Marico Limited is one of India’s leading consumer goods companies operating in global beauty and wellness categories. It is present in over 25 countries across emerging markets of Asia and Africa. It nurtures leading brands across categories of hair care, skin care, edible oils, healthy foods, male grooming and fabric care.

Q3 FY26 Earnings Results

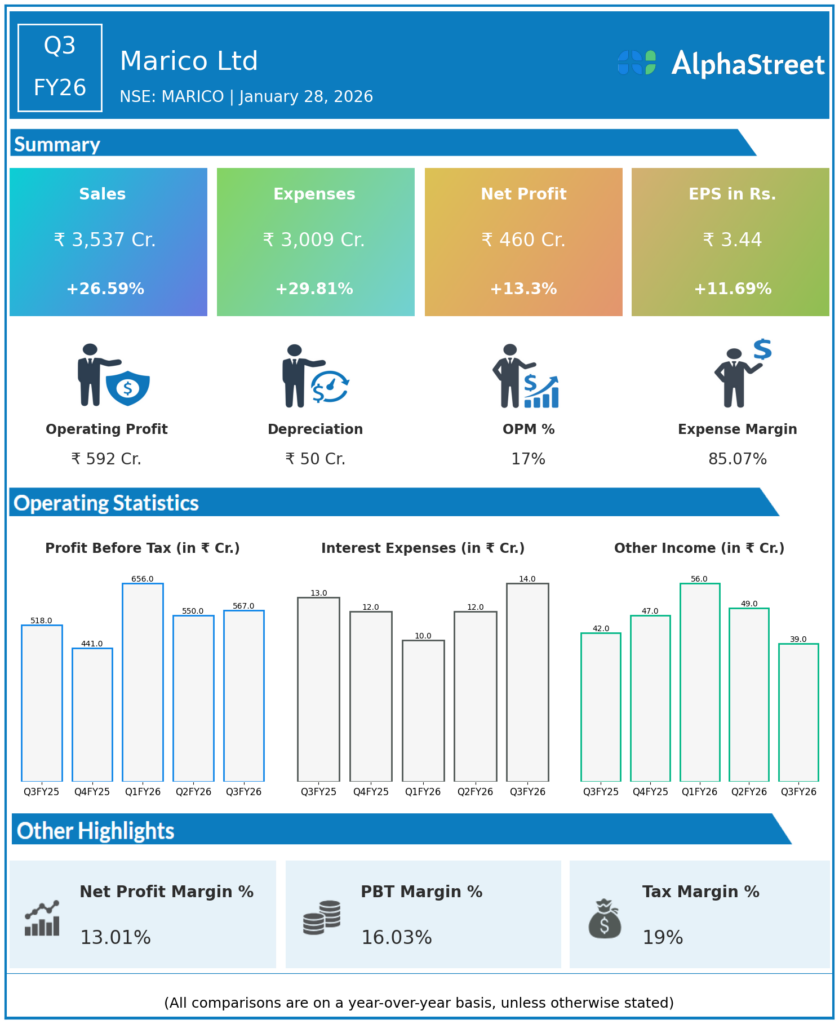

- Revenue from Operations: ₹3,537 cr, +26.6% YoY vs ₹2,794 cr, +1.6% QoQ vs ₹3,482 cr; driven by 8% underlying volume growth in India (domestic revenue ₹2,681 cr, +28% YoY), strong e-commerce/quick commerce, pricing interventions amid inflation, and double-digit international growth.

- EBITDA: ₹592 cr, +11% YoY vs ₹533 cr, margin 16.7% (−234 bps YoY, +60 bps QoQ); contraction due to elevated input costs (copra/edible oils), higher A&P spends (₹336 cr, +14.7% YoY), offset by volume leverage and sequential input easing.

- PAT: ₹447 cr, +12% YoY vs ₹399 cr, +6.4% QoQ vs ₹420 cr, margin 12.6%; EPS ₹3.44 basic (+12% YoY), supported by topline momentum despite margin dip.

- Other key metrics: 95% portfolio gained/sustained market share, 80% improved MAT penetration; 9M revenue ₹10,278 cr (+27% YoY), 9M PAT ₹1,371 cr (+6.6% YoY); Parachute volumes flat on copra prices, value-added hair oils +16%.

Management Commentary & Strategic Decisions

- “Performance reflects strength of operating model and agile execution in driving consistent outcomes,” said MD & CEO Saugata Gupta; high-single-digit volume growth improved sequentially, consumer sentiment strengthening with moderating inflation.

- Strategic moves: Sustained market share gains in 95% portfolio; focus on urban/premium via modern trade/e-com; positive on input costs easing, expect margin recovery; no dividend specifics, but confident in H2 growth amid resilient demand.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹3,482 cr, +31% YoY vs ₹2,664 cr, +30.7% growth highlighted by domestic ₹2,667 cr (+35% YoY, 7% volume growth), intl +20% CCY; pricing countered inflation, despite GST disruptions.

- EBITDA: ₹560 cr, +7% YoY, margin 16.1% (−350 bps YoY); pressured by input costs, A&P, but sequential improvement expected.

- PAT: ₹420 cr, −0.7% YoY vs ₹423 cr; PBIDT ₹609 cr (+0.8% YoY), EPS stable; boosted by resilience amid costs.

- Other key metrics: Parachute Rigids −3% volume (copra peak), value-added hair oils +16%; Saffola flat; H1 strong setup despite September trade dips.

Management Commentary Q2

- “First half showcases resilience amid inflationary pressures; healthy growth in domestic/intl, profit metrics to improve as margins ease,” per CEO Gupta; sustained demand, volume rebound.

- Strategic moves: Distribution expansion, premium/urban push via e-com/modern retail; medium-term double-digit intl growth; copra rangebound post-correction.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.