Established in 1982, Mastek is a provider of vertically-focused enterprise technology solutions. Having its presence in IT industry for almost 4 decades, Mastek Ltd has evolved from an IT solutions provider to Digital transformation partner. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

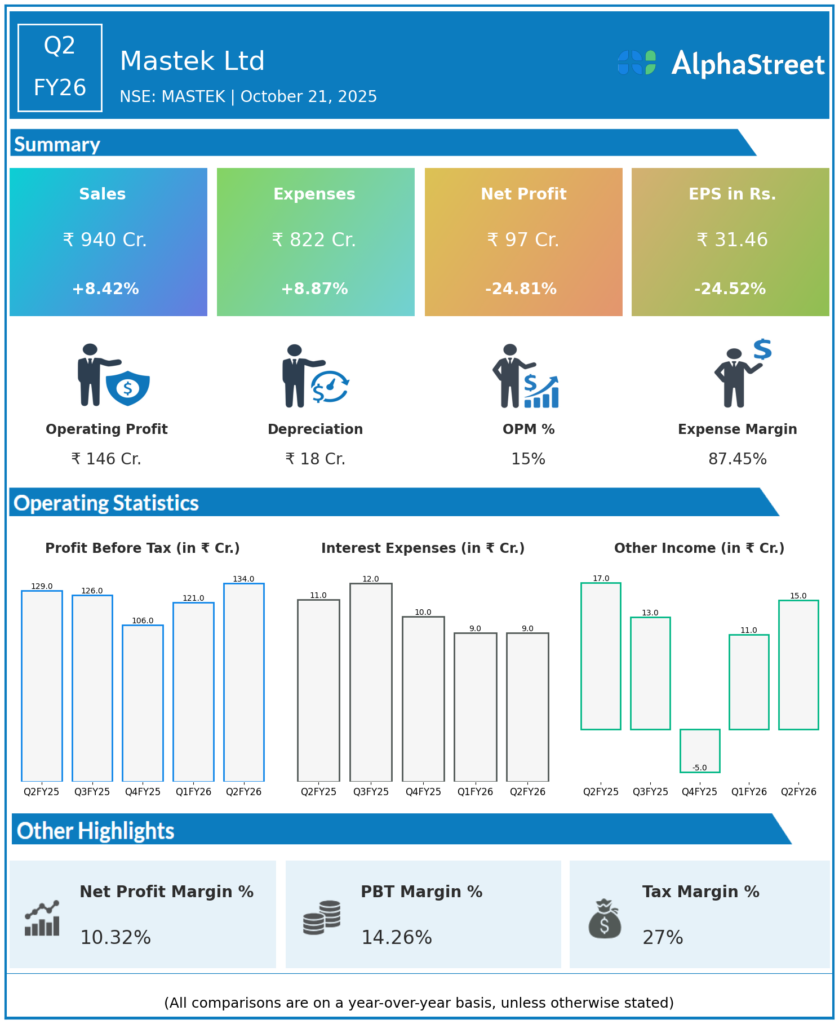

Revenue from Operations: ₹940.4 crore, up 8.4% YoY from ₹867.4 crore and 2.8% QoQ from ₹914.4 crore.

-

Operating EBITDA: ₹145.5 crore, up 6% QoQ, with EBITDA margin at 15.5% versus 15.0% in Q1 FY26 (but down from 16.5% YoY).

-

Profit Before Tax (PBT): ₹160.6 crore vs ₹148.2 crore YoY; marginal sequential improvement.

-

Net Profit (PAT): ₹97.45 crore, down 24.3% YoY from ₹128.65 crore, though up 5.9% QoQ from ₹91.5 crore in Q1 FY26.

-

EPS: ₹31.46 vs ₹42.6 YoY.

-

Order Backlog (12-month executable): ₹2,484.3 crore, up 13.2% YoY and 5.8% QoQ, indicating solid deal inflows amid global macro softness.

-

Geographic Mix:

-

UK & Europe: 64.5% of revenue, continued as the key growth driver (+11% YoY).

-

North America: 22.6% of revenue, moderate recovery after leadership transitions.

-

AMEA: 12.9%, steady sequential traction.

-

-

Employee Headcount: ~5,080; attrition at 18.9%, improved 80 bps QoQ.

Operational Highlights

-

AI-Led Transformation:

-

Over 25 new AI-focused deals signed and 100 active AI transformation projects underway across BFSI, healthcare, and government clients.

-

AI, Data & Automation now form 12.2% of total revenues, a 21.6% QoQ growth.

-

-

Order Pipeline: Healthy continuation of multi-year UK government and healthcare contracts, alongside growing enterprise modernization projects in the US market.

-

Cash Flow: Maintained positive free cash flow for the 12th consecutive quarter, with strong working capital efficiency.

-

Verticals:

-

UK Government & Health Services: Continued double-digit growth and high renewal rates.

-

Digital & Cloud: Modest growth amid slower enterprise IT spending in North America.

-

Management Commentary

Umang Nahata, CEO & MD, stated:

“Q2 FY26 reflects resilience driven by our AI-led digital transformation strategy and our renewed traction in healthcare and public sector businesses. The expanding order book and strong execution in core markets like the UK and Europe lay a solid foundation for sustainable growth going forward.”.

Management reiterated confidence in achieving FY26 revenue growth in high single digits in constant currency and maintaining EBITDA margins in the 15–17% range through continued operational efficiency and AI investments.

Q1 FY26 Earnings Results

-

Revenue: ₹914.4 crore.

-

EBITDA: ₹137.4 crore (margin 15.0%).

-

PAT: ₹91.5 crore.

-

Order Backlog: ₹2,348 crore.

-

AI Revenue Contribution: 10.5% of total income in Q1 FY26 (up to 12.2% in Q2 FY26).

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.