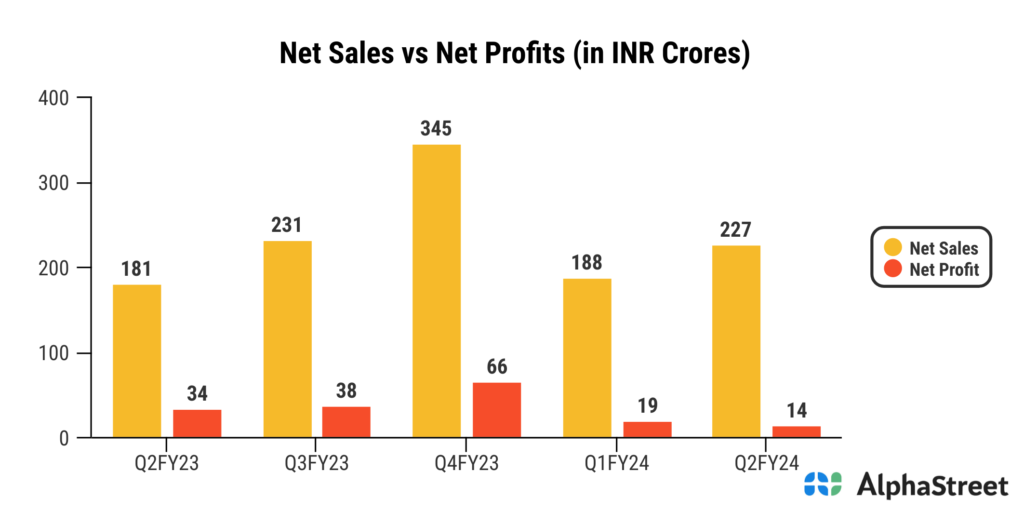

“We have a growth of almost around 40% on the turnover and also 21% on the value of production compared to FY23. However, there is a drop in the PBT, PAT for FY24 as compared to FY23 on the all quarter basis also and the half yearly basis also. We have the reason behind that mainly because all expenditures are well in control except the raw material which has taken the major toll in this half yearly account.”

– Sanjay Kumar Jha, Chairman and Managing Director

Stock Data

| Ticker | MIDHANI |

| Exchange | NSE and BSE |

| Industry | Metallurgical Industry |

Price Performance:

| Last 5 days | -1.11% |

| YTD | -5.39% |

| Last 1 year | 77.03% |

Company Description:

Mishra Dhatu Nigam Ltd (Midhani) is a leading metallurgical company that manufactures superalloys, titanium, special purpose steel and other special metals. It was incorporated in 1973 at Hyderabad as a Government of India Enterprise under the Ministry of Defence.The Indian Government still owns ~74% stake in the company after its IPO in 2018.

Business segments:

The company’s product portfolio includes high-value special steels like Ultra high strength steel, armor-grade plates, martensitic steel, austenitic steel and precipitation hardening steel superalloys (nickel base, iron base, and cobalt base) and varieties of titanium alloys. It is the only manufacturer of titanium alloys in India.

Geographical Split

India – 96% in FY23

Export – 4% in FY23

Industries Served

The company primarily caters to the needs of critical materials and alloys required by strategic sectors in India like Defence, Space, Atomic Energy, Aeronautics, etc.

Manufacturing Capabilities

The company owns and operates 2 manufacturing facilities in Hyderabad, Telangana, and Rohtak, Haryana. It has set up a new unit at Rohtak in Haryana for the manufacture of Armour products and a plant with a capacity of 60,000 Springs per year has been set up to manufacture Springs indigenously.

Expansion

Various Expansion production activities such as 30T Bogie Hearth Furnace, Hot Spring coiling machine for production of Helical Springs, and Wide Plate Mill, were successfully commissioned and projects that will be commissioned in the year are New 20T & 12T Fixed Hearth Furnace for Forge shop, New Vacuum Induction Melting Furnace, 300 Kg Vacuum Arc Skull Melting Furnace, and a new 10T VAR facility, etc.

Order Book

The order book position as on April 2023 stood at Rs 1331 Cr, and in FY22 Company booked orders worth Rs 817 Cr with orders of Defence (68%), Space (9%), Energy (9%), and Others (14%).

