Key highlights from Mindtree Limited (MINDTREE) Q2 FY23 Earnings Concall

Management Update:

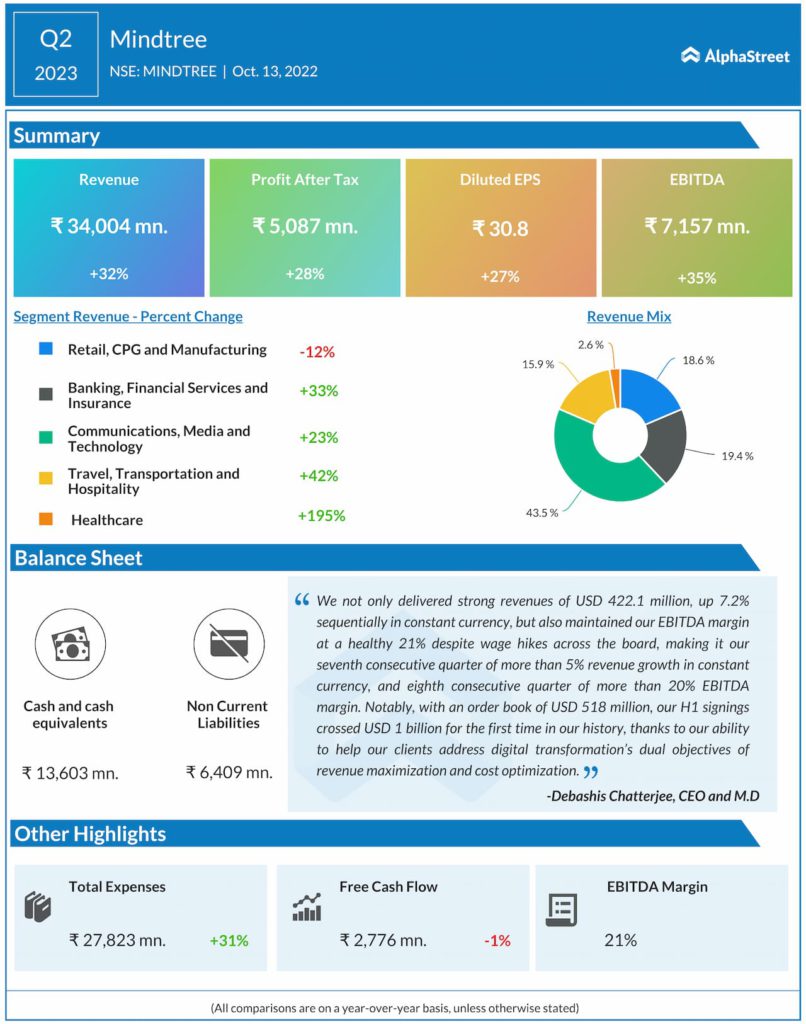

- [00:01:54] MINDTREE said its 1H23 signings crossed $1 billion for the first time in company history.

- [00:10:31] MINDTREE’s 2Q23 LTM attrition was 24.1% and expects it to trend down further.

- [00:16:57] Subject to regulatory approvals, MINDTREE expects this call to be its last quarterly earnings call as Mindtree, considering the LTI merger.

Q&A Highlights:

- [00:19:38] Aniket Pande of ICICI Securities asked about the composition mix of TCV, the mix of pipeline in terms of size. Debashis Chatterjee CEO replied that the mix is a good mix of both deals towards efficiency and revenue maximization.

- [00:20:46] Aniket Pande of ICICI Securities enquired about the outlook on manufacturing and pricing. Venu Lambu ED said that on manufacturing, supply chain challenges are behind MINDTREE. However, there is inflation impact. On pricing it’s common across all sectors.

- [00:28:10] Sameer Dosani with ICICI Prudential asked about any benefits of utilization being low historically this quarter. Vinit Teredesai CFO answered that on utilization currently there is no material change happening on a QonQ basis. In the short run, it’s expected to remain in the 80-82% range.

- [00:28:26] Sameer Dosani with ICICI Prudential also asked about fresher program; targets, people hired and deployed. Vinit Teredesai CFO replied that the fresher hiring and deployment continues to remain strong. MINDTREE’s fresher plans have been progressing as planned.

- [00:30:57] Sameer Dosani with ICICI Prudential asked what part of MINDTREE revenue would be on the basis of past orders and orders won in 2Q23. Venu Lambu ED replied that the book to bill ratio of 1.2 has remained almost unchanged which means there is no material difference in proportion.

- [00:32:42] Abhishek Bhandari from Nomura asked about deal wins being unusually higher in 2Q23 and if it’s sustainable. Debashis Chatterjee CEO said that on deal wins; MINDTREE believes that from a full year perspective the order book is in line with company’s expectation for the full year.

- [00:38:28] Sulabh Govila of Morgan Stanley enquired if there were any mega deal included in the uptick in deal wins in 2Q23. Venu Lambu ED said that deals have come across all the sectors and it has been broad based.

- [00:42:37] Sulabh Govila of Morgan Stanley asked about reason for travel expenses going up since COVID ebbed but again in 2Q23 there has been a moderation from a percentage to revenue perspective. Vinit Teredesai CFO said MINDTREE might see some uptick in 4Q23. The fares are going up and the travel costs might go up due to not increase in travel but due to increase in fares.

- [00:49:34] Nitin Padmanabhan with Investec asked about deal wins in current quarter, if it’s converted to revenue in FY23 or moved to next year. Venu Lambu ED answered that with regard to the revenue realization of the orders, some projects have already started and revenue realization will be happening this quarter and next quarter.