MMTC, a public sector undertaking, was incorporated in 1963, to facilitate foreign trade in India and canalize the export and import of essential minerals and metals. It is under the administrative control of the Ministry of Commerce & Industry, and Government of India and is engaged in trading across minerals, metals, precious metals, agro products, fertilizers & chemicals and coal & hydrocarbons. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

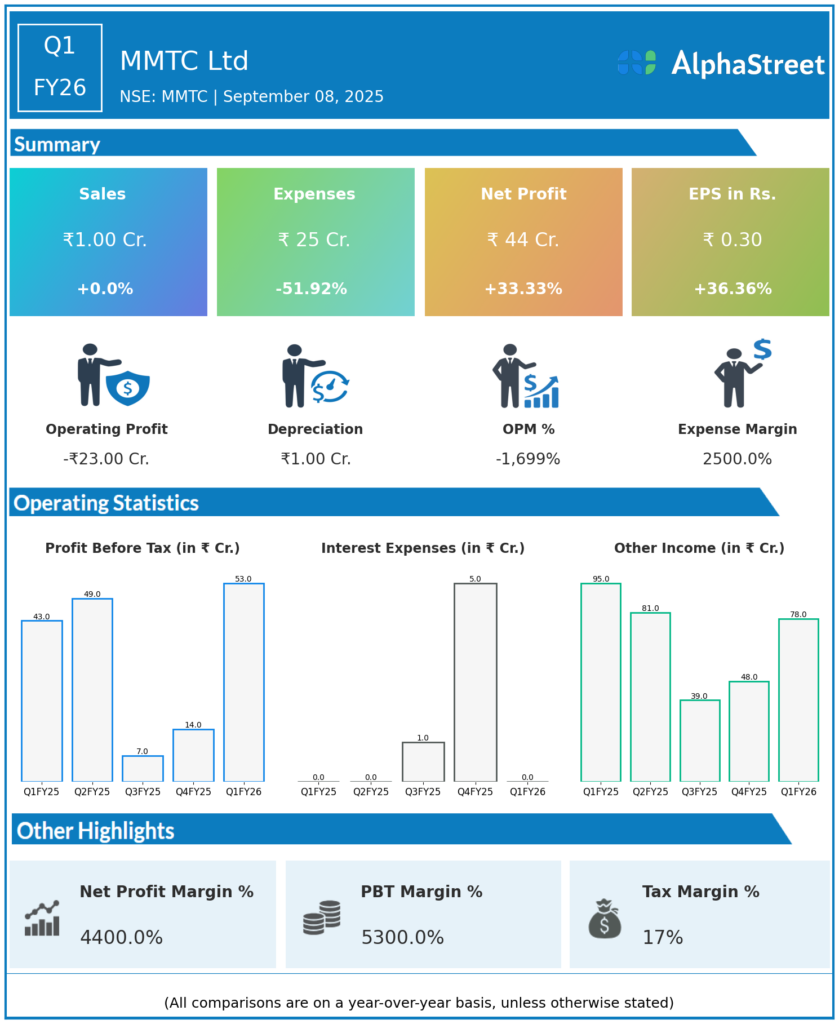

Total Income: ₹1 crores, up 100% QoQ from ₹0 crores in Q4 FY25; remained flat YoY from ₹1 crores in Q1 FY25.

-

Profit Before Tax (PBT): ₹53 crores, up 47.9% QoQ from ₹31.02 crores (Q4 FY25); up 8.6% YoY from ₹42.23 crores (Q1 FY25).

-

Profit After Tax (PAT): ₹44.26 crores, down 36.6% QoQ from ₹69.78 crores (Q4 FY25); up 33.2% YoY from ₹32.69 crores (Q1 FY25).

-

Earnings Per Share (EPS): ₹0.30, down 40% QoQ from ₹0.50; up 36% YoY from ₹0.20.

-

Total Expenses: ₹25.69 crores, down 26.5% QoQ from ₹34.93 crores, down 51% YoY from ₹52.38 crores.

-

Tax Expense: ₹9.21 crores (significant rise QoQ from -₹0.80 crores).

-

Business Operations: MMTC is a large government trading company dealing in minerals, metals, coal, hydrocarbon products, fertilizers, and agricultural commodities in India and overseas.

-

Market Position: MMTC plays a significant role in India’s external trade infrastructure.

Key Management Commentary & Strategic Highlights

-

Management emphasized improved profitability despite lower revenue due to cost rationalization and better operating efficiencies.

-

The company continues to explore new markets and diversify its portfolio to adapt to changing trade environments and regulatory frameworks.

-

Strategic focus remains on leveraging government mandates and strengthening supply chain resilience to enhance earnings stability.

Q4 FY25 Earnings Results

-

Total Income: ₹0 crores.

-

Profit After Tax: ₹2 crores.

-

EPS: ₹0.01.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.