Mindspace is a brand of commercial and industrial parks located in India. It was established by the K.Raheja Group. It is situated in Mumbai, Hyderabad, Chennai and Pune. More than 50 businesses are now located at Mindspace including Accenture, L&T Infotech Ltd, Cognizant Technology and Capgemini offices. It has a diversified portfolio with 175 tenants. Tenants contributed not more than 6.0% of Gross Contracted Rentals. The tenant base comprises of multinational and Indian corporates.

Business Portfolio

The business is spread in different locations like Mumbai, Hyderabad, Chennai and Pune.

Mumbai- In Mumbai, Mindspace has made its presence in the Mindspace Airoli East ,Mindspace Airoli West, Paradigm Mindspace Malad and The Square, Avenue 61 (BKC). Mindspace Airoli East is the largest business park in Mumbai. It came in operation in 2007 covering an area of 50.1 acres. Committed Occupancy is 86.3% and Market Value is INR 45 Billion. It is located near Airoli Railway Station and has significant node of the IT corridor, preferred location for tenants and proximity to the large residential catchment areas of Thane and Navi Mumbai. Mindspace Airoli West is located near Airoli Railway Station. It provides high quality infrastructure with uninterrupted power supply. It came in operation in 2013, covering an area of 50.0 acres. It has a market value of INR 41 Bn. Paradigm Mindspace Malad came in operation in the year 2004. The Square, Avenue 61 (BKC) is located in the sophisticated micro market of Bandra Kurla Complex (“BKC”). It came into operation in 2019 covering an area of 0.9 acres and market valuation of INR 5 Bn. It is well connected with domestic and international airports.

Hyderabad-Mindspace Madhapur is located in the Madhapur micro-market. It is well connected with railway, road and airport. It covers total area of 97.2 acres with a market value of INR 97 Bn. Mindspace Pocharam located in the micro-market of Hyderabad. Total Land Area is 66.5 acres with a Market Value of INR 2 Bn.

Pune- Commerzone Yerawada is located in eastern part of Pune. It is well connected with railway station, Pune International Airport and the upcoming metro station. Total Land Area Covered 25.7 acres with a Market Value of INR 20 Bn. The Square Signature Business Chambers (Nagar Road) is located within the eastern quadrant of Pune. It is well connected with railway station, Pune International Airport and the upcoming metro station. The campus has latest technology and collaborative workspaces. It has total Land Area of 10.1 acres with Market Value of INR 9 Bn. Gera Commerzone Kharadi is located near east micro-market of Pune. It is well connected with railway station, Pune International Airport and the upcoming metro station. This project is designed keeping in mind the humans and nature. It has a total land area of 25.8 acres with a Market Value of INR 21 Bn.

Chennai-CommerzonePorur is located in Chennai, Tamil Nadu. It is very close to Chennai International Airport. Total Land Area covered is 6.0 acres. It has Market Value of INR 8 Bn.

Financial Snapshot

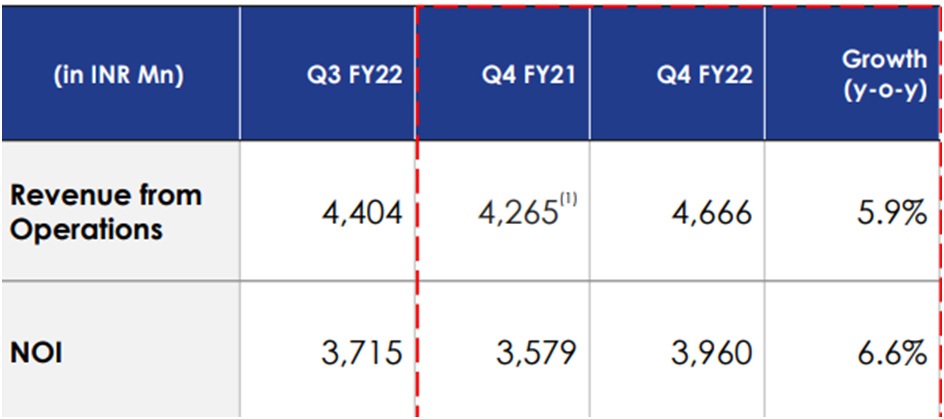

Net Operating Income increased by 10.6% Y-o-Y to INR 3,960 Mn for Q4 FY22. Gross Asset Value of the portfolio improved by 5.7% YoY to INR 264 bn. Net Asset Value increased to INR 364.9 per unit in Q4 FY 2022. For FY 22, NOI for the full year increased by 8.2% YoY to INR 14,864 mn. In-place rents have improved by 10.3% YoY to INR 61.7 psf/month. Average cost of debt decreased by c.50 bps and stood at c.6.6%.

Business Outlook

The company anticipates growth at a CAGR of 6%- 7% to reach 2,000+ GCCs by FY25. The company is expecting that the occupancy will increase by 50% in the coming years. It should focus more to improve liquidity and deepen the market.

SWOT Analysis

Strength- It is a well known brand in the real estate sector. Tenants include both multinational and Indian corporates. The company has rising dividend yields over last five years. The company has a low debt structure. Assets like real estate fall in the category of good inflation hedge that would not only save the country from inflation but also the investor as well.

Weakness- The company has very less cash/cash equivalent in hand. This sector requires huge investment.

Opportunity-The company should concentrate more on expansion in other metropolitan cities as well as globally.

Threat- Stiff competition in the real estate sector. Economic factors affecting the real estate sector. Due to the impact of COVID-19, many companies have shifted to work from home so the demand space has reduced. Moreover the price estates are falling due to lesser demand.

Industry Analysis

The Indian real estate is expected to reach US$ 1 trillion in market size by 2030. It is expected that by 2025 it will contribute 13% to the country’s GDP. Due to rapid urbanisation, there is rapid growth in the real estate sector. Moreover real estate sector is the second-highest employment generator next to agriculture sector. Moreover COVID-19 has also impacted this sector. The demand for real estate has gone down. The Ministry of Housing and Urban Affairs has asked all the states to reduce the stamp duty of property transactions to push real estate activity, generate more revenue and aid economic growth.

Comparative Study

Let’s have a comparative study between Mindspace Reit Vs Embassy Reit. Embassy Reit is the first listed Reit and it is the largest Reit in India. The portfolio consists of 8 office parks, 2 hotels & solar power plant. On the other hand Minspace owns assets, mainly in Mumbai, Chennai, Pune and Hyderabad. 30.2 million SFT is the current leasable area. Major IT giants like Capgemini, Accenture, WNS have their offices in Mindspace. So Mindspace Reit has better popularity among the corporate houses. On the basis of dividend yield comparison Embassy reit pays 6.10% and Mindspace Reit pays 7%. The occupancy of Embassy Reit is 88% and for Mindspace Reit is 84%.