Incorporated in 1995, Mankind Pharma Limited develops, manufactures, and markets pharmaceutical formulations in various acute and chronic therapeutic areas and several consumer healthcare products.

Q3 FY26 Earnings Results

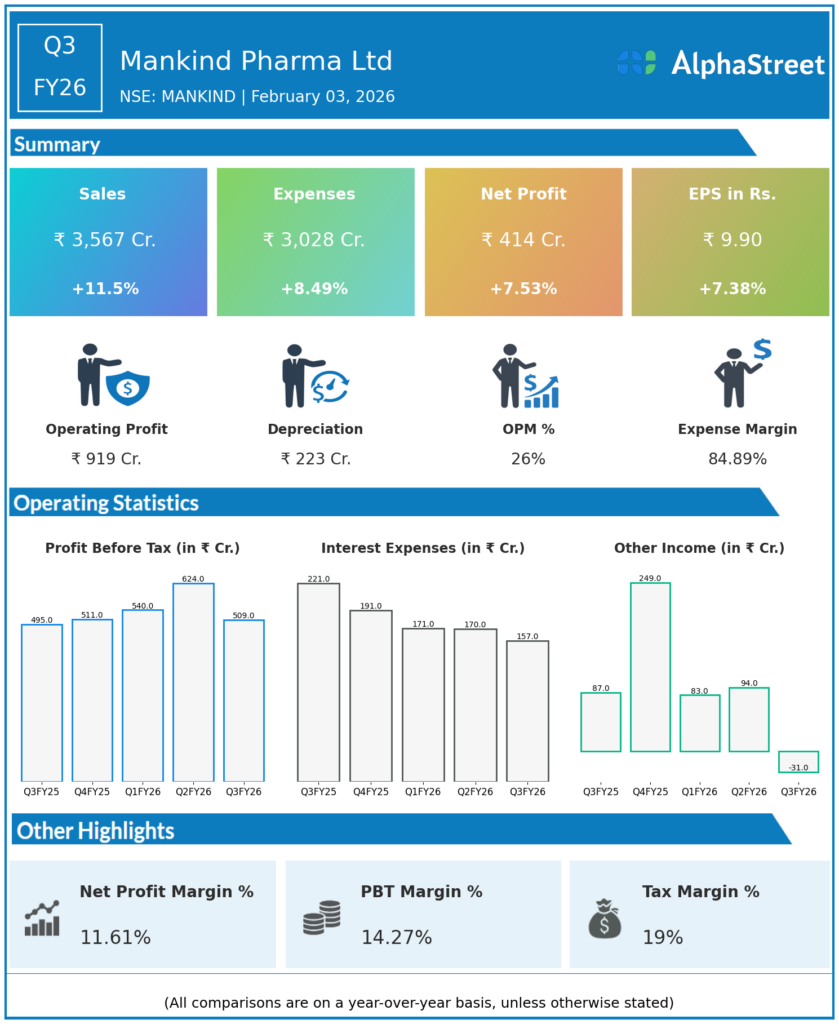

- Revenue from Operations: ₹3,567 cr, +11.5% YoY (vs ₹3,200+ cr last year) driven by strong domestic chronic portfolio demand.

- EBITDA: ₹925 cr implied at 25.9% EBITDA margin expanded margins demonstrate operating leverage.

- PAT: ₹410 cr, +7.7% YoY on improved demand and margin mix.

- EPS: ₹9.9.

- Segments/Geography: Domestic market share in chronic drugs improved to 39.3%; exports also grew in double-digits supporting topline.

Management Commentary & Strategic Decisions

- Management highlighted robust demand for chronic therapy drugs (cardiac and anti-diabetes), seen as the major revenue driver in Q3, suggesting sustained strength in high-growth therapeutic areas.

- EBITDA margin enhancement was attributed to cost efficiencies and improved mix focusing on higher-margin chronic and specialty products.

- Strategic initiatives around BSV integration and specialty portfolio expansion continue to support pipeline and future growth momentum.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹3,697 cr, +20.8% YoY, strong year-on-year growth driven by chronic segment and BSV business consolidation.

- EBITDA: ₹924 cr, 25% margin, reflecting solid profitability with scale.

- PAT: ₹520 cr, -21% YoY (vs ₹661 cr in Q2 FY25), impacted by higher expenses and segment mix.

- EPS: ₹12.4 (diluted EPS).

Management Commentary Q2

- Vice Chairman & MD Rajeev Juneja attributed Q2 growth to outperformance in chronic therapies and BSV integration, though he acknowledged OTC segment pressure due to GST transition and weather impacts.

- Management reaffirmed confidence in long-term growth driven by four pillars: steady base business, specialty chronic portfolio, high-potential OTC, and BSV super-specialty offerings.

- Margin resilience and revenue diversification (domestic + exports) were highlighted as key strengths going forward.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.