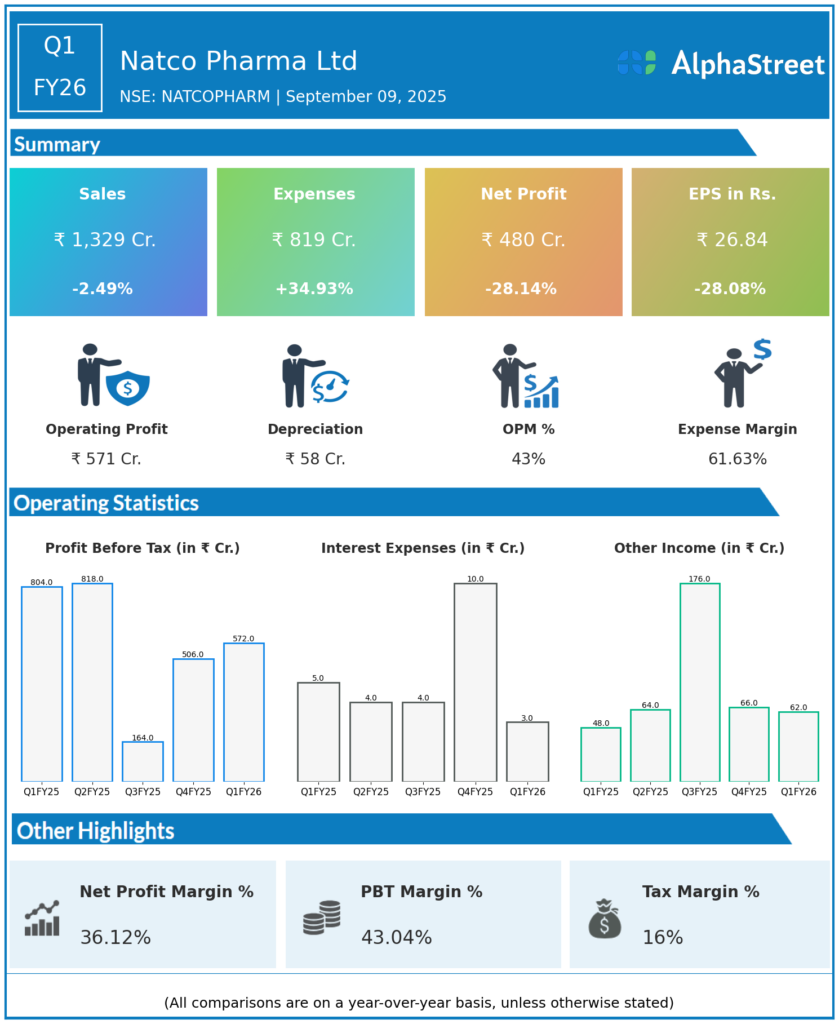

NATCO Pharma Limited (NATCO) is a vertically integrated, research and development focused pharmaceutical company engaged in developing, manufacturing, and marketing complex products for niche therapeutic areas. NATCO has established its presence in all three business segments viz. finished dosage formulations (“FDF”), active pharmaceutical ingredients (“APIs”), Contract Manufacturing Business. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Revenue: ₹1,329 crores, up 25.2% QoQ (Q4 FY25: ₹1,110.30 crores), down 2.4% YoY (Q1 FY25: ₹1,410.7 crores).

-

Profit Before Tax (PBT): ₹571.9 crores, up 19.7% QoQ (Q4 FY25: ₹477.6 crores), down 28.8% YoY (Q1 FY25: ₹803.6 crores).

-

Profit After Tax (PAT): ₹480.3 crores, up 24.3% QoQ (Q4 FY25: ₹386.3 crores), down 28.1% YoY (Q1 FY25: ₹668.5 crores).

-

EBITDA: ₹632.7 crores, margin at 45.5%, down from ₹764.9 crores, margin 56.1% YoY.

-

EPS: ₹26.84, up 24.1% QoQ, down 28.08% YoY.

-

Pharmaceutical Segment Revenue: ₹1,294 crores, down 3.9% YoY.

-

Crop Health Sciences Revenue: ₹34.7 crores, up 118.75% YoY.

-

Interim Dividend: ₹2 per share announced (record date: August 19, 2025; payment from August 26).

-

Operational Notes: US business faced pricing pressure, notably on Revlimid, impacting margins and profit. R&D expenses remain elevated due to high-value projects.

Key Management Commentary & Strategic Highlights

-

Management noted robust margins, supported by operational control and diversified product mix, though US market pricing pressures, especially on Revlimid significantly affected profit.

-

Crop science division continues to scale rapidly, approaching breakeven and contributing to future growth.

-

Increased investments in international markets, notably a strategic stake in a South African firm expected to add to base earnings.

-

Ongoing Kothur facility regulatory reviews and anticipated lower Revlimid contribution post-September could impact future quarters.

-

Management remains optimistic about new launches, research pipeline, and international expansion to sustain long-term growth.

Q4 FY25 Earnings Results

- Revenue: ₹1,221 Crores

- Profit After Tax (PAT): ₹406 Crores

- Earnings Per share (EPS): ₹22.7

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.