Minda Corporation Ltd is one of the leading automotive component manufacturing companies in India with a pan-India presence and international footprint. It is the flagship company of Spark Minda, which was part of the erstwhile Minda Group. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

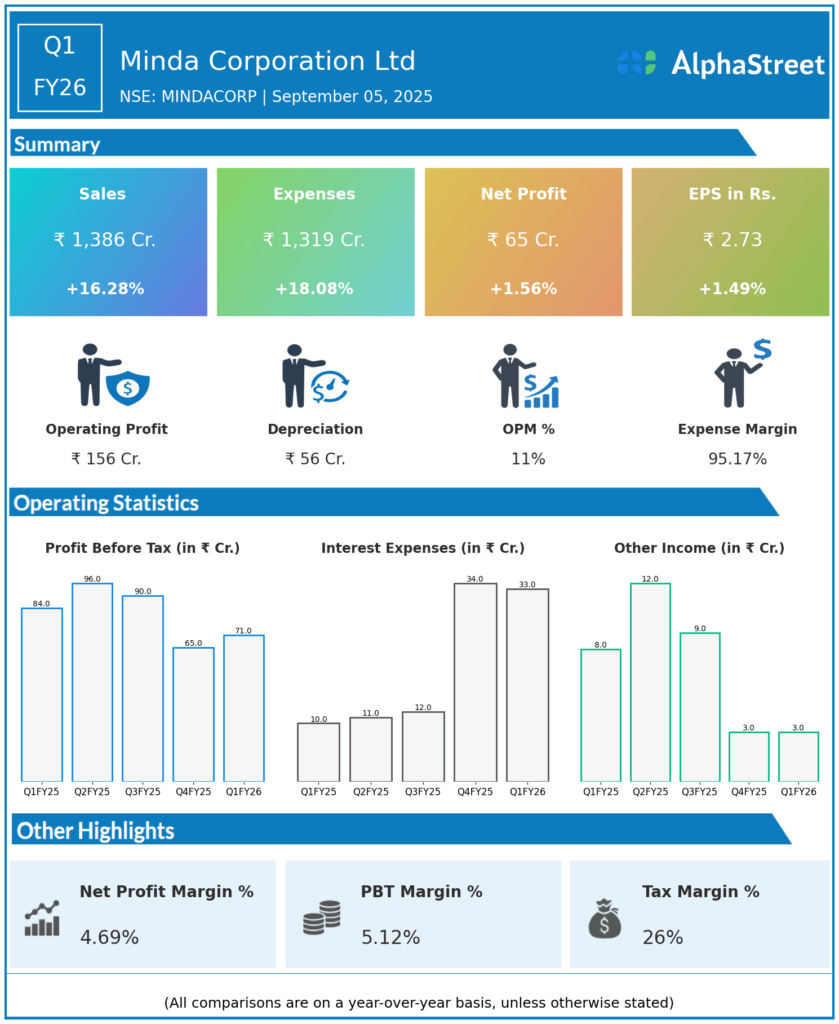

Consolidated Revenue: ₹1,386 crores, up 16.2% YoY (Q1 FY25: ₹1,192 crores).

-

EBITDA: ₹156 crores, with an 11.3% margin, up 23 basis points YoY.

-

Profit Before Tax (PBT): ₹71 crores, margin of 5.1%, down 16.2% YoY (Q1 FY25: ₹84 crores).

-

Profit After Tax (PAT): ₹65 crores, margin 4.7%, up 1.56% YoY (Q1 FY25: ₹64 crores).

-

Operating Margin: Improved to 11.3% (up 23 bps YoY).

-

Standalone Revenue: ₹1,134 crores, up 17.3% YoY; standalone PAT ₹41.8 crores, down 18.9% YoY.

-

Segment Mix: Products for 2/3 wheelers, passenger vehicles, commercial vehicles, and off-roaders; mechatronics, connected systems, plastics, and interiors.

-

Key Joint Ventures: New JV with Toyodenso for advanced automotive switches in India (60% stake); strategic collaboration with Qualcomm to develop Smart Cockpit Solutions.

Key Management Commentary & Strategic Highlights

-

Ashok Minda, Chairman and Group CEO, noted strong demand across key vehicle segments and a focus on operational excellence and technology integration supporting growth.

-

Emphasis on product premiumization, expanding customer base, and innovation as drivers of highest-ever consolidated revenue.

-

Strategic partnerships with Toyodenso and Qualcomm position the company for leadership in automotive switches and smart cockpit technologies.

-

Commitment to sustained R&D investment and strengthening market reach with enhanced exports and diversified product portfolio.

-

Management expressed confidence in delivering sustainable value through consistent execution and continued focus on strategic initiatives.

Q4 FY25 Earnings Results

-

Consolidated Revenue: ₹1,321 crores.

-

EBITDA: ₹153 crores with 11.6% margin.

-

Profit After Tax (PAT): ₹52 crores.

-

Profit Before Tax (PBT): ₹65 crores.

-

Standalone Revenue: ₹1,000 crores.

-

Standalone PAT: ₹40 crores.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.