Manorama Industries Ltd. (MANORAMA.NS) on Tuesday reported a 32% rise in consolidated net profit for the December quarter, supported by higher revenue, while its board approved a multi-year capacity expansion plan.

The Raipur-based specialty fats and edible oils maker said net profit rose to ₹7.23 billion in the quarter ended Dec. 31, 2025, from ₹5.49 billion a year earlier. Profit was largely unchanged from the September quarter.

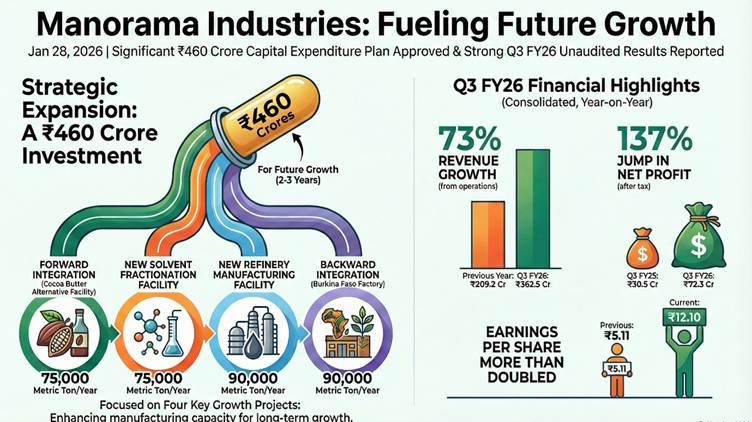

Revenue from operations increased to ₹36.25 billion from ₹20.92 billion a year earlier and ₹32.33 billion in the previous quarter, reflecting higher demand from food, confectionery, and industrial customers, according to its regulatory filing.

Total income stood at ₹37.41 billion, compared with ₹21.31 billion in the year-ago period.

Cost trends

Cost of materials consumed declined sequentially to ₹16.36 billion from ₹24.31 billion in the September quarter, reflecting inventory adjustments and lower procurement.

Employee benefit expenses rose to ₹1.57 billion from ₹1.34 billion, while finance costs increased to ₹1.34 billion from ₹0.78 billion, partly due to higher working capital requirements.

Depreciation and amortization remained stable at ₹0.64 billion. Other expenses increased to ₹5.37 billion from ₹4.83 billion, reflecting higher logistics and administrative costs.

Total expenses eased marginally to ₹27.82 billion on a quarter-on-quarter basis.

Nine-month performance

For the nine months ended December 2025, consolidated revenue rose to ₹97.54 billion from ₹53.80 billion a year earlier. Net profit increased to ₹17.25 billion from ₹6.97 billion.

Segment and market exposure

Manorama operates a single reporting segment covering exotic seed-based fats and butters, including cocoa butter equivalents.

The company runs export-oriented subsidiaries in Africa, the Middle East, and Latin America but did not disclose quarter-specific export and domestic revenue shares.

Capital expenditure

The board approved a ₹46 billion capital expenditure plan over the next two to three years to expand capacity and upgrade infrastructure.

Planned investments include new solvent fractionation and refining facilities, a cocoa butter alternative unit, and a backward integration plant in Burkina Faso. Funding will be through a mix of internal accruals and external sources.

Regulatory and management updates

The company said recently implemented labor codes were not expected to have a material impact on financial results. It also approved senior management reappointments and redesignations.

India’s edible oils and specialty fats sector has seen steady demand from confectionery, bakery and packaged food manufacturers, alongside rising export opportunities.

Manorama Industries Ltd. manufactures specialty fats, cocoa butter equivalents, and exotic seed-based edible oils from its facilities in Chhattisgarh, supplying domestic and overseas food and industrial customers.