Mahindra & Mahindra Ltd is one of the most diversified automobile company in India with presence across 2-wheelers, 3-wheelers, PVs, CVs, tractors & earthmovers.

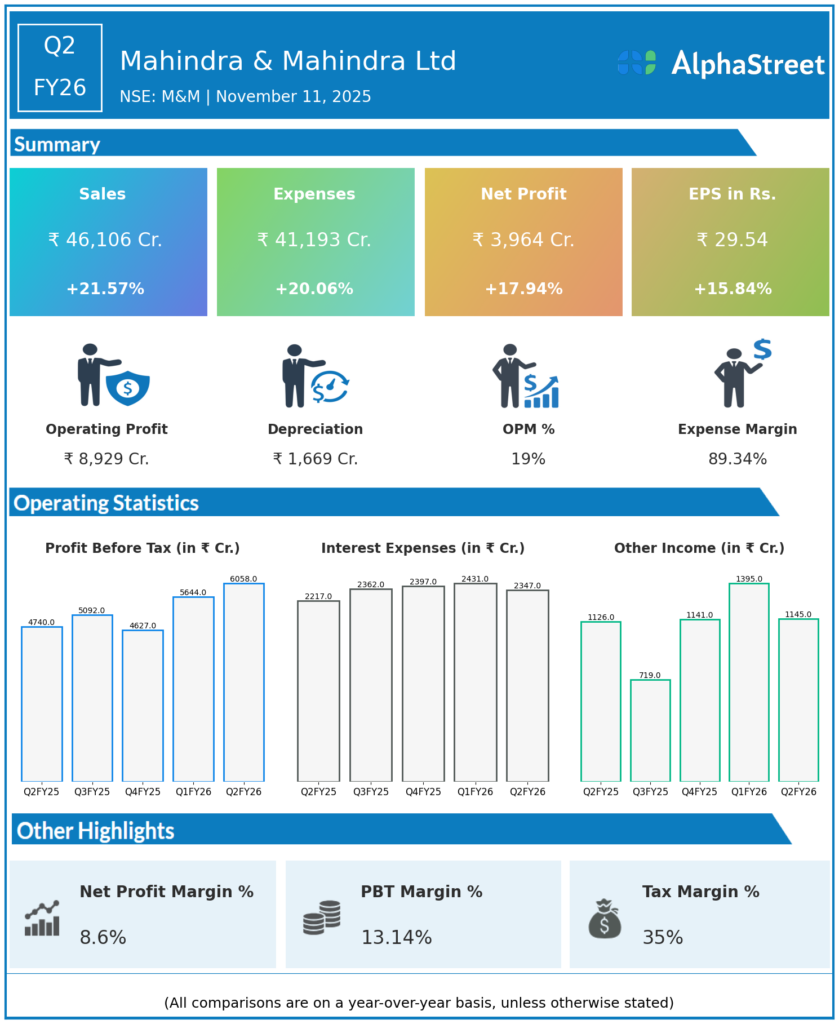

Q2 FY26 Earnings Results:

-

Revenue from Operations (Consolidated): ₹46,106 crore, up 22% YoY from ₹37,924 crore in Q2 FY25

-

Consolidated Profit After Tax (PAT): ₹3,964 crore, up 18% YoY (excluding one-time gains), with RoE at 19.4% annualized

-

Standalone Revenue: ₹35,080 crore, up 21% YoY

-

Standalone PAT: ₹4,521 crore, up 18% YoY from ₹3,841 crore

-

EBITDA (Standalone): ₹6,467 crore, up 23% YoY

-

Total vehicles sold: 2,61,703 units (all-time Q2 record); tractor sales: 1,22,936 units

-

Automotive revenue (Consolidated): ₹27,171 crore, up 25% YoY

-

Farm equipment revenue: ₹10,225 crore, up 25% YoY; PBIT for farm at ₹1,684 crore, margin 19.7%

-

Operating cash flow for H1 FY26: over ₹10,000 crore

-

Margins expanded across segments: Standalone PBIT margin at 9.2% (+80 bps excluding EV contract manufacturing)

-

Financial Services: PAT up 45% YoY, with asset quality maintained

Management Commentary & Strategic Insights

-

CEO Dr. Anish Shah credited gains to strong execution, market leadership in SUVs, and best-ever tractor performance

-

Continued gains in market share and profitability for both Auto and Farm businesses

-

Tech Mahindra (group) EBIT margin improved to 12.1%, up 250 bps YoY

-

Focus on innovation, portfolio expansion, and transformation in Tech Mahindra and Financial Services segments

-

Group remains committed to capital efficiency, sustainable growth, and expanding value in new business verticals

-

Ongoing investments in EV, manufacturing expansion, and digital transformation

-

Confident outlook; sector tailwinds and strong operating cash flow reinforce the growth trajectory

Q1 FY26 Earnings Results

-

Revenue from Operations (Consolidated): ₹45,529 crore, up 22% YoY

-

PAT (Consolidated): ₹4,083 crore, up 24% YoY

-

Standalone revenue: ₹34,143 crore (+26% YoY)

-

Standalone PAT: ₹3,450 crore (+32% YoY)

-

Q1 auto sales volumes: 247,000 units; SUV share at 27.3% (up 570 bps YoY)

-

Strong farm, financial services, and Tech Mahindra performance contributed to topline and margin growth.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.