Multi Commodity Exchange of India (NSE: MCX) India’s largest commodity exchange saw total income rise to ₹697 crore, driven by a surge in average daily turnover for options. The company also implemented a five-for-one stock split during the period to improve liquidity for shareholders.

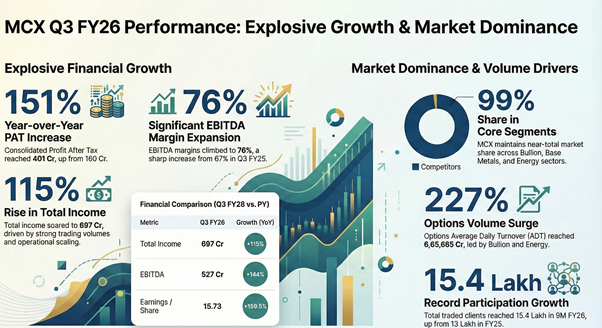

Company announced a consolidated net profit of ₹401.12 crore for the quarter ended December 31, 2025, representing a 151% increase compared to the ₹160.04 crore reported in the same period the previous year. This growth was primarily underpinned by significant expansion in the options segment, where average daily turnover (ADT) more than tripled, alongside a doubling of futures turnover. The performance reflects a sharp acceleration in market participation, particularly in bullion and energy contracts.

Valuation Snapshot

As of the reporting date of December 31, 2025, MCX had a market capitalization of ₹568.04 billion on the BSE. The stock reached a 52-week high of ₹11,218.45 and a low of ₹4,410 during the period (pre-split basis). The Basic Earnings Per Share (EPS) for the quarter was ₹15.73, up from ₹6.28 Y-o-Y. The company’s book value per share increased to ₹82, up from ₹62 in the previous year.

Corporate Actions

The exchange executed a sub-division of its equity shares, splitting each share with a face value of ₹10 into five shares with a face value of ₹2. This corporate action, which received shareholder approval in September 2025, reached its record date on January 2, 2026. Furthermore, the company recognized a ₹1.50 crore provision as a financial disincentive due to a business disruption that occurred on October 28 and 29, 2025, which lasted approximately three hours before normalcy was restored.

Financials

For the third quarter, total income reached ₹697.11 crore, a 115% increase from ₹324.36 crore in the prior-year period. Income from operations, or core billings, grew 121% to ₹665.62 crore. Efficiency improved significantly, with the EBITDA margin expanding to 76% from 67% a year earlier. On a nine-month basis (9M FY26), total income rose 69% to ₹1,503.72 crore, while net profit grew 89% to ₹801.78 crore. Total expenses for the quarter were ₹192.40 crore, up from ₹123.03 crore Y-o-Y, driven largely by higher contribution to statutory funds and regulatory fees.

Business Strategy

Management’s growth strategy centers on increasing institutional participation and diversifying the product suite. Key initiatives include the empanelment of domestic refiners for gold and lead delivery and the expansion of distribution through bank-sponsored broking entities. The exchange is also prioritizing the launch of new products such as electricity derivatives and commodity index options. To manage systemic risk, the Core Settlement Guarantee Fund (SGF) was maintained at ₹1,293.24 crore as of December 31, 2025.

Market Context

The Indian commodity derivatives market is undergoing rapid expansion, with the total market value reaching ₹850 trillion in the first nine months of FY26. MCX maintains a dominant position, commanding over 99% market share across the bullion, base metals, and energy segments. Options-led growth is the primary catalyst for this expansion, with gold and silver together accounting for 78% of the exchange’s futures turnover. Participation is broadening, with the number of total traded clients rising to 15.4 lakh in the nine months ended December 2025.