Incorporated in 1978, NCC Limited undertakes turnkey EPC contracts and BOT projects on Public-Private Partnership basis. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Order Book: ₹70,087 crores as of June 2025, up 33% YoY; secured new orders of ₹3,658 crores this quarter.

-

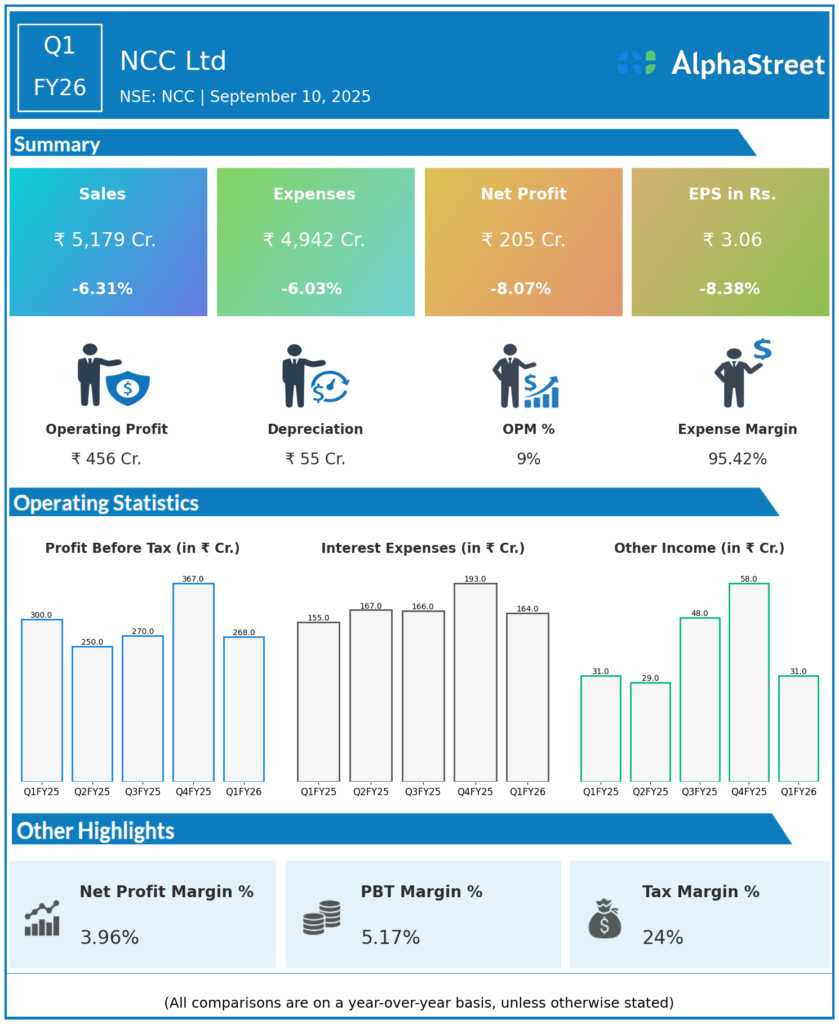

Consolidated Revenue: ₹5,179 crores, down 6.3% YoY (Q1 FY25: ₹5,558 crores).

-

Standalone Revenue: ₹4,430 crores, down 6.7% YoY (Q1 FY25: ₹4,747 crores).

-

EBITDA: ₹456.1 crores, down 4.3% YoY (Q1 FY25: ₹477.7 crores); margin improved to 8.8% vs 8.6% last year.

-

Profit After Tax (PAT): ₹205 crores, down 8.07% YoY (Q1 FY25: ₹209.9 crores); margin at 3.69% versus 3.8% prior year.

-

EPS: ₹3.06 versus ₹3.20 last year.

-

Net Debt: ₹1,574 crores, up from ₹695 crores at Q4 FY25 end; debt/equity ratio at 0.21 (remains healthy for sector).

-

Working Capital & Receivables: Working capital at ₹5,314 crores (30% of turnover); outstanding debtors ₹3,296 crores (77 days), unbilled revenue ₹6,442 crores (37% of total revenue).

-

Capex: ₹92 crores in Q1, versus annual budget of ₹750 crores.

-

ROCE / Return on Net Worth: ROCE 12.62%; return on net worth 13.14%.

Key Management Commentary & Strategic Highlights

-

Robust order book growth (up 33% YoY), bolstered by a 797% YoY surge in new order inflows, providing strong visibility for the next 2.5–3 years and supporting long-term growth ambitions.

-

Most new orders are in the buildings segment, reflecting market leadership and project execution strength.

-

Management maintains FY26 EBITDA margin guidance of 9–9.25%, seeing Q1 as a temporary dip with expectations of margin expansion as execution and revenue pick up.

-

Debt rise is explained as cyclical and expected to normalize by year-end (management guides to ₹1,400–1,500 crores); focus remains on disciplined financial management and working capital control.

- No structural profitability concern noted; management confident in converting large backlog into future sales, aided by a strong L1 pipeline and ongoing project execution discipline.

Q4 FY25 Earnings Results

-

Consolidated Revenue: ₹6,131 crores.

-

PAT: ₹265 crores.

-

EPS: ₹4.04.

-

Net Debt: ₹695 crores.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.