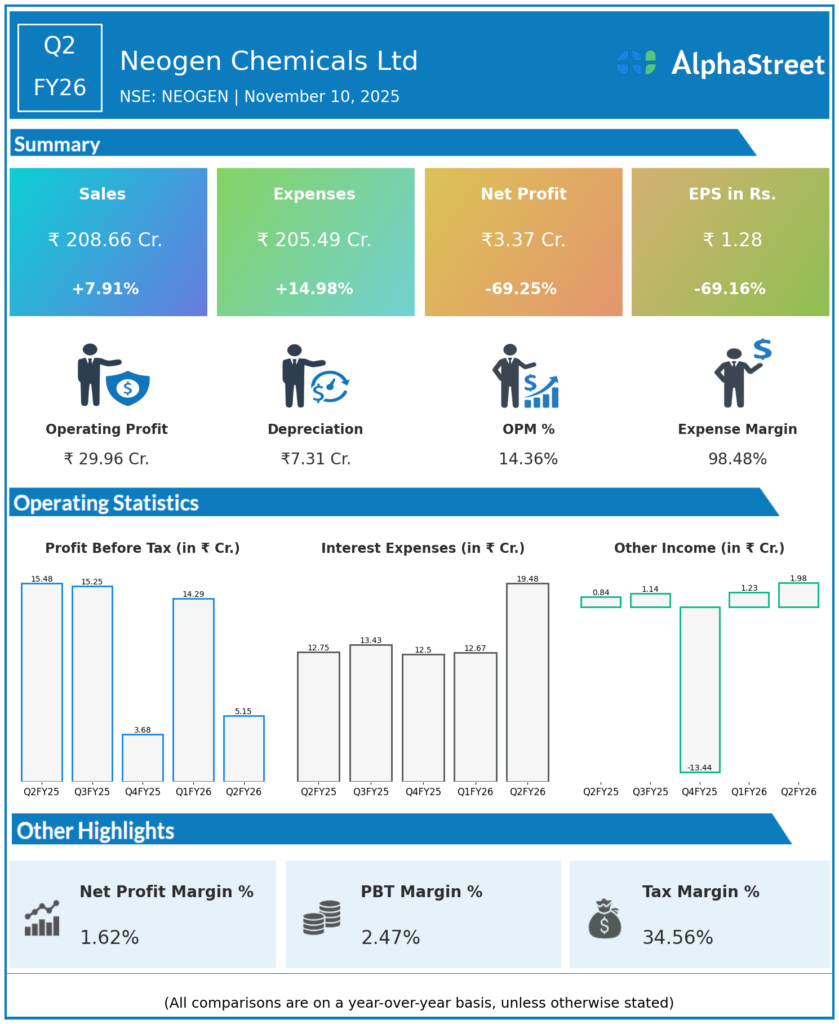

Revenue from Operations: ₹209 crore, up 8% YoY from ₹194.91 crore in Q2 FY25

-

EBITDA: ₹30 crore, down from previous quarters due to increased employee costs and insurance premiums

-

Profit After Tax (PAT): ₹3.37 crore, down 69% YoY from ₹10.9 crore in Q2 FY25 due to higher interest costs and expenses related to the Dahej plant fire incident

-

EBITDA margin shrank to 14.36% from 17.85% YoY

-

Interest coverage ratio declined to 1.54x from 2.77x in Q2 FY24, suggesting increased financial leverage stress

-

Neogen Ionics (battery chemicals) contributed ₹5.42 crore in revenue

-

Despite operational challenges, the company reported highest-ever quarterly revenue driven by volume growth

-

Capital intensive expansion and fire-related costs impacted short-term profitability

Management Commentary & Strategic Insights

-

Dr. Harin Kanani, Managing Director, stated that the company showed operational resilience despite Dahej plant outage

-

Diversified business model helped offset challenges from the plant fire

-

Focus remains on completing plant rebuild, optimizing costs, and ramping up capacity

-

Ongoing investments in high-margin organolithium and specialty chemicals to drive medium- to long-term growth

-

Strategic initiatives include expanding battery chemicals segment and exploring new markets

Q1 FY26 Earnings Results

-

Revenue: ₹186.7 crore, up 4% YoY despite Dahej plant disruption

-

EBITDA: ₹31.5 crore, stable YoY with margins of 18.8%

-

PAT: ₹10.3 crore, steady YoY

-

Operational resilience maintained with stable profitability despite supply constraints.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.