Mindtree Ltd is an Indian multinational company. It mainly deals with Customer Success, Data & Intelligence, Cloud, Enterprise IT Transformation & Automation and Mindtree Consulting. The company was founded on 18 August 1999. The company is headquartered in Bangalore, India. Mindtree has focused on growth to sustain itself in the longrun. The company has 35000 talented professionals across 24 countries.

Area of Operation– The main areas of operation are Canada, Mexico, United States. In Continental Europe it has its presence in Belgium, Denmark, Finland, France, Germany, Netherlands, Norway, Poland, Spain, Sweden and Switzerland. Ithas also expanded in APAC and Middle East. The main countries of operation in this region include Australia, China, India, Japan, Malaysia, New Zealand, Singapore and UAE. In also operates in UK and Ireland.

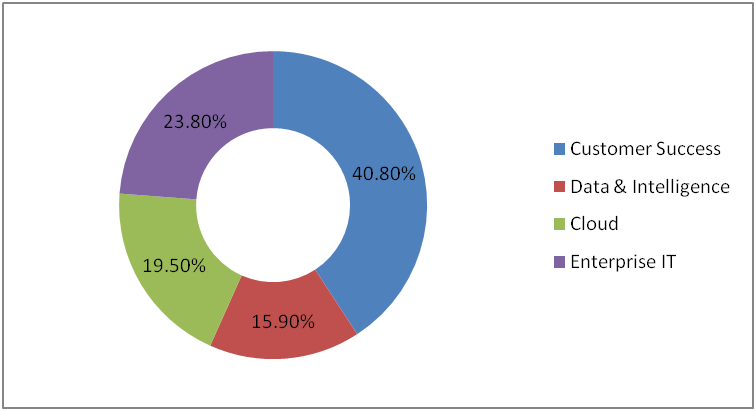

Service Lines:

The main service line includes Customer Success, Data & Intelligence, Enterprise IT Transformation & Automation and Cloud. The revenue contributed by Customer Success is 40.8% of total revenue. It decreased (1.1)% Q-O-Q and improved 31.4% Y-o-Y. Data & Intelligence contributes 15.9% of total revenue. It improved 11.3% Q-o-Q and 36.1% Y-o-Y. Cloud contributes 19.5% of total revenue. It grew 6.6% Q-O-Q and 26.4% Y-o-Y. Enterprise IT contributes 23.8% of total revenue. It increased 6.8% Q-o-Q and 21.5% Y-O-Y.

Industry Served: Mindtree has served the following industries. It includes Banking, Customer Packaged Goods, Insurance, Retail, Travel and Hospitality, Capital Markets, Education Info Service & Professional Service, Manufacturing, Technology, Communication, Health, Transportation Logistic & Freight, Media & Entertainment.

Mindtree has helped banks and financial institutions better engage with users through insightful banking analytics. It has delivered mission-critical banking software and solutions to drive the business forward globally. Mindtree has helped the Customer Packaged Goods industry by providing digital programs with a 360 degree consumer view. It has also helped this industry by unlocking new possibilities with an optimal mix of human intelligence, AI and data engineering. Insurance Sector has benefitted with a technology driven marketplace for life& annuity, accident & health providers with distributors and retailers with market specific strategies for the retail Industry. Travel and Hospitality industry has greatly benefitted with the digital transformation with better customer connections and communication leveraging innovative technology. Mindtree has helped capital market consulting services, asset management firms, and investment banks enable end-to-end technology capability to drive the business forward globally. The Educational institutions, associations are benefitted by modernizing their technology core, leveraging data to make more informed decisions, adopting the cloud, and engineering new products. The healthcare sector has been benefitted through robust healthcare consulting services and healthcare technology solutions. Mindtree has even worked for Media & Entertainment Sector. It works with broadcasters, publishers, gamers, out-of-home services, advertising agencies, and sports and entertainment firms and offers digital transformation solutions. Mindtree has also helped the Transportation, Logistics, and Freight industry. It has transformed the business through digital interventions. The communication industry is benefitting through digital services and engineering prowess so that the customers can be benefitted.

The revenue from Retail, Consumer Products & Manufacturing declined by 8.7% Q-O-Q and increased 15.6% Y-O-Y. Revenue from Banking, Financial Services & Insurance increased by 6.5% Q-O-Q and 31.7% Y-O-Y. The revenue of Communication, Media & Technology increased by 5.9% Q-O-Q and 24.7% Y-O-Y. Revenue from Travel, Transport, Logistics & Hospitality increased 11.2% Q-O-Q and 48.9% Y-O-Y. The Revenue from Health increased by 43.5% Q-O-Q and 170.4% Y-O-Y.

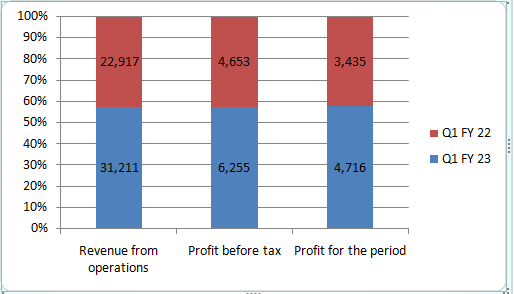

Financial Snapshots (Rs in million)

In terms of USD the revenue is $399.3 million, increased by 4.0% Q-O-Q / 28.6% Y-O-Y. The Net profit is $60.3 million, it declined 3.8% Q-O-Q and grew 29.7% Y-O-Y.

In terms of INR, Revenue is ₹31,211 million, grew 7.7% Q-O-Q and 36.2 % Y-O-Y. The Net profit is ₹4,716 million, declined 0.3% Q-O-Q and grew 37.3 % Y-O-Y. As of 30th June 2022 the company has 37,455 professionals.

