The Company was established in 1981. A joint venture agreement was signed between the Government of India and Suzuki Motor Corporation (SMC), Japan in 1982. The Company became a subsidiary of SMC in 2002.It is the market leader in passenger vehicle segment in India. In terms of production volume and sales, the Company is now SMC’s largest subsidiary. SMC currently holds 56.28% of its equity stake. The principal activities of the Company are manufacturing, purchase and sale of motor vehicles, components and spare parts. Presenting below are its Q1 FY26 earnings:

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

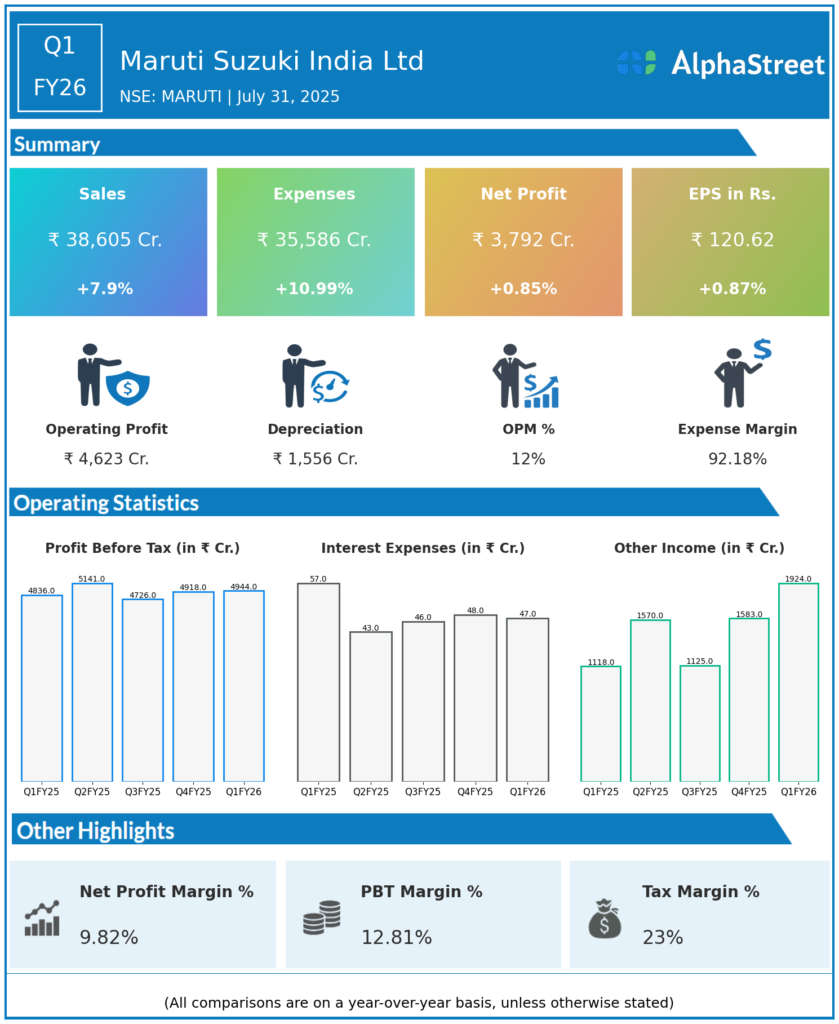

Consolidated Net Profit (PAT): ₹3,792 crore, marginally up 0.9% year-over-year (YoY) from ₹3,760 crore in Q1 FY25; a 3% decline sequentially from ₹3,911 crore in Q4 FY25.

-

Revenue from Operations: ₹38,605 crore, up 7.9% YoY from ₹35,779 crore in Q1 FY25; declined about 5.7% sequentially from Q4 FY25.

-

Net Sales: ₹36,625 crore in Q1 FY26, up from ₹33,875 crore in Q1 FY25.

-

Operating EBIT: Declined 18.9% YoY to ₹3,058 crore from ₹3,771 crore, showing margin pressure.

-

EBITDA: Around ₹3,997 crore, down 11.2% YoY; EBITDA margin contracted to about 10.4% from 12.6% YoY.

-

Sales Volume: Increased 1.1% YoY to 5,27,861 vehicles, comprising 4,30,889 domestic sales (down 4.5%) and 96,972 exports (up 37.4%).

-

Key Margin Pressures: Due to adverse commodity prices, foreign exchange movements, higher sales promotion expense, and new plant (Kharkhoda greenfield) expenses.

-

Market Environment: Domestic passenger vehicle demand remains sluggish.

Key Management Commentary & Strategic Highlights

-

The company acknowledged a sluggish domestic demand environment impacting sales growth.

-

Domestic sales decline was offset by strong export growth delivering overall volume growth.

-

Management highlighted margin pressures due to commodity, currency, and operational costs related to newer plant setup.

-

Efforts continue on cost control and operational efficiencies.

-

The company maintains focus on new model launches, export markets, and production efficiency.

-

The greenfield Kharkhoda plant is ramping up but adds new fixed costs in the short term.

-

Outlook includes navigating current market softness with strategic investments in product and plant capacity.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Consolidated Net Profit (PAT): ₹3,911 crore.

-

Revenue: Approximately ₹40,920 crore.

-

Profit and Revenue: Q4 was stronger sequentially, supporting an annual performance backdrop.

-

Operational EBIT and Margins: Higher than Q1 FY26, indicating some margin normalization expected ahead.

-

The quarter benefitted from comparatively better domestic demand and stable export volumes before the summer softness.