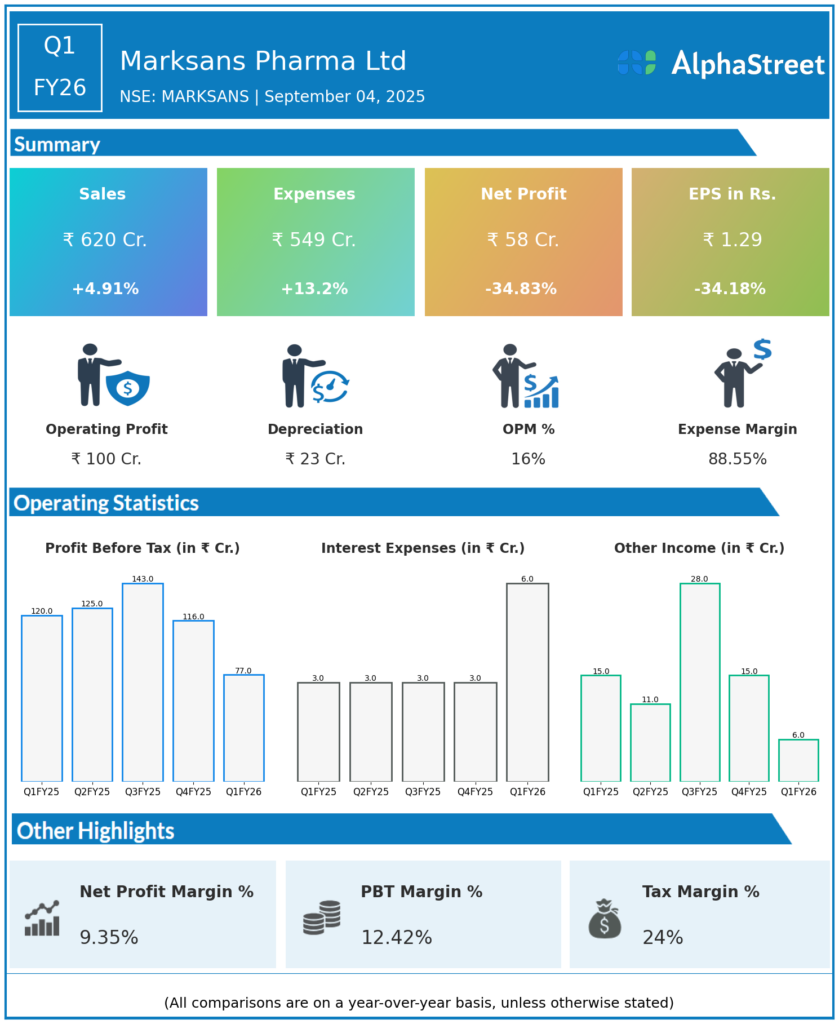

Marksans Pharma is engaged in the Business of Formulation of pharmaceutical products. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹620 crores, up 5% YoY (Q1 FY25: ₹605.6 crores), and up 8.5% QoQ (Q4 FY25: ₹576.5 crores).

-

Gross Profit: ₹358.2 crores, up 8.9% YoY; gross margin expanded 209 bps YoY to 57.8% due to lower input costs and liquidation of high-cost inventories.

-

EBITDA: ₹103 crores; EBITDA margin at 16.1%, down 560 bps YoY due to higher staffing costs, forex loss, and provision for expected credit loss (ECL).

-

Profit Before Tax (PBT): ₹76.6 crores, down 36% YoY and 23.6% QoQ.

-

Profit After Tax (PAT): ₹58.2 crores, down 34.8% YoY (Q1 FY25: ₹89.1 crores), down 25% QoQ (Q4 FY25: ₹77.6 crores).

-

Earnings Per Share (EPS): ₹1.29, down 34% YoY (Q1 FY25: ₹2.0).

-

Major One-Offs: A ₹10.48 crore ECL provision for emerging markets and a ₹6.2 crore forex loss impacted profitability for the quarter.

-

Cash Position: ₹711 crores as of June 30, 2025, supporting future expansion and R&D investments.

-

Regional Growth: US market led growth, +30.6% YoY. UK/EU/Oceania and RoW/India segments showed soft demand due to price pressure, but UK benefited from new launches in high-margin liquid products.

-

Dividend: Quarterly payout of ₹0.20 per share.

Management Commentary & Strategic Highlights

-

Management explained that Q1 is typically seasonally soft, compounded by pricing pressure in Europe and temporary costs for expansion/integration projects.

-

Strengthening portfolio with new launches in US/UK and integration of the new Goa facility are expected to drive synergies and recovery in coming quarters.

-

Execution discipline, cost control, and innovation pipeline will remain priorities for FY26; full-year revenue is expected to approach but may not exceed ₹3,000 crores due to ongoing global tariff headwinds.

Q4 FY25 Earnings Results

-

Revenue: ₹708 crores.

-

Profit After Tax (PAT): ₹91 crores.

-

EPS: ₹2

-

EBITDA: ₹85 crores.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.