“NCC bagged orders worth Rs 12,612cr in 9MFY23 and the company has L1 order of Rs 3000cr. On the back of strong order momentum, the company has revised order inflow guidance from Rs 16,000cr to Rs 20,000cr in FY23. The management expects similar traction in order pipeline in FY24 with continued momentum in govt-led infrastructure spending. Order book of Rs 41,862cr is well diversified comprising of Buildings (48%), Transportation (11%), Water & Railways (21%), Electrical (8%), Irrigation (4%), Mining division (7%), Others (1%). The order book does not include O&M potential for Malad wastewater treatment plant to be executed over 15 years.” – Management, NCC Ltd.

| Stock Data | |

| Ticker | NSE: NCC & BSE: 500294 |

| Exchange | NSE & BSE |

| Industry | Construction |

| Price Performance | |

| Last 5 Days | -2.64% |

| YTD | +10.60% |

| Last 12 Months | +71.03% |

Company Description:

NCC Limited, a leading construction company in India that is involved in various segments of the construction industry. The company has a diverse portfolio and undertakes civil construction for buildings & housing, roads, water & environment, mining, electrical, power among others. NCC also has a subsidiary, NCC Urban, which takes up urban infrastructure projects such as the development of residential & commercial complexes, serviced apartments, SEZs, integrated townships, and complexes with advanced building techniques. The company owns land bank in various cities in South India and has acquired lands in and around Bengaluru, Chennai, Goa, Gurgaon, Hyderabad, Lucknow, Raipur for its real estate projects. Additionally, the company also undertakes the development of infrastructure projects through government concessions (road and energy projects), and has a presence in the infrastructure markets of the GCC through its subsidiaries with a key focus on roads, building, and water network.

Critical Success Factors:

- NCC Limited, has over four decades of experience in completing numerous construction projects across various infrastructure areas with timely execution. The company has a proven skill set in core infrastructure areas and has executed projects for various central and state level agencies, PSUs, as well as private sector clients. NCC has a diversified capability and a wider geographic presence, which further enhances its addressable opportunities. The company has a strong track record of handling and completing large projects with multiple clients, which gives it the qualification to bid for large projects. Recent order wins such as State water & Sanitation Mission from UP Govt, Nagpur Mumbai expressway, Project Seabird, Bangalore Metro Rail Corporation Ltd, and Building Project by NBCC, Nauroji Nagar, showcases its ability to win large projects. The company has worked with diverse clients like NHAI, NTPC, CIDCO, MSRDC, AIIMS, AAI, Coal India, Indian Oil, SAIL, NBCC, among others. The company’s continued investments in building organizational capabilities would help maintain growth momentum.

- The company’s order book has remained resilient in the past, providing revenue visibility for 2-3 years. NCC’s order book has swelled to Rs 41,862cr as of Dec’22, aided by robust order inflows to the tune of Rs 12,612cr in 9MFY23. The order book is well diversified across sectors, and geographically, the top four states in terms of the order book exposure are Uttar Pradesh, Maharashtra, Karnataka, and Telangana. The company has already surpassed its earlier guidance of order inflows of Rs 16,000cr for FY23 (including L1) and revised the guidance upwards to Rs 20,000cr, and the management expects order inflows to gain momentum given the strong emphasis on affordable housing, Jal Jeevan mission, and roads & expressway and metro & railway segments.

- The company has a diversified portfolio of investments and land holdings in South India, with a fair value of approximately Rs 525 crore as of March 31, 2022. NCC has been focused on monetizing non-core subsidiaries to improve its liquidity profile and reduce debt. The company has already divested its complete stake in NCC Vizag Urban Infrastructure to Garden Realty Private Limited, and the expected proceeds are approximately Rs 500 crore against loans and equity. The company’s gross debt stood at Rs 1950 crore in Dec’22, and the management has set a target to reduce it to Rs 1600-1700 crore in FY23-end. Additionally, the company’s investments in debt and mutual funds provide adequate surplus, which further strengthens its balance sheet.

