Narayana Hrudalaya Ltd is engaged in providing economical healthcare services. It has a network of multispecialty and super specialty hospitals spread across multiple locations. Presenting below are its Q1 FY26 Earnings.

Q1 FY26 Earnings Results:

-

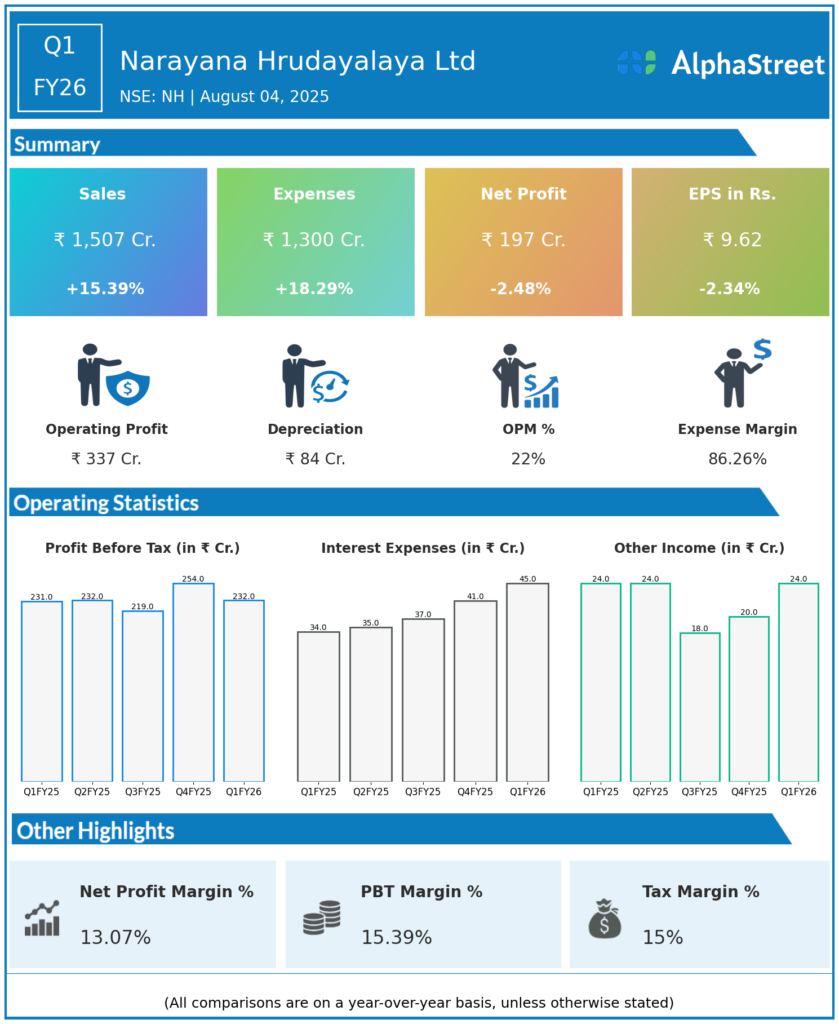

Total Income: ₹1,531 crore, up 12.2% year-over-year (YoY) and 17.5% quarter-over-quarter (QoQ).

-

Revenue from Operations: Approximately ₹1,507 crore, up 15.4% YoY.

-

EBITDA: ₹361 crore, up 10.8% YoY; EBITDA margin was 23.8%, down from 24.8% YoY.

-

Profit Before Tax (PBT): ₹231 crore, nearly flat YoY; up 2.5% sequentially.

-

Profit After Tax (PAT): ₹197 crore, down 2.4% YoY but up 3.1% QoQ; net profit margin ~13%.

-

EPS: ₹9.70 vs ₹9.90 Q1 FY25.

-

Key Business Segments:

-

India Revenue: ₹1,132.6 crore, up 7.8% YoY.

-

Cayman Islands Revenue: ₹396.8 crore, up 48.4% YoY.

-

-

Expenses: ₹1,300 crore, up 14.7% YoY.

-

Net Debt: ₹343 crore; net debt-to-equity of 0.09.

Key Management Commentary & Operational Highlights

-

Healthy double-digit revenue growth was driven by robust performance and expansion in both India and international (Cayman Islands) operations.

-

India business maintained steady 7–8% growth; new blocks and upgraded facilities contributed to clinical efficiency and increased patient intake.

-

Cayman Islands business saw exceptional growth, with 48% YoY revenue jump, partly due to expanded service offerings and greater global patient inflow.

-

Margins softened slightly due to increased costs and sustained investments in capacity, technology, and talent.

-

The balance sheet remains strong, with low net leverage, enabling continued expansion.

-

Management reaffirmed its long-term strategy: large-scale capex (₹3,000 crore planned over three years) to add 2,000 beds, invest in digital health, and deepen presence in high-acuity specialties.

Q4 FY25 Earnings:

- Narayana Hrudayalaya Ltd reported Revenues for Q4 FY25 of ₹1,475.00 Crores up from ₹1,246.00 Crore year on year, a rise of 18.38%.

- Total Expenses for Q4 FY25 of ₹1,241.00 Crores up from ₹1,048.00 Crores year on year, a rise of 18.42%.

- Consolidated Net Profit of ₹197.00 Crores up 3.14% from ₹191.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹9.65, up 3.43% from ₹9.33 in the same quarter of the previous year.