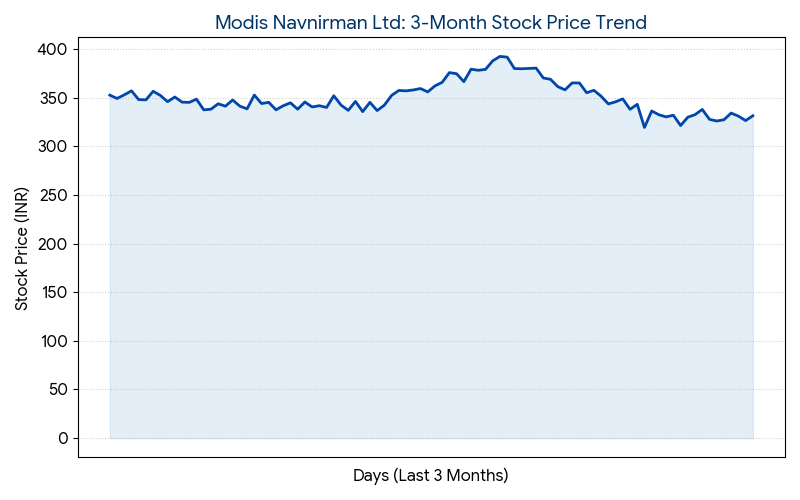

Modis Navnirman Ltd (BSE: 543539, NSE: MODIS) closed at INR 328.75 today, February 17, 2026, representing an intraday decrease of 1.65%. The Mumbai-based real estate developer operated between an intraday high of INR 333.25 and a low of INR 328.45.

Market Capitalization

As of the market close on February 17, 2026, the company’s market capitalization stands at INR 644.06 crore (approximately USD 77.6 million).

Latest Quarterly Results

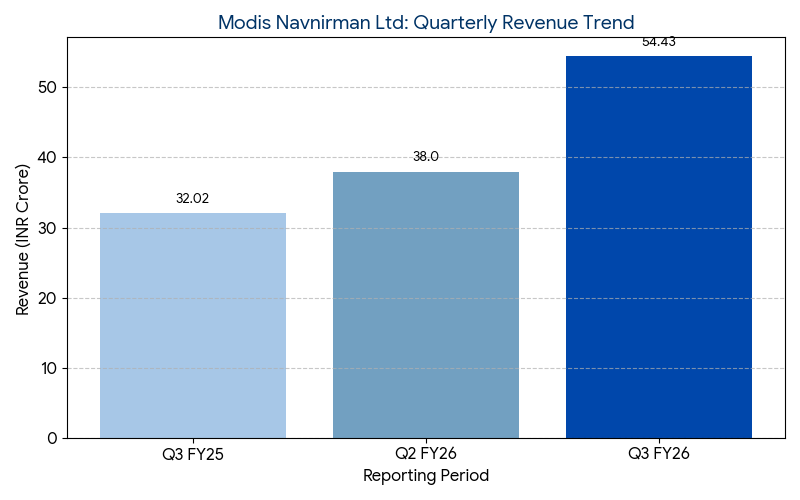

For the third quarter ended December 31, 2025 (Q3 FY26), Modis Navnirman reported consolidated revenue from operations of INR 54.43 crore, a 70% increase from INR 32.02 crore in the same period last year. Net profit for the quarter rose to INR 12.77 crore, up 82.17% year-over-year from INR 7.01 crore.

The company operates primarily in the real estate redevelopment segment. Segment-specific highlights include:

- Residential & Mixed-Use Development: Revenue was driven by project execution at “Rashmi Vasudeo” and the commencement of the “Rashmi Icon” project.

- Operating Efficiency: EBITDA for the quarter was reported at INR 14.85 crore, with EBITDA margins expanding by 219 basis points to 27.27%.

FINANCIAL TRENDS

Nine-Month Overview

For the nine-month period ended December 31, 2025 (9M FY26), revenue from operations totaled INR 137.82 crore, a 103.36% increase compared to INR 67.8 crore in 9M FY25. Net profit for the nine-month period reached INR 24.8 crore, surpassing the full-year profit of FY25 (INR 23.11 crore). Directional trends indicate sustained growth in both top-line revenue and bottom-line profitability.

Business & Operations Update

Modis Navnirman officially commenced construction of “Rashmi Icon” in Malad West, Mumbai, on February 6, 2026. The project is a mixed-use development comprising 201 residential units and 17 commercial units across 4,744 square meters. Additionally, the company completed the handover of 90 homes at the “Rashmi Vasudeo” project in Borivali West.

The company successfully migrated from the SME platform to the Main Boards of the BSE and NSE on November 14, 2025.

M&A or Strategic Moves

The company confirmed the successful completion of its merger with Shree Modis Navnirman Private Limited, effective from April 1, 2025. In January 2026, the company secured a new redevelopment mandate in Borivali West with an estimated gross development value of INR 250 crore.

Q&A Focal Points

During the post-earnings Q&A session, management and analysts focused on the following key operational and financial areas:

- Project Acquisition Strategy: Management emphasized a selective approach to Mumbai redevelopment, prioritizing land parcels and societies that offer clear execution timelines and high-margin visibility over high-volume, low-margin acquisitions.

- Capital Structure and Debt: Analysts queried the funding of the current project pipeline. Management confirmed the company remains debt-free, utilizing internal accruals and customer advances to fund construction cycles without external borrowing.

- Geographic Concentration: Discussion centered on the company’s decision to remain focused on Mumbai’s western suburban micro-markets (Borivali and Malad), where the company maintains existing infrastructure and vendor relationships.

- Execution Timelines: In response to questions regarding the “Rashmi Icon” project, the company provided clarity on the phased delivery schedule, noting that the mixed-use nature of the project allows for diversified cash flow streams.

- Regulatory Environment: Management addressed the impact of recent MHADA and SRA (Slum Rehabilitation Authority) policy updates, identifying them as the primary external factors influencing the velocity of future project approvals.

Guidance & Outlook

Management indicated a focus on the execution of the existing project pipeline and the acquisition of high-demand redevelopment mandates in Mumbai. Regulatory developments regarding MHADA and SRA (Slum Rehabilitation Authority) policies in Maharashtra remain the primary industry context to watch for, as these impact the company’s core redevelopment business model.

Performance Summary

Modis Navnirman stock ended 1.65% lower at INR 328.75 today. The company reported a 70% increase in Q3 revenue to INR 54.43 crore and an 82.17% rise in net profit. The nine-month performance has already exceeded the previous full fiscal year’s results, supported by the completion of a major merger and the launch of new projects in the Mumbai region.