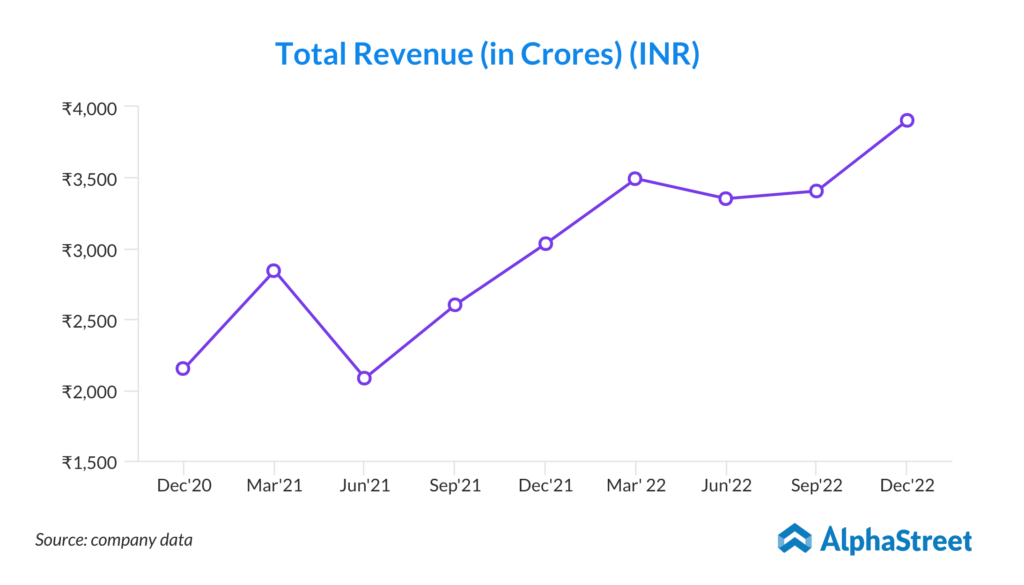

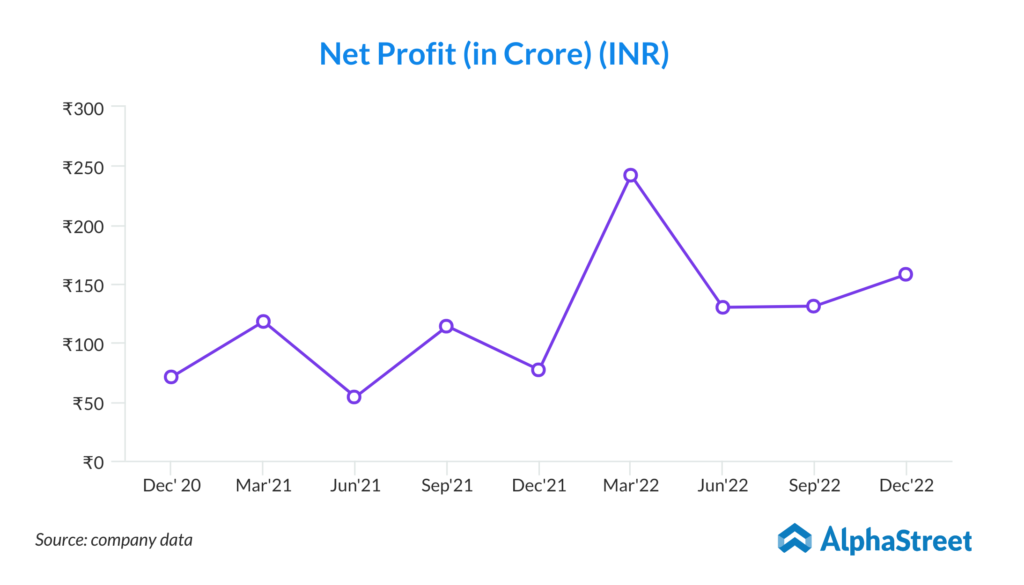

- NCC has consistently maintained healthy operating margins despite lower order inflows due to Covid-19, with a muted topline growth of 4.4% CAGR over FY17-22. However, the company exhibited strong execution and reported a topline growth of 37.6% YoY in 9MFY23. The management has revised the topline guidance to 30% YoY in FY23 and aims to attain margins of 9.5-10%. Additionally, NCC has a robust order book, which provides revenue visibility for 2-3 years and is well diversified across sectors and geographies. The company has also been divesting non-core subsidiaries and monetizing its land holdings, which has led to debt reduction and improved its liquidity profile. Overall, NCC has a healthy balance sheet, strong execution capabilities, and a diversified presence, which makes it better positioned to offset the impact of slowdown in any particular segment.

Key Challenges:

- Despite the healthy financials and strong execution record, NCC Ltd faces concerns related to project execution risk. Infrastructure projects involve complex design and engineering, which can lead to cost and time overruns, impacting the company’s profitability. There is also a risk of being blacklisted due to quality or delay issues, and media censure in case of unforeseen deaths or injuries related to the infrastructure built by the company.

- Contractual risk is a significant concern for NCC Ltd, as the company’s ability to fulfill its contractual obligations is critical for the successful execution of its orders. These contractual obligations include meeting specific quality standards, adhering to timelines, and complying with other terms and conditions specified in the contracts. Inability to fulfill these obligations could result in legal action against the company, which would not only impact its financial performance but also damage its reputation in the market. Additionally, contractual disputes can also lead to delays and cost overruns, further impacting the profitability of the company.

- The fluctuation in the price of key raw materials such as cement, bricks, sand, and steel is a concern for NCC. These price changes could result in a rise in input costs, putting pressure on the company’s margins and profitability. As a result, the company may need to adjust its prices to maintain profitability or seek alternative suppliers to reduce input costs. It is critical for the company to closely monitor the prices of raw materials and take necessary measures to mitigate the risk of price volatility.

- NCC has been involved in multiple litigations in recent years, which have caused concerns about the possibility of future legal challenges. This has resulted in uncertainties regarding the outcomes of the ongoing litigations, which could impact the company’s financial position and reputation. In particular, the company is awaiting clarity on the Sembcorp and Taqa arbitration cases, which are expected to be resolved by the end of FY23. These litigations could lead to financial losses, penalties, and other negative consequences, affecting the company’s performance and stock price.

Q3FY23 Result:

NCC Ltd had a strong Q3FY23 performance with a healthy topline of Rs 3849.6cr, driven by decent execution across project sites. The company’s EBITDA margin expanded by 61bps/58bps YoY/QoQ to 9.8% on account of moderation in raw material prices. Additionally, other income came in at Rs 54.1cr mainly due to a profit of Rs 29cr in land sale, Rs 17cr from interest income and Rs 6cr from dividend income. The company’s PAT stood at Rs 157.7cr, up by 106.4%/+20.4% YoY/QoQ. The company’s order book stood at Rs 41,862cr as of Dec 31, 2022, providing revenue visibility of 3x TTM revenue. The company received orders worth Rs 5495cr in Q3FY23 in water, electrical and building divisions.