Max Financial Services Limited incorporated on 24 February, 1988 is part of India’s leading business conglomerate – the Max Group. Company is primarily engaged in growing and nurturing business investments and providing management advisory services to Indian group companies. It owns and actively manages an 81.83% majority stake in Max Life Insurance, India’s largest non-bank life insurer and 4th largest private life insurance company. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

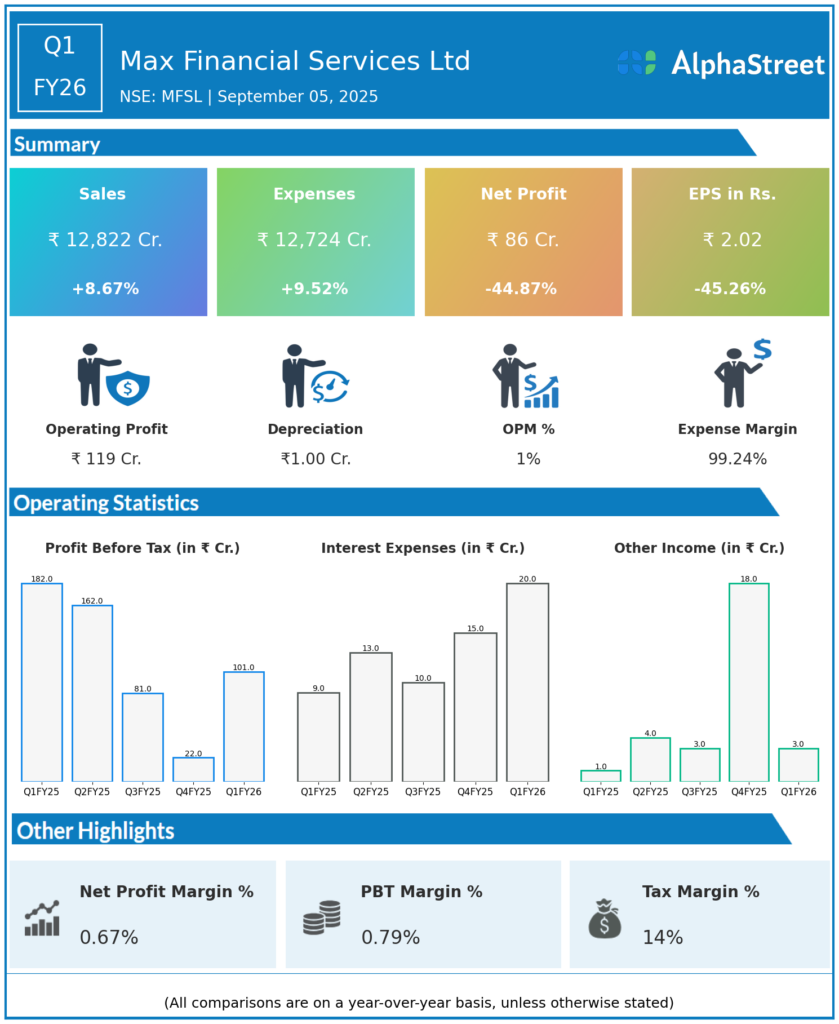

Total Income: ₹12,822 crores, up 8.67% YoY (Q1 FY25: ₹11,802.0 crores); down 13.9% QoQ (Q4 FY25: ₹14,898.5 crores).

-

Total Expenses: ₹12,724 crores, up 9.5% YoY; down 14.9% QoQ.

-

Profit Before Tax (PBT): ₹101.48 crores, down 44.2% YoY (Q1 FY25: ₹181.75 crores); turnaround from a loss of ₹59.4 crores in Q4 FY25.

-

Profit After Tax (PAT): ₹86 crores, down 44.8% YoY (Q1 FY25: ₹156 crores); recovered from a loss of ₹50 crores in Q4 FY25.

-

Earnings Per Share (EPS): ₹2.02, down 45.2% YoY (Q1 FY25: ₹3.70).

-

Net Interest Income (NII): ₹132 crores, up 16.8% YoY.

-

Value of New Business (VNB): ₹335 crores, up 32% YoY.

-

Gross Written Premium (GWP): ₹6,397 crores, up 18% YoY, including a 17% rise in renewal premium.

-

Assets Under Management (AUM): ₹1,83,211 crores, up 14% YoY.

-

Operating Return on Embedded Value (RoEV): 14.3%.

-

Market Share: Private industry market share at 10%, up 121 bps YoY.

-

New Business Margins: Improved to 20.1% from 17.5% YoY.

-

Other Metrics: Individual new business sum assured up 26%, new retail policy sales up 10% YoY.

Management Commentary & Strategic Highlights

-

Despite a sharp decline in quarterly profit due to investment income volatility, embedded value and operating metrics at Max Life Insurance (subsidiary) showed sustained strength.

-

Growth was driven by strong new business premiums, gross written premiums, and robust expansion in annuity, protection, and non-participating savings segments.

-

The company added 15 new business partners in Q1, and expects high margin, product innovation, and distribution expansion to continue driving growth.

-

Cost discipline and operational efficiencies remain key priorities against macro market headwinds and regulatory changes.

Q4 FY25 Earnings Results

- Revenue: ₹12,376 Crores.

- PAT (Net Profit): ₹38 Crores

- PBT (Profit Before Tax): ₹22 Crores

- EPS: ₹0.91

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.