Madras Rubber Factory Limited (MRF) is the parent company of the MRF Group. The Company is engaged in the business of manufacturing tyres. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

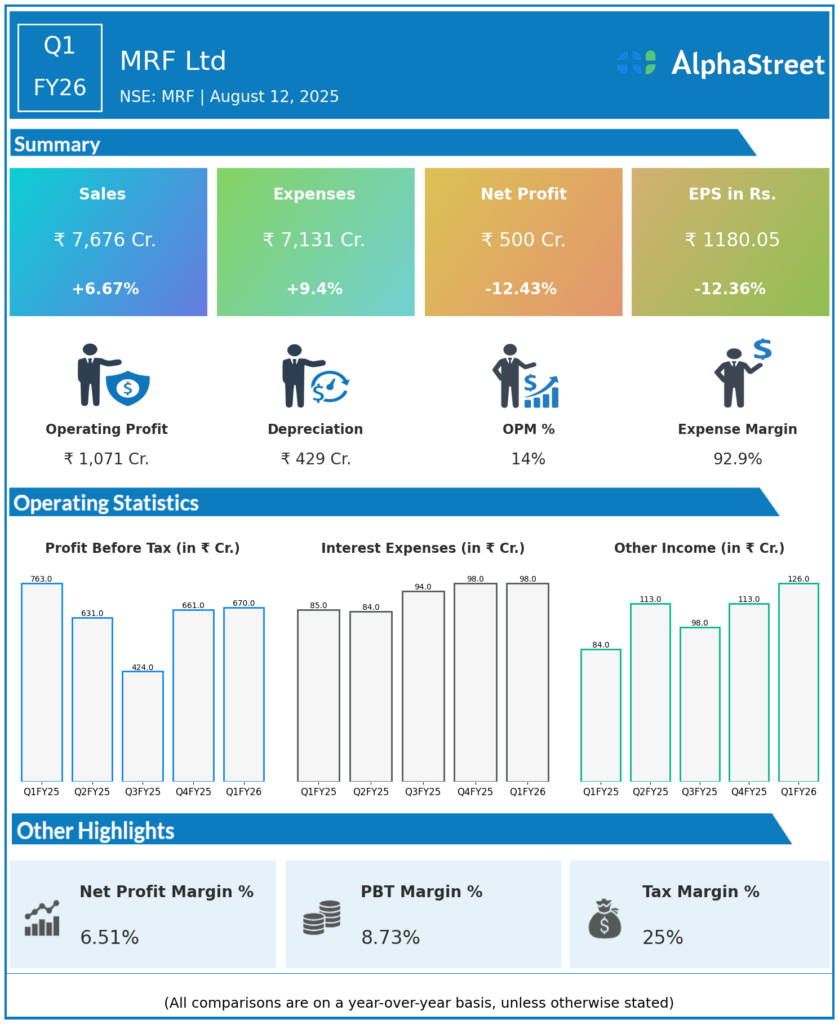

Net Profit (PAT): ₹500 crore, down 12.4% year-over-year (YoY) from ₹562.55 crore in Q1 FY25, and down about 2% quarter-on-quarter (QoQ) from ₹497.85 crore in Q4 FY25.

-

Revenue from Operations: ₹7,676 crore, a 7% YoY increase from ₹7,077.84 crore and 8% QoQ growth from ₹6,943.84 crore.

-

EBITDA: ₹1,034 crore, decreased 9% QoQ; EBITDA margin contracted over 200 basis points to 13.7% from 16.1% YoY.

-

Gross Margin: Declined by 300 basis points to 34.3% from 37.3% YoY despite only a 6% increase in raw material costs to ₹4,597 crore.

-

Total Expenses: ₹7,131 crore, up nearly 9.4% YoY and also increased from the previous quarter.

-

Profit Margins: Net profit margin reduced to around 6.4% from 7.8% in Q1 FY25.

Key Management Commentary & Strategic Highlights

-

Management cited rising raw material and operational costs as the main reasons for margin compression despite revenue growth.

-

Focus continues on maintaining cost efficiency and operational discipline amid a challenging commodity cost environment.

-

MRF is investing in capacity expansion and technology upgrades to sustain long-term competitiveness.

-

The company is closely monitoring market demand and supply chain dynamics as the industry adapts to inflationary pressures.

-

Despite near-term margin pressure, MRF remains committed to delivering volume growth and operational excellence.

Q4 FY25 Earnings Results

- MRF Ltd reported Revenues for Q4FY25 of ₹7,075.00 Crores up from ₹6,349.00 Crore year on year, a rise of 11.43%.

- Total Expenses for Q4FY25 of ₹6,527.00 Crores up from ₹5,915.00 Crores year on year, a rise of 10.35%.

- Consolidated Net Profit of ₹512.00 Crores up 29.29% from ₹396.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹1,207.49, up 29.29% from ₹933.96 in the same quarter of the previous year.

-

EBITDA Margin: 16.1%, higher than Q1 FY26.

-

The quarter exhibited better profit margins amid a different commodity and cost structure compared to Q1 FY26.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.