Muthoot Capital Services Limited (NSE:MUTHOOTCAP), has reported a transformative fiscal year 2024-25, characterized by record-breaking operational milestones and a significant shift toward a multi-product business model.

Performance Trends: Record Disbursements and Asset Quality

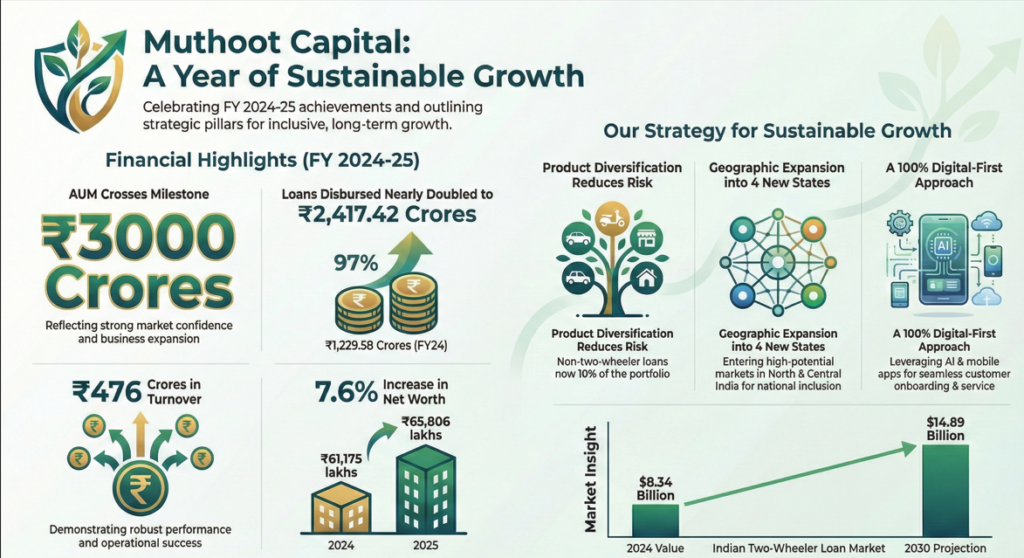

MCSL achieved its highest-ever disbursement of ₹2,642 crore, representing a growth rate of 83.68% over the previous fiscal year. This surge propelled the company’s Assets Under Management (AUM) to cross the ₹3,000 crore milestone, a 51.74% increase from ₹2,015 crore in FY 2023-24. While Total Income rose to ₹47,650 lakhs, Net Profit (PAT) stood at ₹4,631 lakhs, compared to ₹12,249 lakhs in the previous year, which had included extraordinary income from the sale of loan pools.

A critical highlight of the year was the substantial improvement in asset quality, with the Gross NPA (GNPA) dropping from 10.17% to 4.88% and Net NPA (NNPA) reaching 2.30%. The company’s net worth also increased by 7.6%, reaching ₹65,806 lakhs.

Market Position and Recognition

MCSL maintains a robust financial standing with CRISIL and ICRA ratings of A+/Stable. The company was recognized as the “Best Vehicle Financer of the Year” at the Lendtech X-Factor Awards and was certified as a “Great Place To Work” with a trust index score of 82%. It remains a key player in the two-wheeler financing segment, leveraging a nationwide network of over 5,200 branches through Muthoot FinCorp Limited.

Key Announcements: Licensing and Diversification

The company announced several strategic developments to future-proof its operations:

- IRDAI Corporate Agency License: MCSL acquired a license to distribute insurance products, enabling a more comprehensive financial suite for its customers.

- Product Diversification: Moving beyond its core two-wheeler focus, the company successfully introduced Used Car Loans and Used Commercial Vehicle Loans.

- Geographical Expansion: MCSL entered high-potential markets in North and Central India, specifically targeting Bihar, Jharkhand, Uttar Pradesh, and Rajasthan.

- Information Security: The firm achieved the ISO/IEC 27001:2022 Certification, reinforcing its commitment to data security and operational resilience.

- Leadership Succession: A transition in leadership saw Tina Suzanne George appointed as Whole-Time Director, following the retirement of Thomas George Muthoot as Managing Director.

Outlook: The 2025-2028 Strategic Roadmap

MCSL has set ambitious targets for the next three years to reach an AUM of ₹10,000 crores by 2028. Key pillars of this outlook include:

- Achieving a 35% CAGR in AUM through digital-first and data-driven strategies.

- Becoming a multi-product company where alternate products contribute 40% of overall disbursements.

- Aiming for a GNPA below 4.5% and a Return on Assets (ROA) of over 4%.

- Doubling down on green finance by expanding its electric vehicle (EV) financing vertical.