The Company was established in 1981. A joint venture agreement was signed between the Government of India and Suzuki Motor Corporation (SMC), Japan in 1982. The Company became a subsidiary of SMC in 2002.It is the market leader in passenger vehicle segment in India. In terms of production volume and sales, the Company is now SMC’s largest subsidiary. SMC currently holds 56.28% of its equity stake.

The principal activities of the Company are manufacturing, purchase and sale of motor vehicles, components and spare parts.

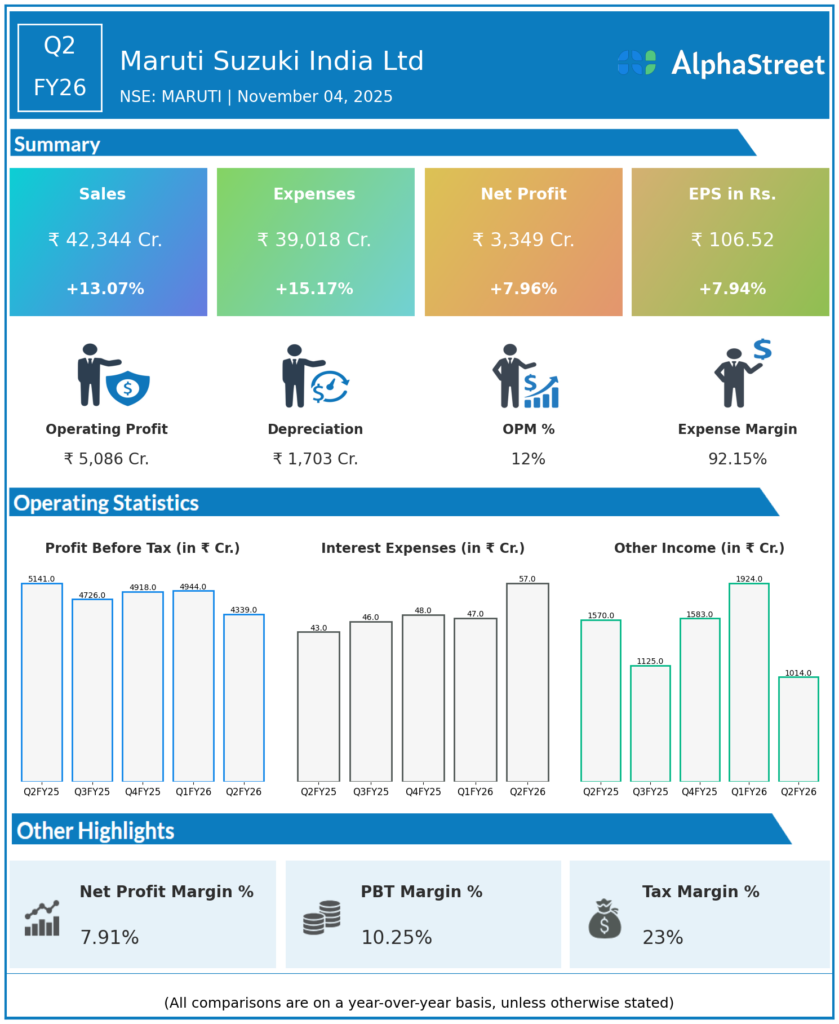

Q2 FY26 Earnings Results:

-

Total Revenue from Operations: ₹42,344 crore, up 13% YoY from ₹37,203 crore.

-

Net Profit After Tax (PAT): ₹3,349 crore, up 7.9% YoY from ₹3,069 crore.

-

EBITDA: ₹4,434 crore, marginally up 0.4% YoY from ₹4,417 crore.

-

EBITDA Margin: 10.53%, down from 11.87% in Q2 FY25.

-

Domestic wholesales declined 5.1% YoY to 440,387 units due to GST rate change time lag impact.

-

Exports grew robustly by 42.2% YoY to 110,487 units, highest-ever in any quarter.

-

Overall sales volume rose 1.7% YoY to 550,874 units.

-

October 2025 sales saw PV wholesale growth of 10.48% YoY, retail sales up nearly 20%.

-

Market share in October 2025 at about 43.5%.

Management Commentary & Strategic Insights:

-

Management noted export growth as a key driver compensating for subdued domestic demand.

-

Margins pressured by input cost and commodity price volatility.

-

Company focuses on new model launches and production efficiencies to drive profitable volume growth.

-

Preparing for GST implementation impact normalization.

-

Maintaining leadership with a focus on customer satisfaction and network strengthening.

Q1 FY26 Earnings Results:

-

Total Revenue: ₹38,605 crore, up 8% YoY.

-

PAT: ₹3,792 crore, up 0.9% YoY.

-

Export growth of 37%, which offset weaker domestic sales.

-

Domestic passenger vehicle sales declined by around 4.5%.

-

EBITDA margin faced pressure from commodity and cost inflation but remained robust overall.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.