“Cloud, digital transformation, cost optimization and consolidation type opportunities characterize the pipeline. While we expect to have a soft start to FY ’24 as we deal with some slowdown in BFS, including a client-specific issue, and delayed contract conversions in this environment, we expect Q1 to be characterized by stability across segments with strong sequential growth starting second quarter onwards, which will result in a rising Y-o-Y growth through FY ’24. For the full year, we expect to register at least industry average growth in Direct ex mortgage.”

-Nitin Rakesh, Chief Executive Officer

Stock Data

| Ticker | MPHASIS |

| Industry | IT |

| Exchange | NSE & BSE |

Share Price

| Last 1 Month | -0.2% |

| Last 6 Months | -7% |

| Last 12 Months | -14.3% |

Business Basics

Mphasis Limited is a leading global information technology (IT) solutions provider specializing in offering end-to-end services and solutions to clients across various industries. The company operates in multiple geographies and delivers innovative and transformative solutions that help businesses adapt and thrive in the digital age. In terms of services, Mphasis offers a comprehensive portfolio that spans various domains such as applications, infrastructure, digital, and cognitive technologies. Their application services encompass application development, maintenance, and support, while their infrastructure services include data center operations, cloud management, and security services.

Digital transformation is a key focus for Mphasis, with its digital services aimed at enabling organizations to leverage emerging technologies such as artificial intelligence (AI), machine learning, internet of things (IoT), and blockchain to drive business growth and efficiency. These services encompass digital strategy consulting, user experience design, data analytics, automation, and enterprise mobility solutions. Mphasis also specializes in cognitive technologies, leveraging AI and machine learning capabilities to harness the power of data and automate processes. Their cognitive solutions include intelligent automation, virtual assistants, chatbots, and predictive analytics.

The company serves a wide range of industries, including banking, financial services, insurance, healthcare, telecommunications, retail, and logistics. Mphasis focuses on understanding the unique needs and challenges of each industry and tailoring their solutions accordingly. Mphasis prides itself on its innovation-driven approach and customer-centric mindset. They collaborate with their clients, understanding their business objectives and challenges, and co-create solutions that deliver measurable value. The company strives to provide superior customer experiences by ensuring flexibility, agility, and scalability in its services and solutions.

Q4 FY23 Financial Performance

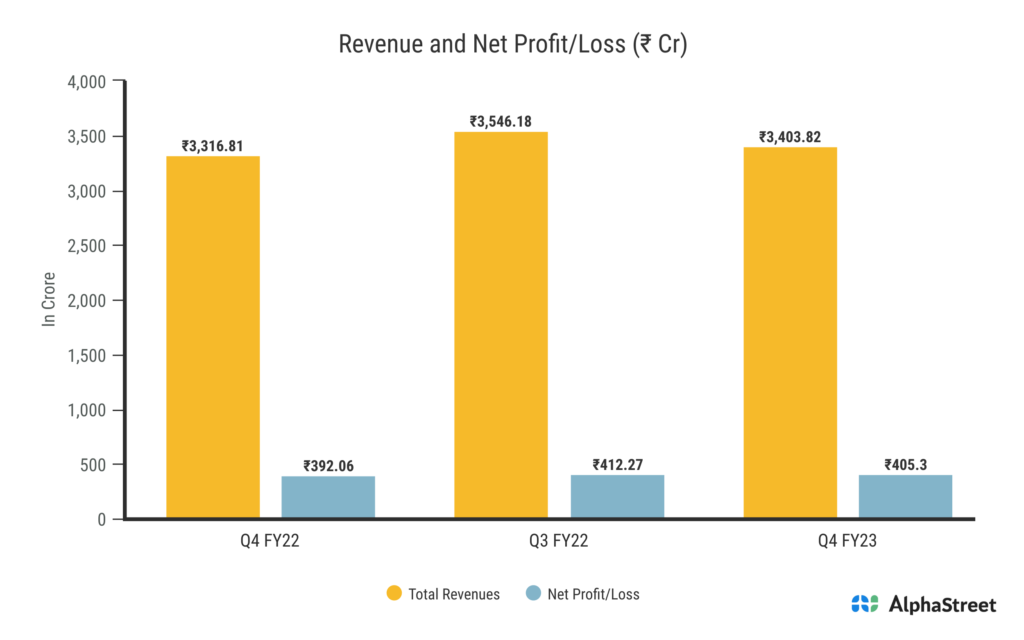

Mphasis Limited reported Total Income for Q4 FY23 of ₹3,403.82 Crores up from ₹3,316.81 Crore year on year, an increase of 2.6%. Consolidated Net Profit of ₹405.3 Crores, up 3.4% from ₹392.06 Crores in the same quarter of the previous year. The Earnings per Share is ₹21.39 in this quarter.

