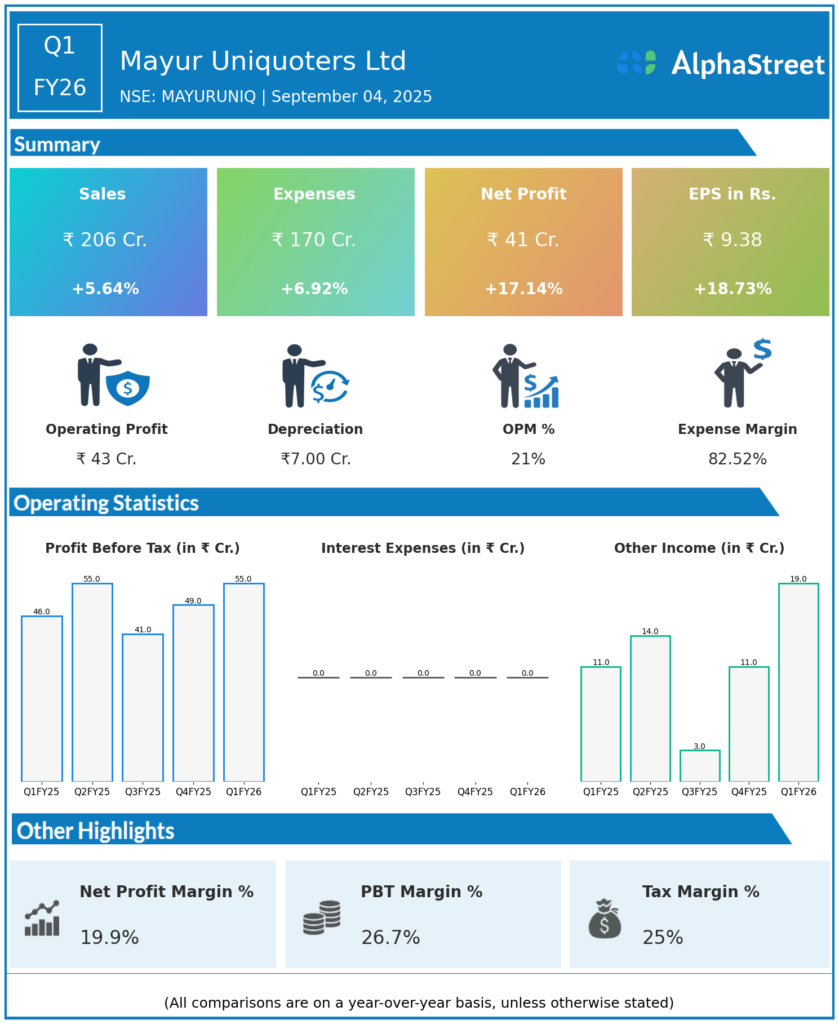

Mayur Uniquoters is primarily engaged in the business of manufacturing of Coated Textile Fabrics, artificial leather and PVC Vinyl which are widely used in different segments such as Footwear, Furnishings, Automotive OEM, Automotive replacement market, and Automotive Exports. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Income: ₹206 crores, up 5.6% YoY and 3.5% QoQ (Q1 FY25: ₹224.05 crores; Q4 FY25: ₹227.57 crores).

-

Profit Before Tax (PBT): ₹54.97 crores, up 7% YoY and 37.7% QoQ (Q1 FY25: ₹51.37 crores; Q4 FY25: ₹39.93 crores).

-

Profit After Tax (PAT): ₹40.73 crores, up 17% YoY and 26.4% QoQ (Q1 FY25: ₹37.38 crores; Q4 FY25: ₹32.22 crores).

-

Earnings Per Share (EPS): ₹9.38, up 18.6% YoY and 28.8% QoQ (Q1 FY25: ₹8.50; Q4 FY25: ₹7.30).

-

Total Expenses: ₹170 crores, up 6.92% YoY, down 3.8% QoQ (Q1 FY25: ₹172.67 crores; Q4 FY25: ₹187.64 crores).

-

Tax Expense: ₹14.25 crores, up 1.8% YoY, up 84.8% QoQ (Q1 FY25: ₹14.00 crores; Q4 FY25: ₹7.71 crores).

Management Commentary & Strategic Highlights

-

The company reported steady revenue growth supported by strong domestic and export demand, especially in the automotive OEM export market.

-

PAT growth reflects higher other income and cost control despite rising employee expenses.

-

Management is optimistic on sales CAGR of 11% over FY25–27 amid a healthy order pipeline and margin stability.

-

Mayur Uniquoters focuses on innovation and operational efficiency to sustain growth and RoIC above 20%.

Q4 FY25 Earnings Results

-

Total Income: ₹214 crores.

-

Profit After Tax: ₹35 crores.

-

EPS: ₹7.97

-

Total Expenses: ₹169 crores.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.