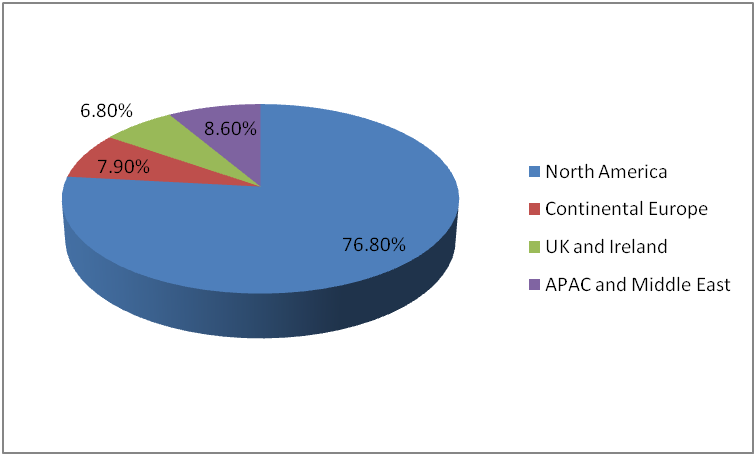

Geographical Analysis of Revenue

For Q1 FY 23 North America contributes 76.8% of total revenue. It has been observed that there is a growth of 8.5% Q-O-Q and 28.9% Y-o-Y. The Continental Europe contributes 7.9% of the total revenue. It has declined (9.2)% Q-O-Q and improved 17.8% Y-O-Y. UK and Ireland contribute 6.8% of total revenue. There has been a decline of (18.7)% Q-O-Q and improvement of 14.0% Y-O-Y. APAC contributes 8.6% of total revenue. There is a growth of 2.6% Q-O-Q ad 54.2%Y-O-Y.

Industry Analysis

India’s IT industry contributes 7.7% to GDP. Revenue from digital is expected to contribute 38% of all IT & ITES revenue by FY25. If we analyse the IT industry, we can see Opportunity-wise, the IT sector is growing. But on the other hand there is a huge shortage of talented employees. The employees have multiple job opportunities. . Mindtree is also not an exception. Over the last 12months the attrition rate prevailing is 24.5%.

Major Strength, Weakness, Opportunity & Threats

Strength- The company has a wide range of product mix. This helps to cater the need of different customers. Compared to other major players , Mindtree has higher profit margins. The main focus of this company is customer driven innovation. It has zero promoter pledge.

Weakness-Customer preferences are fast changing so the company needs to cater with technical change all the time. Different countries have different prevailing policies which can impact the business. Inflation, economic turbulence and COVID-19 have also impacted this business.

Opportunity-As technological innovation advances, MindTree can significantly venture into adjacent and a wide array of products. It has provided excellent customer services both in premium and lower segment.

Threats- Mindtree is facing stiff challenges from international and local competitors. The change in political environment with US and China trade war, Brexit impacting European Union, and overall instability in the Middle East has impacted MindTree’s business both in the local market and in international markets.

Peer Comparison

| Company | PE Ratio | PB Ratio | Dividend Yield |

| MindTree Ltd | 28.93 | 8.73 | 0.93% |

| TCS Ltd | 29.01 | 12.38 | 1.42% |

| Infosys Ltd | 27.4 | 8 | 2.15% |

| HCL Technologies Ltd | 18.45 | 4.15 | 4.79% |

From the investor perspective the investor should select the company which has least P/E ratio and P/B ratio. The reason behind such selection is the lower the P/E ratio is, the better it is for both the business and potential investors.So if the investor makes a thorough study, he will go for HCL Technologies Limited.

Strategic Deals

Mindtree has entered into several strategic deals in Q1 FY 23. It has signed a deal with a U.S.-based airline company to accelerate growth by transforming its core systems and digital channels.It has also signed a deal with a healthcare technology provider for business-critical application development and maintenance services.

A leading hyperscaler has signed a multiyear managed services deal with Mindtree to provide technology and program management support to the company’s digital stores worldwide. It has even entered into a strategic partnership with a global specialty insurance and reinsurance company to manage services program, IT infrastructure, and security.

An audio company also entered into a strategic deal with Mindtree to manage services deals consisting of cloud, development, and testing services. An Australian wealth management company has signed a deal with Mindtree for core modernization and digital transformation program.

Partnerships & Alliance– Mindtree has partnered with global technology leaders such as Microsoft, SAP, Adobe and Salesforce, DataStax, ThingWorx and Conversable to bring a new breakthrough of technology.

Merger with L&T– MindTree is entering in a merger with L&T Infotech to form the sixth-largest IT services firm in India by revenue. This move will create a $3.5-billion powerhouse. This new entity will be named as LTIMindtree. The Shareholders of Mindtree will be issued 73 L&T Infotech shares for every 100 shares held. Larsen & Toubro Ltd, the parent company, will hold 68.7% of the combined entity after the merger.

Achievements

Mindtree has been recognized as a major contender by Everest Group in its Healthcare Payer Digital Services PEAK Matrix. It has also achieved certification from the British Standards Institution (BSI) for seven ISO standards across 18 locations. It has ranked among Asia-Pacific’s top ten companies on the FT-Nikkei-Statista Asia-Pacific Climate Leaders list for achieving the greatest reduction in greenhouse gas (GHG) emissions.

Mindtree has won the Golden Peacock Award for Risk Management for business excellence and maturity in enterprise risk management. It was awarded with HR Diversity and Inclusion Award for outstanding D&I initiatives. Received award from Association for Talent Development (ATD) for driving impact and solving business challenges through talent development practices.