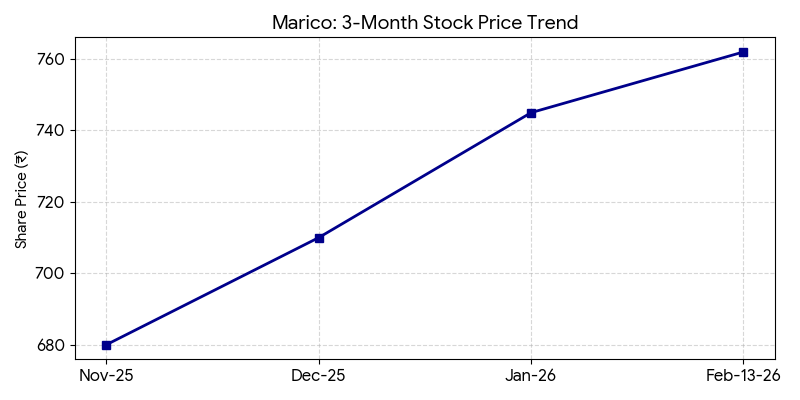

Marico Limited (NSE: MARICO; BSE: 531642) shares closed 1.07% lower at ₹762.45 on Friday. The FMCG major reported steady profit growth for the quarter ended December 31, 2025, supported by volume gains across domestic and international markets.

Market Capitalization

The company’s market capitalization stands at approximately ₹98,492 Cr as of February 13, 2026.

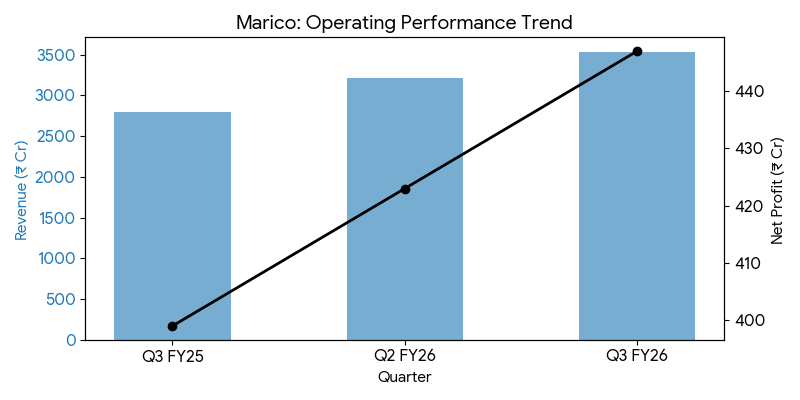

Latest Quarterly Results

Consolidated revenue for Q3 FY26 increased 26.6% to ₹3,537 Cr. Net profit for the quarter grew 12% to ₹447 Cr compared to the previous year.

Segment Highlights:

- India Business: Domestic revenue rose 27.6% to ₹2,681 Cr, driven by price hikes and volume growth.

- International: International revenue grew 23.5% to ₹856 Cr.

- E-commerce: This channel remained a primary growth driver during the quarter.

Full Year Results Context

Annual revenue for FY25 stood at ₹11,039 Cr with a profit of ₹1,629 Cr. Year-to-date trends indicate continued volume expansion in core categories.

Financial Trends

Business & Operations Update

Marico reported that over 95% of its portfolio maintained or gained market share. EBITDA for the quarter was ₹592 Cr, though margins contracted by 240 basis points to 16.7% due to higher input costs and advertising spends.

M&A or Strategic Moves

The company did not report any major acquisitions during the current quarter.

Equity Analyst Commentary

Institutional analysts from ICICI Securities and HDFC Securities maintain active coverage. Analysts noted margin pressure but highlighted resilient volume growth.

Guidance & Outlook

Management expects gradual demand improvement in coming quarters. Recovery in EBITDA margins is the primary metric to watch.

Performance Summary

Marico shares closed at ₹762.45. Q3 revenue surged 26.6% to ₹3,537 Cr. Net profit rose 12% with international markets contributing significantly.