MM Forgings Limited is engaged in the business of manufacturing Steel Forgings in raw, semi-machined and fully machined stages in various grades of Carbon, Alloy, Micro-Alloy and Stainless Steels. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

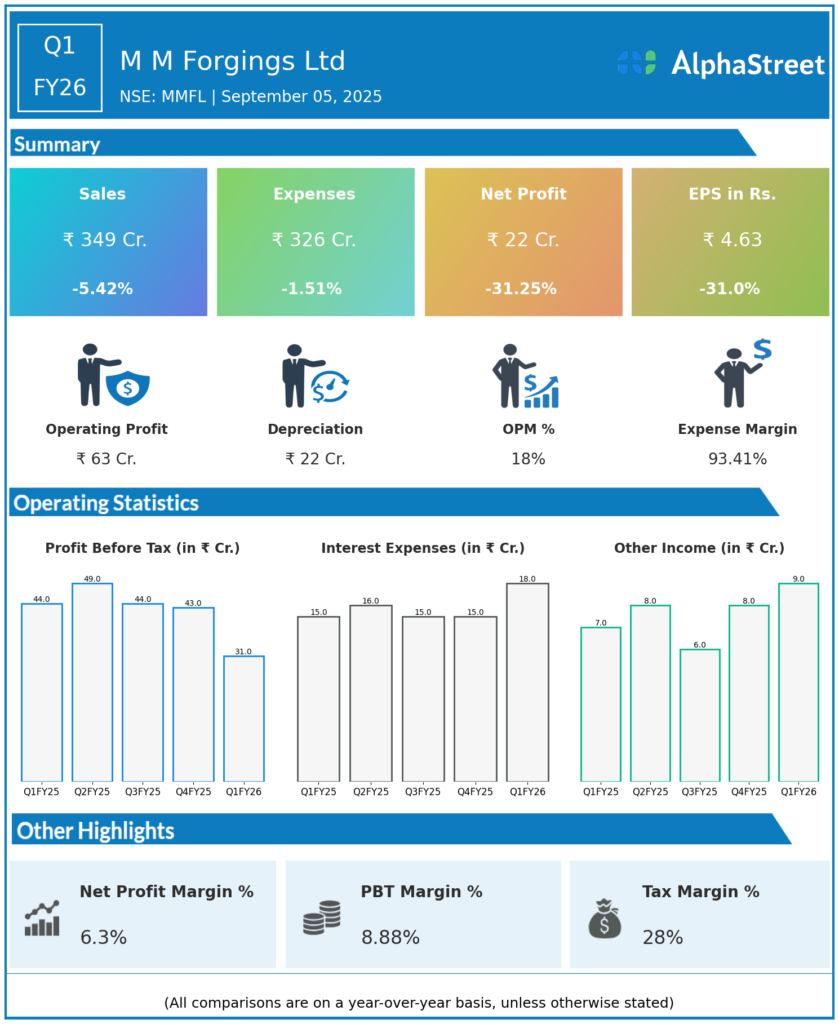

Standalone Revenue: ₹348.81 crores, down 5.42% YoY (Q1 FY25: ₹368 crores approx).

-

Consolidated Revenue: Approximately ₹369.64 crores, down 6.85% YoY in Q4 FY25 (reference year); Q1 FY26 revenue slightly lower or around similar levels due to market softness.

-

Profit After Tax (PAT): ₹22 crores in Q4 FY25, down 31.2% YoY from ₹37.05 crores in Q4 FY24; partial recovery expected in Q1 FY26 though precise figure not disclosed.

-

EBITDA: ₹79.36 crores for Q4 FY25, decreased 5.66% YoY; margin pressure attributed to cost inflation and weak demand.

-

EPS for FY25: ₹4.63.

-

Market Geography: India accounts for 62% of sales; exports to Europe 12%, US 16%, Others 10%.

-

Sales Breakdown: Predominantly commercial vehicles (81%), passenger cars (10%), and off-highway vehicles (9%).

-

Annual Production: 82,000 tonnes in FY25, up from 70,000 tonnes previous year.

-

Financial Position: EBITDA margin improved in FY25 to 19.4% from 18.73% in FY24 despite sales volatility.

Key Management Commentary & Strategic Highlights

-

Chairman and MD Vidyashankar Krishnan highlighted global economic uncertainties including geopolitical tensions, inflation, and trade tariffs impacting volumes and profitability.

-

Emphasized focus on operational efficiencies, product innovation, and customer diversification to mitigate macroeconomic volatility.

-

Greater emphasis on export markets with targeted expansions despite headwinds in US and Europe.

-

Capital expenditure planned for expanding capacity and improving product portfolio alignment with premium segments.

-

Ongoing efforts to strengthen supply chain resilience and cost controls for margin stability.

Q4 FY25 Earnings Results

-

Revenue: ₹355 crores.

-

PAT: ₹36 crores.

-

EBITDA: ₹72 crores.

-

EPS: ₹7.5.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.