Joint-Venture

Utkarsha Aluminium Dhatu Nigam Ltd is a (50:50) JV of the company and National Aluminium Co. Ltd, incorporated to set up a High-end Aluminum Alloy Production plant at Nellore. To establish a green field project of an Aluminum Alloy flat rolled product facility on the land of 110 Acres.

Research & Development

The company has recently invested in new DSC, SEM, image analyzer, 300KN UTS, and immersion ultrasonic equipment. And to create ceramic-based composite armour and development and production of composite raw materials it has signed a MoU with Carborundum Universal Ltd & HAL. it has filed 11 patents and 16 IPRs.

Focus

The company aims for geographical expansion and to operate from multiple locations and also it seeks to enter into the new markets of oil and gas, mining, power, railways, chemical, and fertilizers. It has increased its focus on research and development and entered into collaborations with Indian and international research institutions.

Financials:

What we like:

- Most advanced and unique facilities:

The company stands as India’s sole facility for advanced vacuum-based melting and refining, employing cutting-edge technologies such as vacuum induction melting, vacuum arc remelting, and electron-beam melting. Notably, it achieved a national first by producing Hafnium metal crucial to the space sector, utilizing an innovative electron beam melting furnace. The company’s diverse facilities, including air induction melting, enable the manufacturing of large nickel super-alloy-based castings. This technological prowess ensures flexibility and allows the company to deliver high-quality products meeting stringent customer requirements, positioning it as a leader in innovation and advanced materials within the industry.

- Strategic Government Support:

Being a Public Sector Undertaking (PSU) under the Ministry of Defence, Midhani benefits from consistent government support, particularly in the form of defense contracts and funding for research and development projects. Government contracts constitute approximately 63% of Midhani’s annual revenue, providing a stable income source (as of April 2023).

- Strong and growing long term customer relations:

Midhani’s client portfolio extends beyond defense to include aerospace, energy, and industrial sectors. This diversification mitigates risks associated with dependency on a single market segment. The company has successfully expanded its customer base, with a 15% increase in the number of clients over the last three years.

Midhani also holds an active collaboration with customers in the product development process. This collaborative approach is reflected in the fact that more than 80% of the orders are on a nomination basis. The company had 1,331 Crores Order book as on April 1, 2023.

- The company has technological and defense moat:

Midhani has a technological moat supported by distinct factors. Firstly, it stands as the exclusive producer of Ni and Ti alloy steel, offering a cost-effective alternative to imported materials. Titanium is used in aircraft spars and support and is notoriously difficult to work with, only Russians seem to have the process and methods and decades old experience in working with Ti. So, if Midhani does really gain experience with working on it, it’s a real “defense” moat.

Secondly, Midhani’s possession of patents for specific brands showcases its commitment to innovation, with an active research department tailoring materials to meet customer demands. Notably, they manufacture specialized materials for Bulletproof jackets, patka, and vehicles, utilizing formulations developed by Bhabha Atomic Center. Furthermore, Midhani’s AS9001 certification establishes it as a qualified supplier for space and aerospace industries. While the passenger industry faces challenges, strategic collaborations, such as with Lockheed Martin, indicate promising prospects in the growing defense aircraft sector—a trend worth monitoring.

- The company has a robust Research and Development:

Midhani has consistently focused on innovation, resulting in the development of proprietary alloys and steels with unique properties. The company holds over 20 patents for its specialized alloys, demonstrating a commitment to technological leadership.

Factors to consider:

- Market Dependency:

Midhani’s revenue is heavily influenced by government contracts and defense expenditures. Any significant fluctuations in government spending may impact the company’s financial performance.

- Competition:

The metallurgical industry is competitive, and Midhani faces competition from both domestic and international players. The company needs to continuously innovate to maintain a competitive edge.

- Global Economic Factors:

Economic downturns or geopolitical uncertainties may affect the demand for high-performance alloys and specialty steels, impacting Midhani’s sales and profitability.

- Supply Chain Risks:

The company may face challenges related to the availability and cost of raw materials, as well as potential disruptions in the supply chain, affecting production schedules.

- Currency Fluctuations:

As Midhani engages in international transactions, currency fluctuations can impact its financial performance and profitability.

Conclusion:

Mishra Dhatu Nigam Ltd, with its decades of experience and commitment to excellence, stands as a key player in the metallurgical industry. While the company benefits from government support and maintains a strong position in specialized alloy production, it must proactively address market dependencies, competition, and external economic factors to ensure sustained growth and profitability.