This is the real estate development arm of Max Group. Company is a leading Real Estate player in Delhi – NCR. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

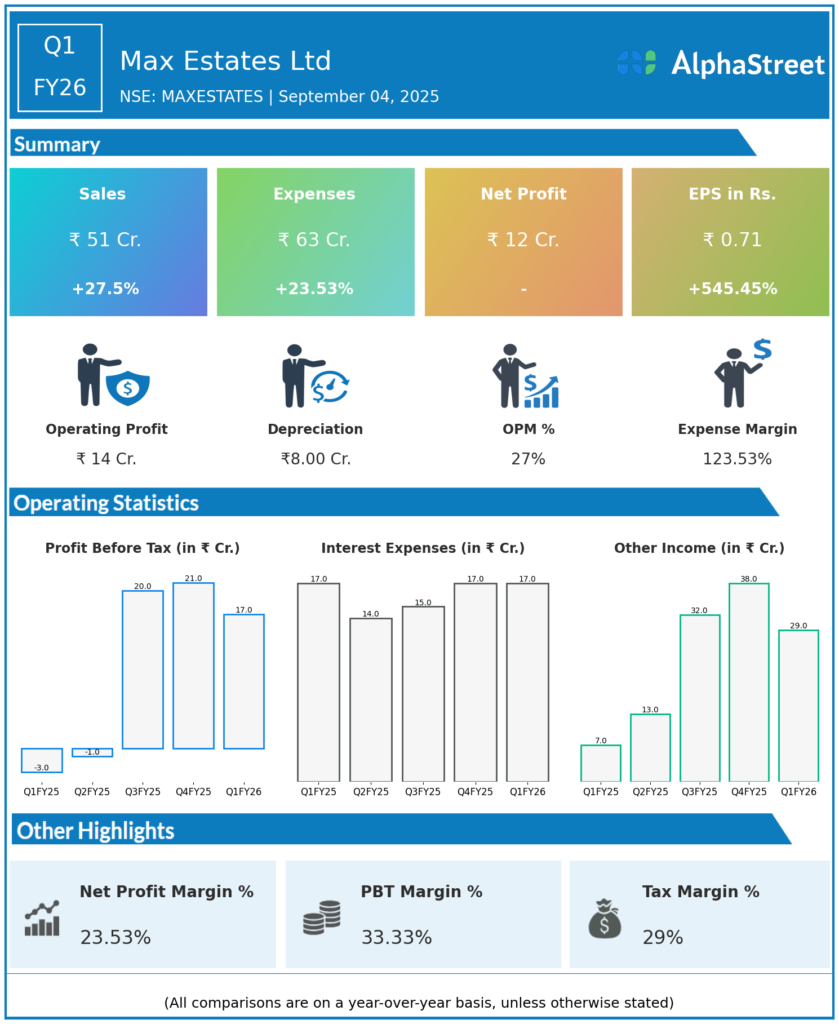

Revenue: ₹51.5 crores, up 28% YoY (Q1 FY25: ₹40.6 crores), up 29% QoQ (Q4 FY25: ₹40 crores).

-

EBITDA: ₹14 crores.

-

Profit Before Tax (PBT): ₹17 crores.

-

Profit After Tax (PAT): ₹12 crores, up sharply from ₹2 crores in Q1 FY25.

-

EPS: ₹0.71.

-

Lease Rental Income: ₹34 crores, up 33% YoY.

-

Expenses: ₹63 crores, up 23% YoY.

-

EBITDA Margin: 27% (Q1 FY25: 37.6%).

-

Pre-sales Bookings: ₹217 crores from Estate 360, Gurugram (Q1), compared to ₹127 crores in Q4 FY25.

-

Collections: ₹360 crores, driven mainly by Estate 128 (₹277 crores) and Estate 360 (₹83 crores).

-

Business Development: Acquired Boulevard Projects Private Ltd and a mixed-use land parcel in Noida for expansion.

-

Commercial Portfolio: 100% occupancy; annualised rental income (as of Mar 2025) at ₹146 crores.

-

Cash Position: ₹1,578 crores cash & equivalents as of Q1 FY26; gross debt at ₹1,406 crores.

Management Commentary & Strategic Highlights

-

Management retained guidance for launches/pre-sales for FY26 at ₹9,500 crores/₹6,000–6,500 crores with 3 new projects planned for H2 FY26.

-

The company is targeting ₹21,000 crores pre-sales bookings by FY28 and expects rental income to cross ₹700 crores annualised in five years.

-

Commercial projects continue to outperform, with high occupancy and premium leasing rates (e.g., Adobe leased at 30% premium to the market).

-

Focus remains on high-margin business development, phased launches, and strong collections for robust cash flow.

Q4 FY25 Earnings Results

-

Revenue: ₹40 crores.

-

PAT: ₹14 crores.

-

PRE-SALES: ₹127 crores.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.