Mazagon Dock Shipbuilders Limited (MDL), Mumbai, established in 1774, is a prominent shipyard in India. Initially a small dry dock, MDL has evolved into a renowned shipbuilding company. It has constructed 801 vessels since 1960, including warships, submarines, cargo/passenger ships, and offshore platforms.

Q2 FY26 Earnings Results

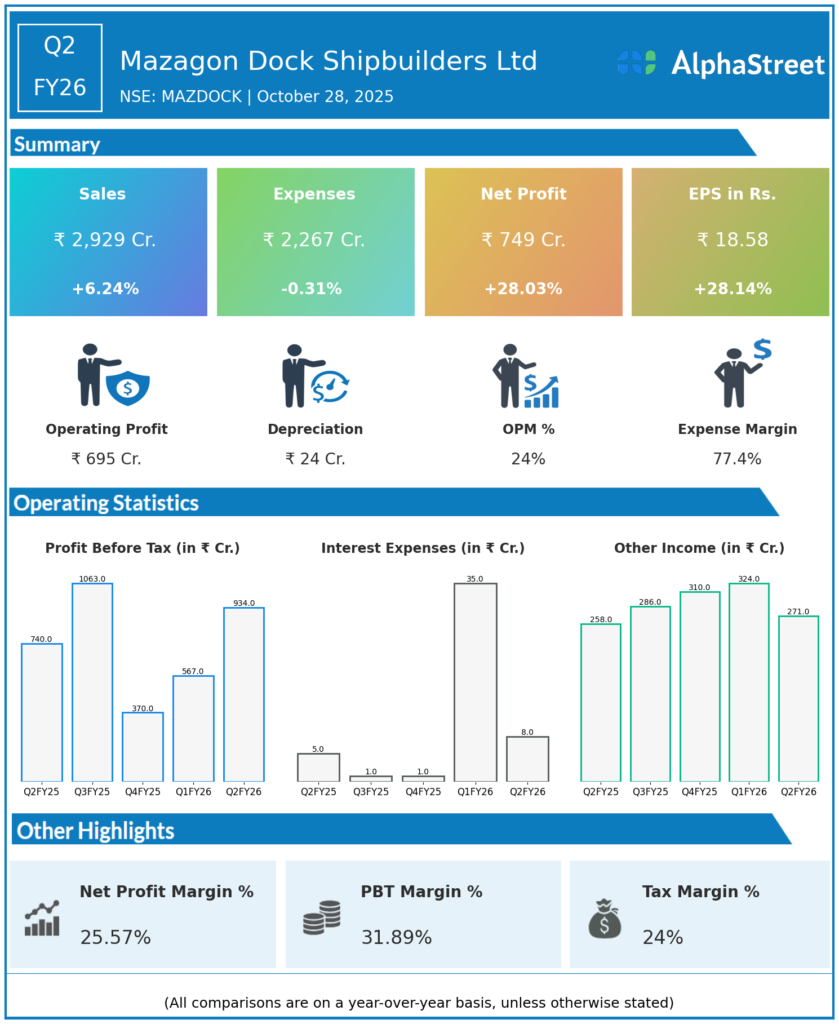

Revenue from Operations: ₹2,929.24 crore, up 6.3% YoY from ₹2,756.83 crore in Q2 FY25.

EBITDA: ₹694 crore, up 36% YoY from ₹510 crore; EBITDA margin expanded to 23.7% from 18.5% YoY.

Profit Before Tax (PBT): ₹933.94 crore, up 26% YoY and 65% QoQ.

Profit After Tax (PAT): ₹749.48 crore, up 28.1% YoY from ₹585.08 crore in Q2 FY25.

PAT Margin: Expanded to 24.2%.

Order Book: ₹27,415 crore as of September 30, 2025.

Interim Dividend: ₹6 per equity share; record date November 4, 2025.

Employee Cost: ₹223 crore, down slightly from Q1 FY26.

Management Commentary & Strategic Decisions

-

Management attributed robust profit growth and margin expansion to strong execution of warship and submarine milestones, improved project mix, and stable input costs.

-

The company highlighted operational efficiency improvements and disciplined workforce management driving margin gains.

-

Mazagon Dock benefited from timely milestone deliveries of key defence projects, notably advanced destroyers and Scorpene-class submarines.

-

Strategic focus continues on building India’s naval strength, scaling indigenous capabilities, and expanding both the core defence business and high-value contracts.

-

Interim dividend and solid order book underscore confidence in visibility for future growth; management expects sustained progress in H2 FY26.

Q1 FY26 Earnings Results

Revenue from Operations: ₹2,625.59 crore, up 11.4% YoY from ₹2,357.02 crore in Q1 FY25.

EBITDA: ₹302 crore, down 53% YoY from ₹642 crore; margin contracted to 11.4% from 27.2% YoY.

Profit After Tax (PAT): ₹452.15 crore, down 35% YoY from ₹696.10 crore.

PAT Margin: 17.2%.

Order Book: Stood steady at ₹27,000+ crore.

Operational Update: Sequential profit rose 39% QoQ despite margin compression due to back-ended project deliveries.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.