Incorporated in 2009, One Mobikwik Systems Ltd is a digital banking platform which offers a wide range of financial products for both consumers and merchants. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Financial Results

-

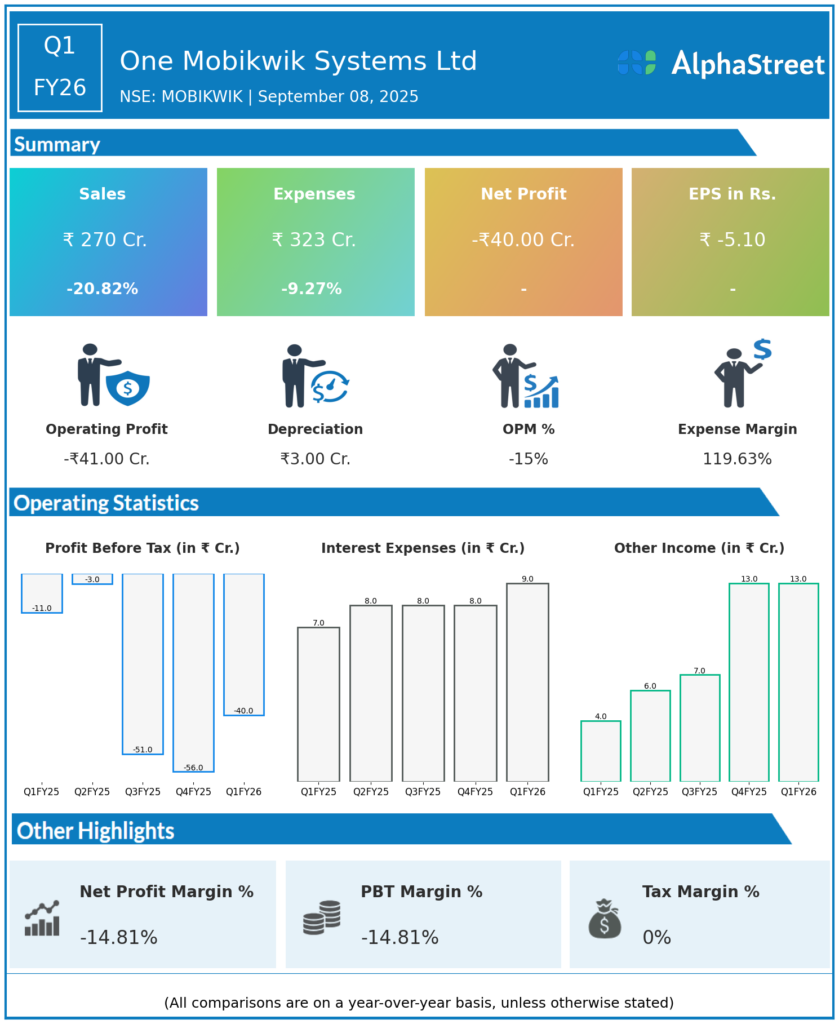

Total Income: ₹270 crores, up 3.7% QoQ (Q4 FY25: ₹271.56 crores), down 20.8% YoY (Q1 FY25: ₹345.83 crores).

-

Total Expenses: ₹323.51 crores, up 18.8% QoQ, down 9.2% YoY.

-

Profit Before Tax (PBT): Net loss of ₹41.88 crores, compared to a loss of ₹0.64 crores in Q4 FY25 and loss of ₹6.35 crores in Q1 FY25.

-

Profit After Tax (PAT): Net loss of ₹40 crores, up significantly from losses of ₹0.67 crores in Q4 FY25 and ₹6.62 crores in Q1 FY25.

-

Earnings Per Share (EPS): -₹5.10, compared to -₹0.01 in Q4 FY25 and -₹1.20 in Q1 FY25.

-

Payments GMV: ₹384 billion, growing 53% YoY and 16% QoQ, driven by increasing registered users (180.2 million) and merchant base (4.64 million).

-

Payments Gross Margin: All-time high of 28%, up 12% YoY, supported by net payment margin maintained at 15 bps.

-

Digital Finance Growth: EMI disbursals up 31% QoQ to ₹6,931 million with take rates improving to 8% and gross margin rising to 13.3%.

Key Management Commentary & Strategic Highlights

-

Management highlighted continued strong growth in payments GMV and gross margin, with digital finance and new growth segments gaining momentum.

-

Despite losses, the company is focused on improving EBITDA driven by gross margin expansion and fixed cost reduction.

-

The lending segment saw improved take rates and disbursal growth, while the payments segment maintained strong customer engagement and platform strength.

-

Management expects EBITDA break-even within FY26 through focused operational efficiency and business scale-up.

-

Recent SEBI approval to operate as a stockbroker and clearing member through subsidiary Mobikwik Securities Broking Pvt Ltd positions the company for diversified revenue streams.

Q4 FY25 Earnings Results

-

Total Income: ₹266 crores.

-

PAT: Net loss of ₹56 crores.

-

EPS: -₹7.17.

-

Payments GMV: ₹331 billion approximately.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.