MPS is a B2B learning and platform solutions company powering education, and research for corporates. MPS has unlocked a new growth trajectory due to the combined effect of lower attention spans, rapid growth in digital consumption, and the recent advances in AI/ML. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

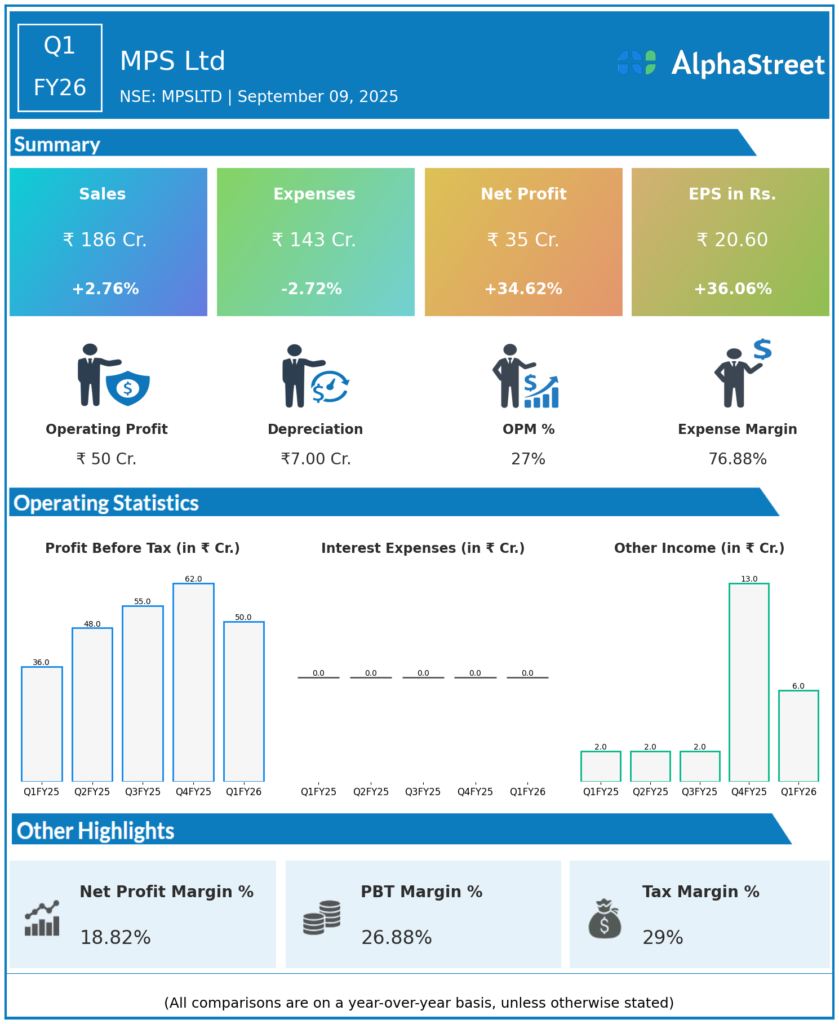

Total Income: ₹186 crores, up 27.3% QoQ (Q4 FY25: ₹151.93 crores), and up 2.76% YoY (Q1 FY25: ₹182.77 crores).

-

Total Expenses: ₹143.28 crores, up 27.2% QoQ and down 2.7% YoY.

-

Profit Before Tax (PBT): ₹49.50 crores, up 26.1% QoQ and up 37.2% YoY (Q4 FY25: ₹39.26 crores; Q1 FY25: ₹36.08 crores).

-

Tax Expense: ₹14.26 crores, up 35.2% QoQ and 39.9% YoY.

-

Profit After Tax (PAT): ₹35.24 crores, up 22.7% QoQ and up 34.6% YoY (Q4 FY25: ₹28.71 crores; Q1 FY25: ₹25.89 crores).

-

Earnings Per Share (EPS): ₹20.60, up 21.6% QoQ and up 36.06% YoY (Q4 FY25: ₹17.10; Q1 FY25: ₹15.30).

-

EBITDA: ₹50.3 crores (margin 27.0%), up 22.5% YoY; margin increased 428 bps YoY.

-

Segment Highlights: Education Solutions saw revenue growth of 57% YoY, Research Solutions declined 8% as the company exited ₹20 crore worth of low-margin business.

-

Geography: North America contributed 51% of revenue, expected to trend higher.

Key Management Commentary & Strategic Highlights

-

Management highlighted strong margin expansion driven by cost controls, a deliberate exit from low-margin business in Research Solutions, and robust Education Solutions growth.

-

EBITDA margin expansion was a strategic focus; the AJE segment was downsized for profitability, with margin improvement from 10% to 23% and target of 30% by year-end.

-

Board approved merger of ADI BPO Services into MPS for simplified structure, and restructuring of European entities for consolidated eLearning operations.

-

Acquisition pipeline remains robust, with multiple deals under evaluation in education technology, each generating $10M+ revenue and 15%+ EBITDA margins.

-

Management remains confident about fiscal FY26, expecting to issue strong guidance and drive growth through organic initiatives in upcoming quarters.

Q4 FY25 Earnings Results

-

Total Income: ₹182 crores.

-

PAT: ₹47 crores.

-

EPS: ₹27.52.

-

EBITDA Margin: 30.8% (vs 27.0% in Q1 FY26).

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.