Metropolis Healthcare Limited is one of the leading Indian diagnostics companies. The Company owns a chain of diagnostic centres across India, South Asia, Africa and the Middle East. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

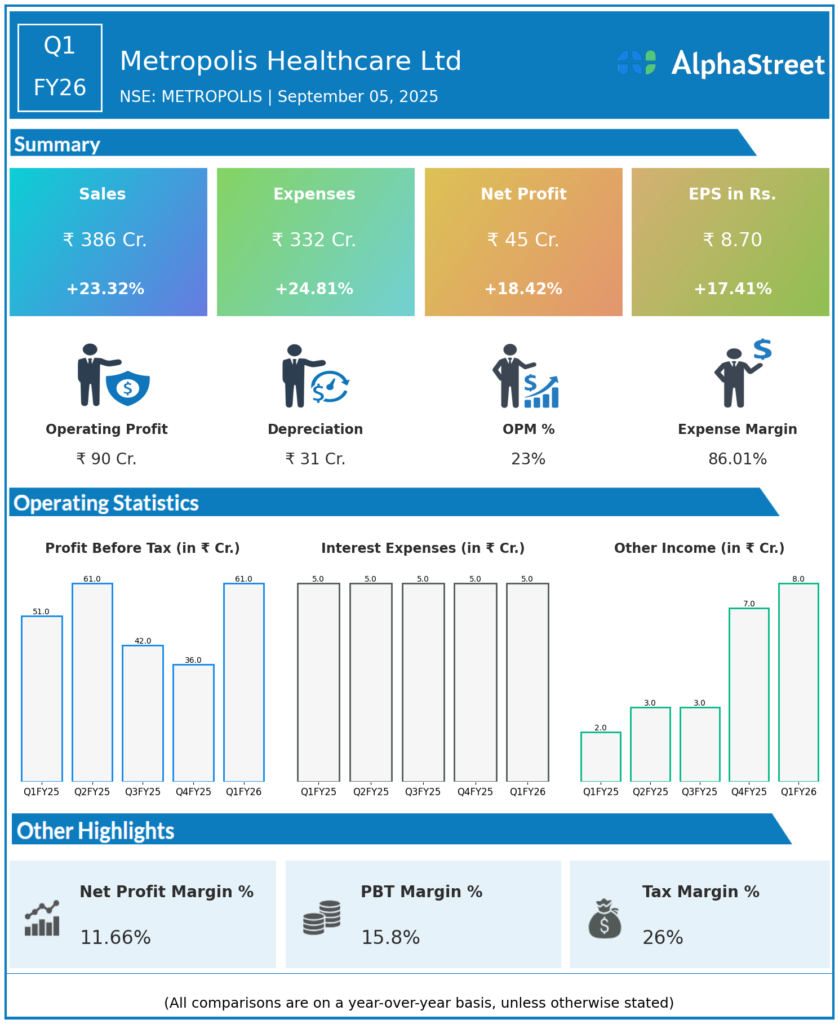

Revenue: ₹386 crores, up 23% YoY (Q1 FY25: ₹313.4–315.8 crores) and up 18% QoQ (Q4 FY25: ₹333.5 crores).

-

Profit After Tax (PAT): ₹45 crores, up 18.4% YoY (Q1 FY25: ₹38.1 crores), up 23.8% QoQ (Q4 FY25: ₹36.5 crores).

-

Earnings Per Share (EPS): ₹8.7, up 17.4% YoY and 22.5% QoQ (Q1 FY25: ₹7.4; Q4 FY25: ₹7.1).

-

EBITDA: ₹89.8 crores, up 14% YoY (Q1 FY25: ₹78.8 crores); group EBITDA margins at 23.1% (organic margin 24.7%, up 0.4pp QoQ); margin contracted slightly due to low-margin acquisition integration.

-

Profit Before Tax (PBT): ₹61.2 crores, up 19.9% YoY and 21.2% QoQ.

-

Total Expenses: ₹332.4 crores, up 25.5% YoY and 17.4% QoQ.

-

Segmental Growth: Specialty diagnostics revenue up 32% YoY, B2C revenue up 19% YoY, B2B up 29% YoY.

-

Volumes: Patient and test volumes up 11% and 12% YoY, respectively; revenue per patient up 11% YoY, revenue per test up 10% YoY.

-

Recent Acquisitions: Core Diagnostics, DAPIC Dehradun, and Scientific Pathology Agra integrated successfully, expanding specialty business and regional footprint.

-

**TruHealth preventive portfolio and innovation-led upselling continue to drive premium segment growth.

Management Commentary & Strategic Highlights

-

CEO Ameera Shah cited strong organic momentum aided by richer test mix, scientific engagement, and innovation, driving record growth in both B2C and specialty segments.

-

Acquisition synergies are yielding in lab consolidation, procurement, and margin improvement; management targets group margin expansion in coming quarters.

-

Expansion into Tier 2/3 markets, digital engagement, and radiology pilots are fueling new patient volume growth and customer engagement.

-

Management expects stable margins, disciplined M&A, and ongoing growth in specialty diagnostics as drivers for H2 and FY26.

Q4 FY25 Earnings Results

-

Revenue: ₹345 crores.

-

PAT: ₹29 crores.

-

EPS: ₹5.63.

-

EBITDA Margin: 23%.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.