Mphasis Key Revenue Segments

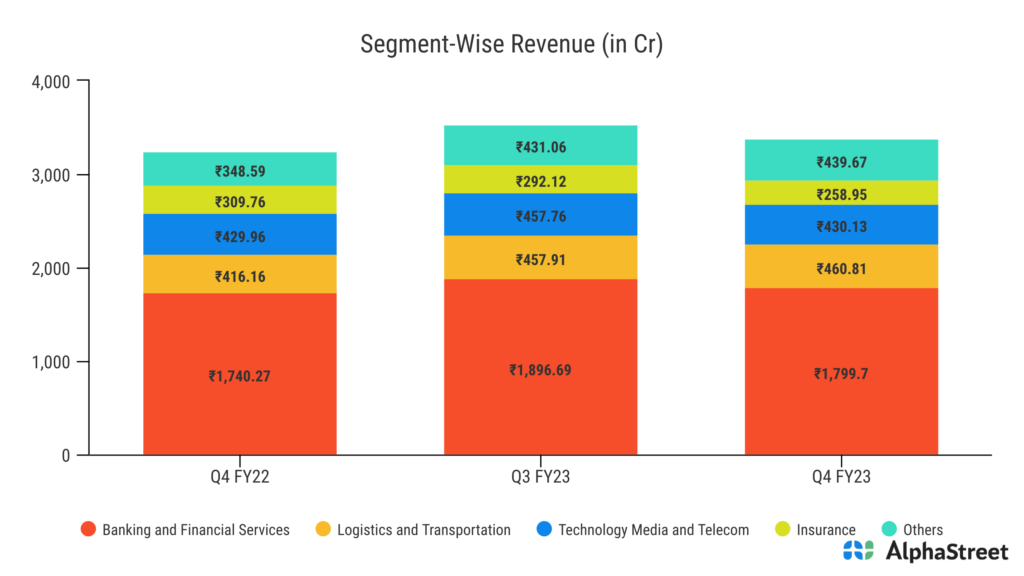

Mphasis Limited generates revenue from various segments, including banking and financial services, logistics and transportation, technology, media, and telecom, as well as the insurance sector. In the banking and financial services segment, Mphasis provides a wide range of solutions and services to banks, financial institutions, and other financial service providers. This includes services such as application development and maintenance, data analytics, risk management, compliance, and customer experience enhancement.

The logistics and transportation segment focuses on helping companies in the transportation and logistics industry streamline their operations and improve efficiency. Mphasis offers solutions for supply chain management, freight management, transportation planning, and fleet management, among others. In the technology, media, and telecom sector, Mphasis caters to clients in the technology industry, media companies, and telecommunications service providers. They offer services such as software development, IT infrastructure management, digital transformation consulting, and customer experience management.

Additionally, Mphasis serves the insurance sector, providing solutions and services to insurance companies and brokers. This includes software development for policy administration, claims management, underwriting, and risk assessment. Mphasis also offers data analytics solutions to help insurance providers make better-informed decisions.

Mphasis New Client Deals & TVC

Revenue from new clients for the business is still rising quickly, increasing by 39% in FY23. The NCA segment accounted for 22% of total revenue in FY23. In the final quarter of FY23, Mphasis recorded net new deals with a total contract value of $309 million. This includes a significant deal worth $150 million from a new client. The company’s $250 million mega deal in FY22 helped it reach a TCV of $1.4 billion overall. The company continues to consistently maintain a run rate of $300 million or more in TCV wins per quarter, and net new TCV in FY23 is at $1.3 billion. On an annual basis, the business added clients in the $5 million, $10 million, and $20 million plus categories. It also added one client to the $150 million and $200 million categories year over year. In FY23, the average size of a large deal was $61 million, which is a two-fold increase from the previous three years.

India’s IT Industry

The rapid rates of industrialization and globalization bode well for India’s IT industry. Research predicts that the Indian IT sector will be worth $350 billion by 2025. According to the most recent prediction from Gartner, Inc., India’s IT spending will increase 2.6% in 2023. In the upcoming year, Indian companies will keep increasing their investments in important information technology sectors. The cost advantage India provides compared to developed countries is one of the major factors fostering the expansion of the IT sector in that nation. Indian IT companies offer solutions that are affordable without sacrificing quality. This cost advantage has been a major factor in the growth of offshore IT outsourcing and has given Indian businesses a competitive advantage overseas. The IT-BPM industry will contribute 7.4% of India’s GDP in FY 2022. The IT and BPM industries are expected to generate $245 billion in revenue in FY 2023. The IT industry is anticipated to produce $194 billion in export revenue and $51 billion in domestic revenue in FY 2023. As of March 2023, 5.4 million people worldwide are employed in the IT-BPM sector.