Maithan Alloys is engaged in the business of manufacturing and exporting of all three bulk Ferro alloys- Ferro Manganese, Silico Manganese and Ferro Silicon. It is also engaged in the generation and supply of Wind Power and has a Captive Power Plant. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

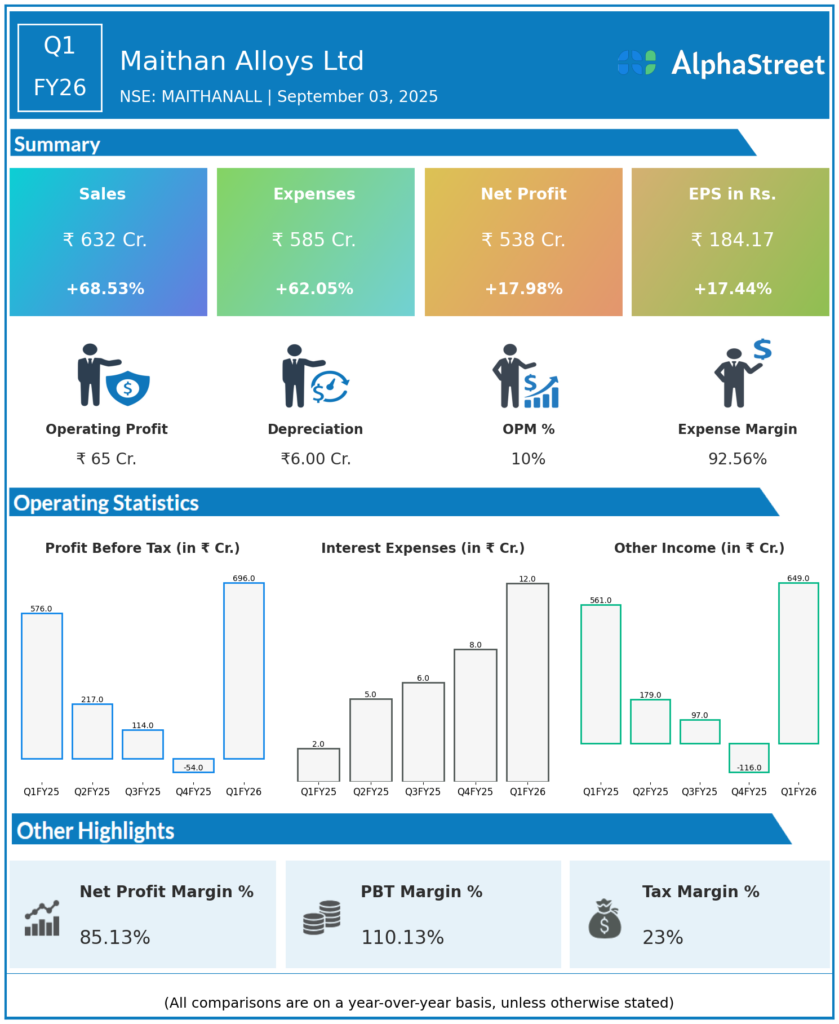

Revenue: ₹632 crores, up 68.6% YoY (Q1 FY25: ₹375 crores) and up 12.5% QoQ (Q4 FY25: ₹435 crores).

-

Profit After Tax (PAT): ₹538 crores, up 17.9% YoY (Q1 FY25: ₹458 crores).

-

Earnings Per Share (EPS): ₹184.1, up from ₹156.8.

-

Operating Profit Margin (OPM): 11%, showing improvement over previous years.

-

Return on Capital Employed (ROCE): 23.3%; Return on Equity (ROE): 18.3%.

-

Debt-to-Equity Ratio: Low, with net debt at a moderate level supporting growth.

-

Other Income: Included ₹809 crores, significantly boosting profit metrics.

-

Segmental Revenue: Primarily from bulk ferro alloys, including ferro manganese, silico manganese, and ferro silicon.

-

Power Segment: Generates and supplies captive wind power.

-

Debtor Days: Improved from 54.8 to 29 days, indicating better receivables management.

-

Working Capital Days: Increased from 255 to 497 days, reflecting higher inventory and receivables.

-

Dividend Payout: Historically low, around 5.3% of profits over the past three years.

Management Commentary & Strategic Highlights

-

Management highlighted strong revenue recovery driven by higher ferro alloy volumes and better pricing environment.

-

Operational efficiency and expansion in captive power capacity contributed positively to margins and cash flow.

-

With robust demand for manganese alloys globally, the company is strategically expanding production capacity.

-

Focus remains on improving working capital efficiency and optimizing cost structures.

Q4 FY25 Earnings Results

-

Revenue: ₹435 crores.

-

Profit After Tax (PAT): -₹58 crores.

-

Earnings Per Share (EPS): -₹20.9.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.