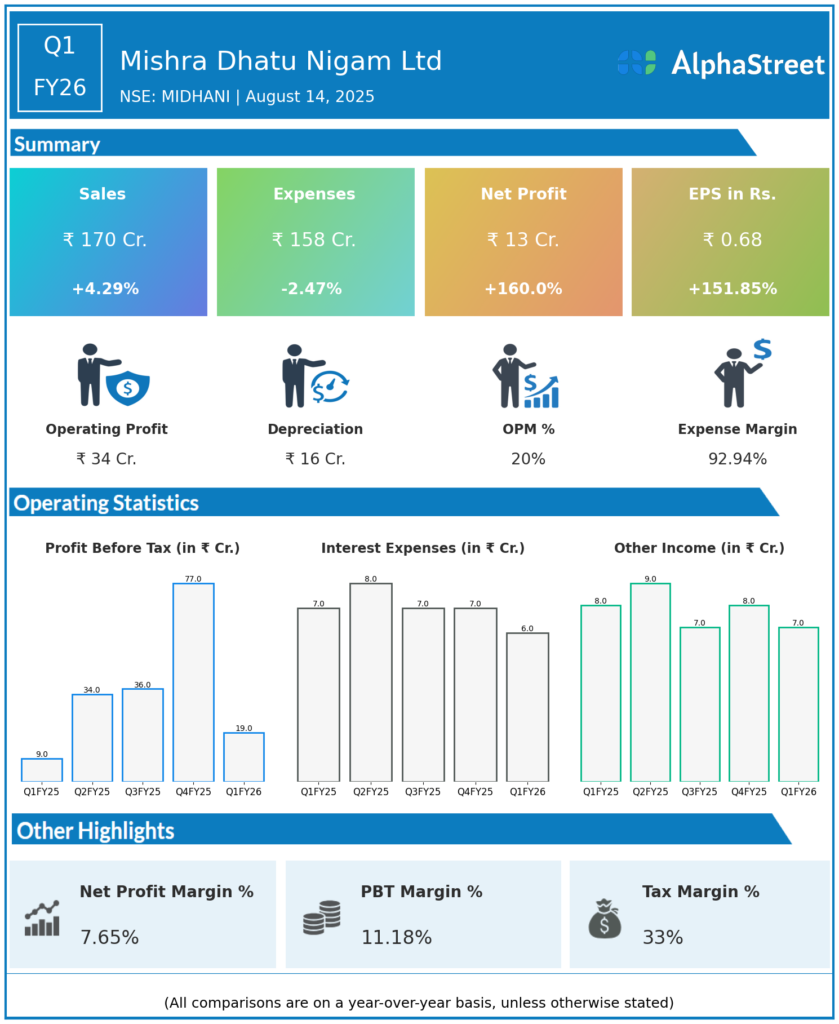

Mishra Dhatu Nigam Ltd (MIDHANI) manufactures superalloys, titanium, special purpose steel and other special metals. It was incorporated in 1973 at Hyderabad as a Government of India Enterprise under the Ministry of Defence. GoI still owns ~74% stake in the company after its IPO in 2018. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹170.5 crore, up 4.2% year-over-year (YoY) from ₹163.45 crore in Q1 FY25.

-

Profit Before Tax (PBT): ₹19.0 crore, up 112% YoY from ₹8.96 crore.

-

Net Profit (PAT): ₹12.8 crore, a 160% jump from ₹5.11 crore in Q1 FY25.

-

EBITDA: ₹41.28 crore, up 32.9% YoY (₹31.07 crore last year).

-

Value of Production (VoP): ₹241.29 crore, up 14.5% YoY.

-

EBITDA Margin: Expanded to 20.05% from 14.28% YoY, indicating stronger operational efficiency.

-

Order Book: Stood at ₹1,827 crore as of July 1, 2025, securing future growth visibility.

-

Finance Cost: Declined 10% YoY, supporting improved margins.

-

Share Performance: Despite robust earnings, shares traded marginally lower on results day, reflecting the seasonally small contribution of Q1 to annual results.

Management Commentary & Strategic Highlights

-

Management highlighted strong demand momentum in defence and strategic materials, with particular focus on indigenization, cost control, and expanding production capabilities.

-

Operational efficiency and capacity utilization remained core drivers for profit growth and margin expansion.

-

The company continues to align with India’s “Make in India” initiative, serving defence, aerospace, and nuclear energy with advanced alloys and specialty metals.

-

New leadership appointments and strengthening of financial controls were mentioned, ensuring further governance and strategic alignment.

-

Future outlook remains positive: a healthy order pipeline, rising export opportunities, and a commitment to value creation for stakeholders.

Q4 FY25 Earnings Results

-

Revenue: ₹411 crore, nearly 2.5x Q1 FY26 (reflecting high seasonality of business).

-

Net Profit: ₹56.2 crore, much higher than Q1 due to the nature of annual order execution cycles.

-

EBITDA: ₹101 crore, up 69% sequentially; strong finish to previous fiscal year.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.