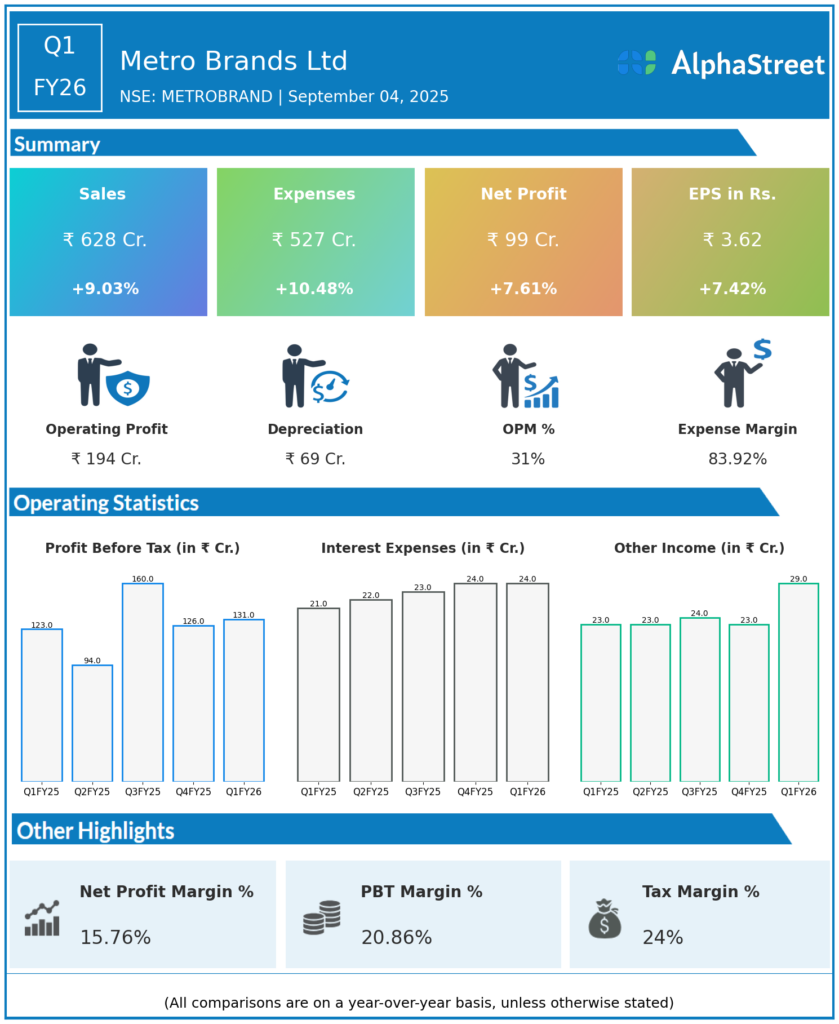

The company is one of the largest Indian footwear & accessories specialty retailers and are among the aspirational Indian brands in the footwear category.Its a one-stop shop for of branded products for the entire family, including men, women, unisex, and children, and for every occasion, including casual and formal events. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Income: ₹628 crores, up 8.1% QoQ (Q4 FY25: ₹607.33 crores), and up 9.03% YoY (Q1 FY25: ₹599.45 crores).

-

Total Expenses: ₹526.86 crores, up 4.6% QoQ and 10.4% YoY.

-

Profit Before Tax (PBT): ₹129.96 crores, up 25.4% QoQ and 5.7% YoY.

-

Tax Expense: ₹32.02 crores (compared to -₹50.79 crores in Q4 FY25), representing increased tax outflow.

-

Profit After Tax (PAT): ₹98.80 crores, down 36.5% QoQ but up 7.6% YoY (Q4 FY25: ₹155.57 crores; Q1 FY25: ₹92.27 crores).

-

Earnings Per Share (EPS): ₹3.62, down 36.8% QoQ, up 7.42% YoY (Q4 FY25: ₹5.70; Q1 FY25: ₹3.40).

-

Gross Margin: Approximately 59.7%.

-

EBITDA Margin: Approximately 43.2%, with 45.1% in standalone business.

-

E-Commerce Revenue: Growth of 45% YoY, contributing 13.7% of total revenue (Q1 FY25: 10.4%).

-

Store Expansion: Added 20 new stores across various formats during Q1 FY26.

Management Commentary & Strategic Highlights

-

CEO Nissan Joseph highlighted stable growth driven by strong consumer sentiment and consistent execution across channels despite some external macro-economic challenges.

-

Growth in e-commerce, especially omni-channel sales, was a key highlight supporting revenue and margin expansion.

-

The company continues investment in digital infrastructure and retail network expansion to enhance customer experience.

-

Competitive pressures and seasonal factors moderated quarterly profitability, but management expects healthy demand going forward.

Q4 FY25 Earnings Results

-

Total Income: ₹643 crores.

-

Profit After Tax: ₹95 crores.

-

EPS: ₹3.48.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.